Answered step by step

Verified Expert Solution

Question

1 Approved Answer

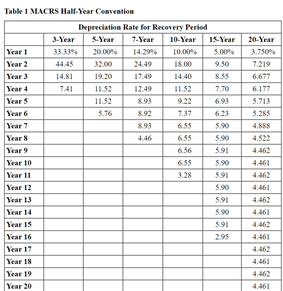

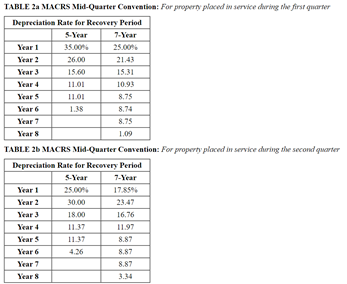

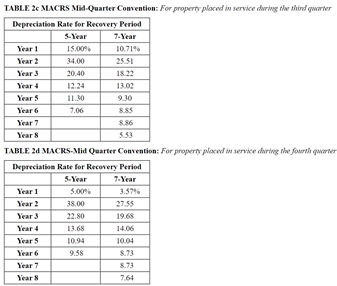

[The following information applies to the questions displayed below.] Burbank Corporation (calendar-year-end) acquired the following property this year: (Use MACRS Table 1, Table 2 and

[The following information applies to the questions displayed below.]

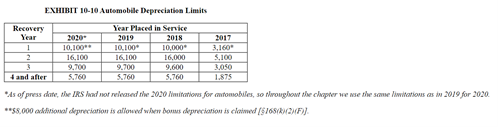

Burbank Corporation (calendar-year-end) acquired the following property this year: (Use MACRS Table 1, Table 2 and Exhibit 10-10.)

| Asset | Placed in Service | Basis | |

| Used copier | November 12 | $ | 11,000 |

| New computer equipment | June 6 | 17,200 | |

| Furniture | July 15 | 35,200 | |

| New delivery truck | October 28 | 22,200 | |

| Luxury auto | January 31 | 73,200 | |

| Total | $ | 158,800 | |

Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. (Round your answer to the nearest whole dollar amount.)

c. What is Burbanks maximum cost recovery deduction this year assuming it elects 179 expense and claims bonus depreciation?

Table 1 MACRS Half-Year Convention Depreciation Rate for Recovery Period 3-Year S-Year 7-Year 10-Year IS-Year Year 1 33.3396 20.00% 10.00% 5.00% Year 2 24.49 18.00 9.50 Year 3 14.81 19.20 17.49 14.40 Year 4 7.41 11.52 12.49 11.52 7.70 Years 11.52 6.93 Year 6 5.76 892 7.37 6.23 Year 7 893 6.55 5.90 Year 8 446 6.55 5.90 Year 9 6.56 5.91 Year 10 6.55 5.90 Year 11 5.91 Year 12 5.90 Year 13 5.91 Year 14 5.90 Year 15 5.91 Year 16 2.95 Year 17 Year 18 Year 19 Year 20 20-Year 3.7509 7.219 6.677 6.177 5.713 5.285 4,888 4.522 4.462 4.462 4.461 4,461 4,461 4.461 TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during we first quarter Depreciation Rate for Recovery Period 5-Year 7-Year Year 1 35.00% 25.00% Year 2 26.00 21.43 Year 3 15.60 15.31 Year 4 11.01 10.93 Years 11.01 8.75 Year 6 1.38 8.74 Year 7 8.75 Year 8 1.09 TABLE 2 MACRS M-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period S-Year 7-Year Year 1 25.00% 17.85% Year 2 30.00 23:47 Year 3 18.00 16.76 Year 11.37 11.97 Years 11.37 8.87 Year 6 4.26 8.87 Year 7 8.87 Year 8 TABLE 2 MACRS Mid Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period 5-Year 7-Year Year 1 15.00 10.7196 Year 2 34.00 25.51 Year 3 20.40 18.22 Year Year 11.30 9.30 Year 6 7.06 885 Year 7 Years 5.53 TABLE 24 MACRS-Mid Quarter Convention: For propery placed in service choring Hoe fourthwarter Depreciation Rate for Recovery Period 5-Year 7-Year Year 1 5.00% 3.57% Year 2 38.00 27.55 Year 3 22.80 19.68 Year 1 13.68 Years 10.94 10.04 Year 6 9.58 8.73 Year 7 8.73 Year 7.64 EXHIBIT 10-10 Automobile Depreciation Limits Recovery Year 1 2 2020 10.100 16.100 9.700 Year Placed in Service 2019 2018 10.100 10,000 16.100 16,000 9.700 9.600 5760 5.760 2017 3.160 5.100 3,050 1.875 and after *As of press date, the IRS had not released the 2020 Mitations for automobiles, so trouglow the chapter we wse the same wat ons as in 2019 for 2020 **58.000 dona depreciation is allowed her bonus depreciation is claimed (516572XF)]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started