Question

[The following information applies to the questions displayed below.] Charles Merrill owns a housekeeping service, Charles Cleaners, in Florida. No employee has exceeded the Social

[The following information applies to the questions displayed below.]

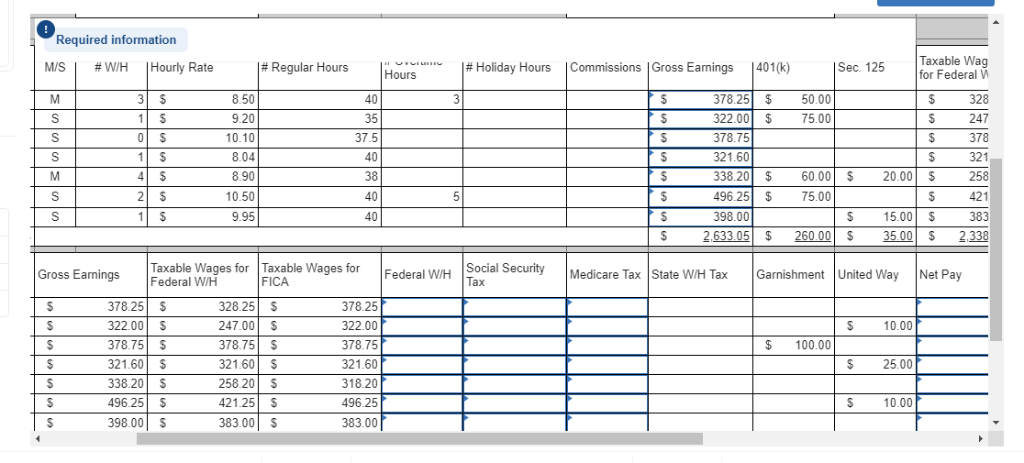

Charles Merrill owns a housekeeping service, Charles Cleaners, in Florida. No employee has exceeded the Social Security tax wage base. Total, prove, and rule the entries. Use the wage bracket method in the federal tax table in Appendix C. (Round your intermediate calculations and final answers to 2 decimal places.)

Using the payroll register, complete the General Journal entry for the employees' pay for the July 13 pay date. Paychecks will be issued on July 18. Employees are paid weekly. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

For the weekly payroll ending July 13, 2018, checks dated July 18, 2018, complete the payroll register.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started