Question

[The following information applies to the questions displayed below.] Demarco and Janine Jackson have been married for 20 years and have four children (no children

[The following information applies to the questions displayed below.]

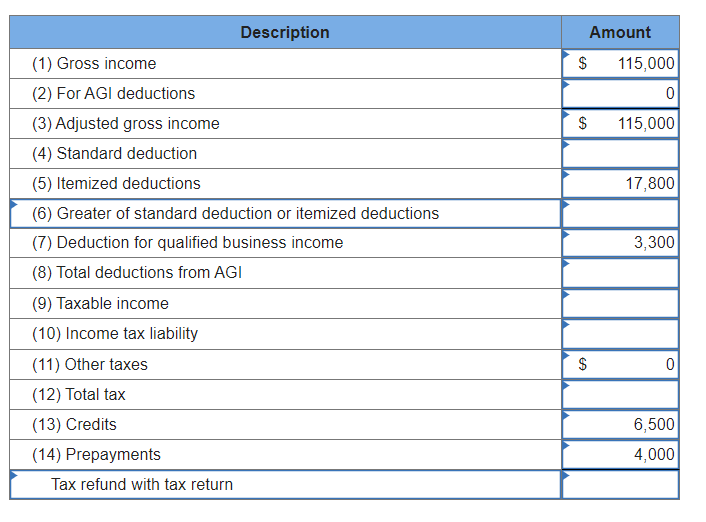

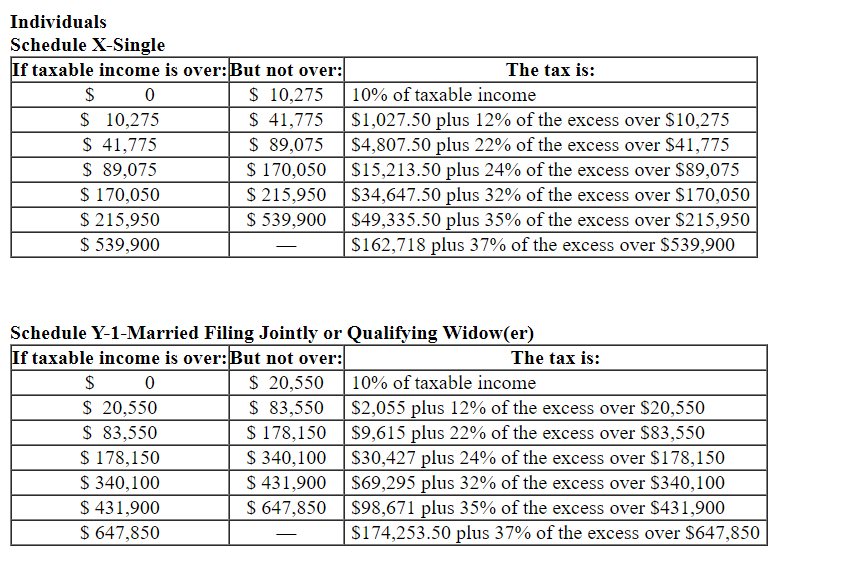

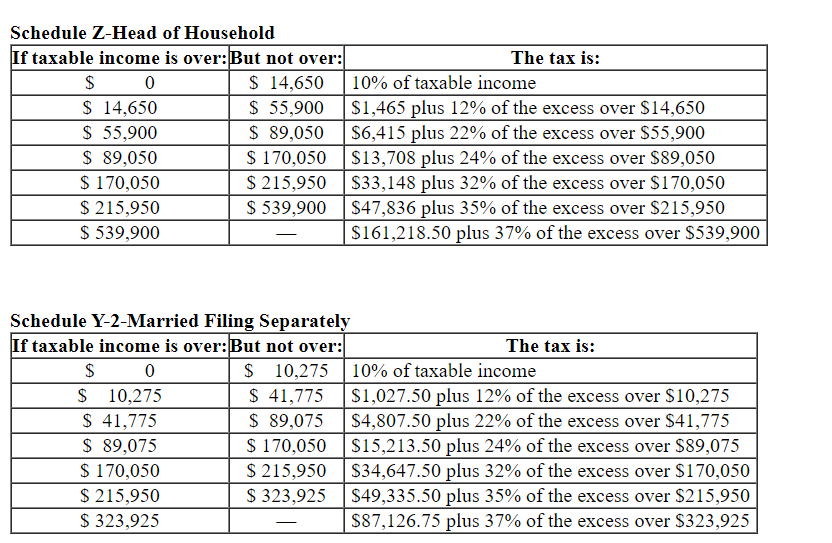

Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at year-end) who qualify as their dependents (Damarcus, Jasmine, Michael, and Candice). The couple received salary income of $98,500 and qualified business income of $16,500 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $232,500 and they sold it for $282,500. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $17,800 of itemized deductions, and they had $4,000 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at year end, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. (Use the tax rate schedules.)

a. What is the Jacksons' taxable income, and what is their tax liability or (refund)?

Note: Do not round intermediate calculations.

Individuals Srhadula X_Sinola \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Description } & \multicolumn{2}{|c|}{ Amount } \\ \hline (1) Gross income & $115,000 \\ \hline (2) For AGl deductions & \\ \hline (3) Adjusted gross income & 115,000 \\ \hline (4) Standard deduction & \\ \hline (5) Itemized deductions & 17,800 \\ \hline (6) Greater of standard deduction or itemized deductions & \\ \hline (7) Deduction for qualified business income & 3,300 \\ \hline (8) Total deductions from AGl & \\ \hline (9) Taxable income & \\ \hline (10) Income tax liability & \\ \hline (11) Other taxes & \\ \hline (12) Total tax & \\ \hline (13) Credits & \\ \hline (14) Prepayments & \\ \hline Tax refund with tax return & \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$14 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & - & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Individuals Srhadula X_Sinola \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Description } & \multicolumn{2}{|c|}{ Amount } \\ \hline (1) Gross income & $115,000 \\ \hline (2) For AGl deductions & \\ \hline (3) Adjusted gross income & 115,000 \\ \hline (4) Standard deduction & \\ \hline (5) Itemized deductions & 17,800 \\ \hline (6) Greater of standard deduction or itemized deductions & \\ \hline (7) Deduction for qualified business income & 3,300 \\ \hline (8) Total deductions from AGl & \\ \hline (9) Taxable income & \\ \hline (10) Income tax liability & \\ \hline (11) Other taxes & \\ \hline (12) Total tax & \\ \hline (13) Credits & \\ \hline (14) Prepayments & \\ \hline Tax refund with tax return & \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$14 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & - & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular}

Individuals Srhadula X_Sinola \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Description } & \multicolumn{2}{|c|}{ Amount } \\ \hline (1) Gross income & $115,000 \\ \hline (2) For AGl deductions & \\ \hline (3) Adjusted gross income & 115,000 \\ \hline (4) Standard deduction & \\ \hline (5) Itemized deductions & 17,800 \\ \hline (6) Greater of standard deduction or itemized deductions & \\ \hline (7) Deduction for qualified business income & 3,300 \\ \hline (8) Total deductions from AGl & \\ \hline (9) Taxable income & \\ \hline (10) Income tax liability & \\ \hline (11) Other taxes & \\ \hline (12) Total tax & \\ \hline (13) Credits & \\ \hline (14) Prepayments & \\ \hline Tax refund with tax return & \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$14 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & - & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Individuals Srhadula X_Sinola \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{ Description } & \multicolumn{2}{|c|}{ Amount } \\ \hline (1) Gross income & $115,000 \\ \hline (2) For AGl deductions & \\ \hline (3) Adjusted gross income & 115,000 \\ \hline (4) Standard deduction & \\ \hline (5) Itemized deductions & 17,800 \\ \hline (6) Greater of standard deduction or itemized deductions & \\ \hline (7) Deduction for qualified business income & 3,300 \\ \hline (8) Total deductions from AGl & \\ \hline (9) Taxable income & \\ \hline (10) Income tax liability & \\ \hline (11) Other taxes & \\ \hline (12) Total tax & \\ \hline (13) Credits & \\ \hline (14) Prepayments & \\ \hline Tax refund with tax return & \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$14 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & - & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started