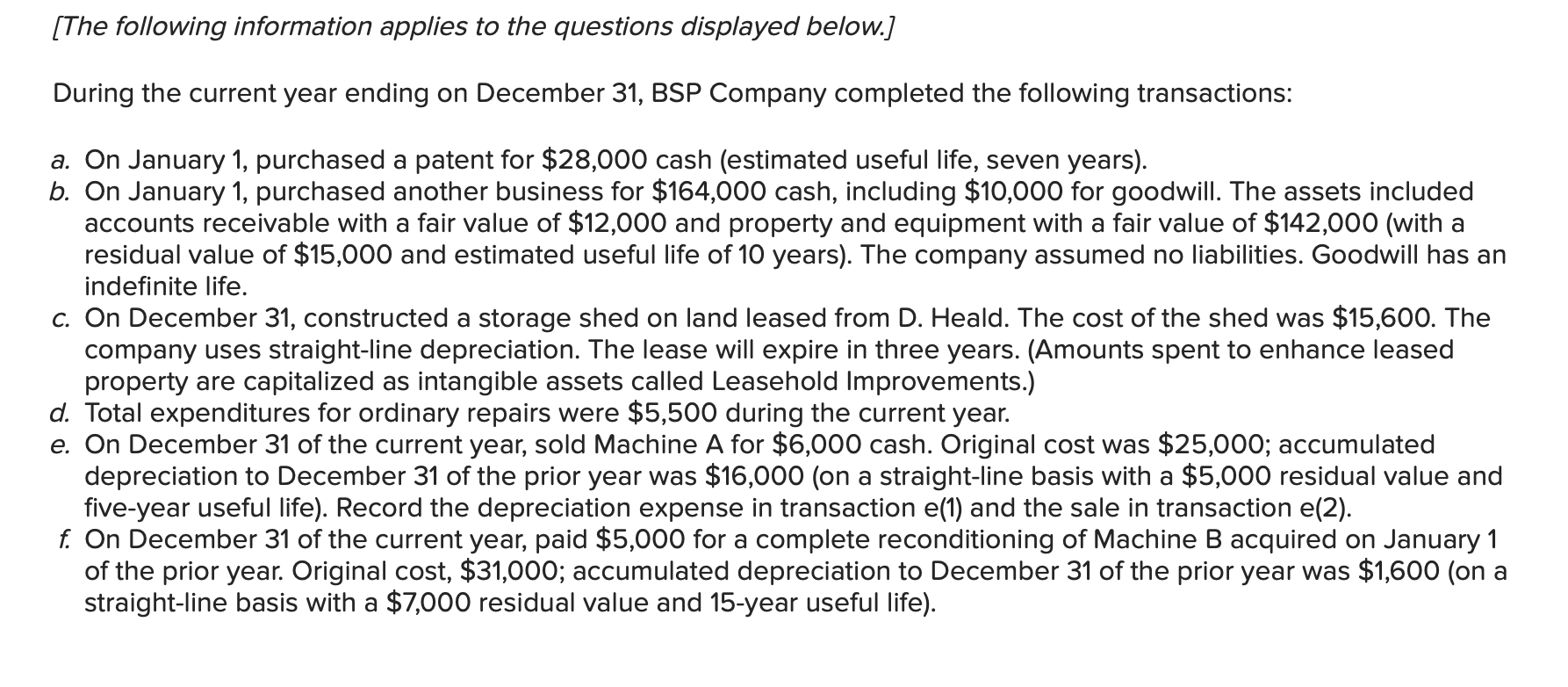

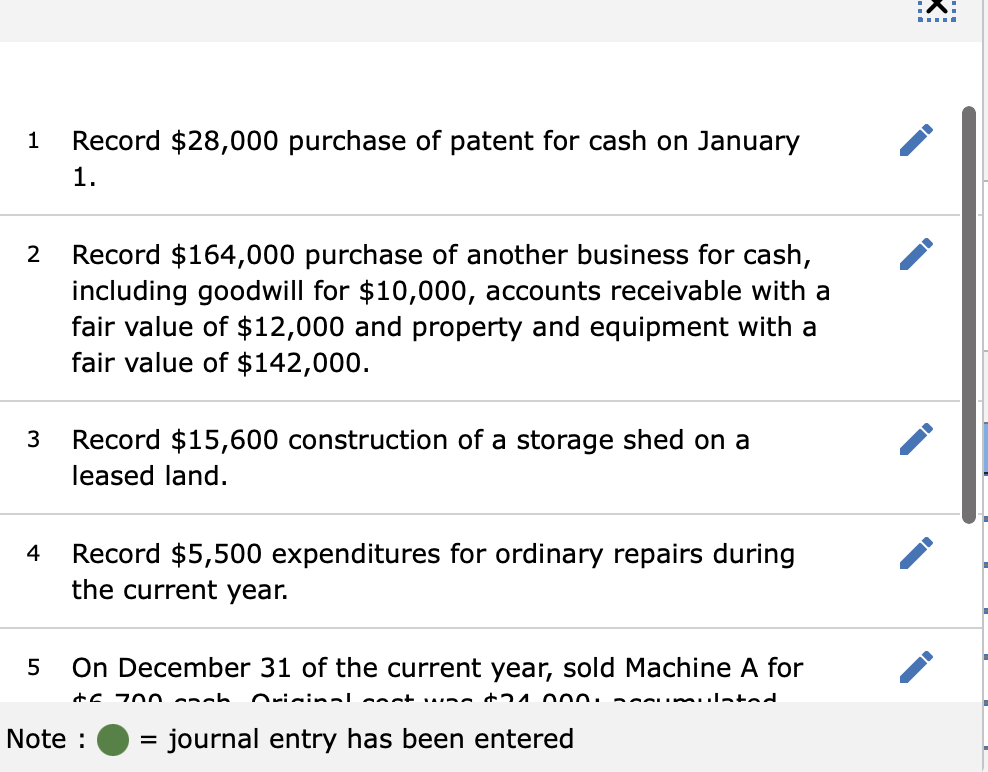

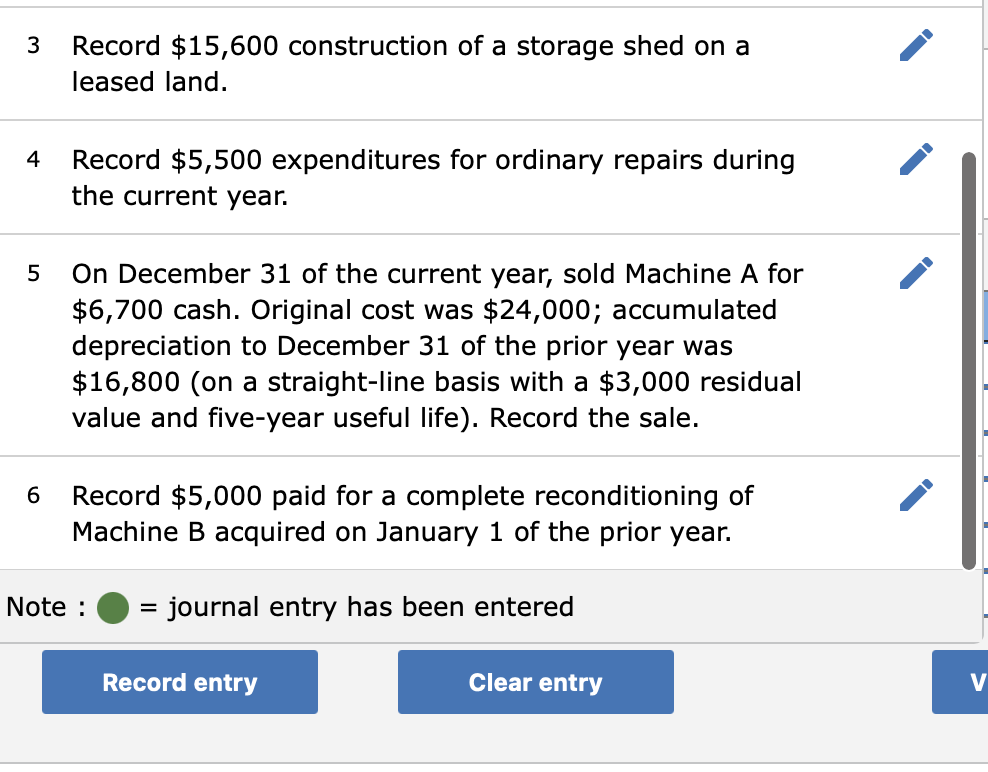

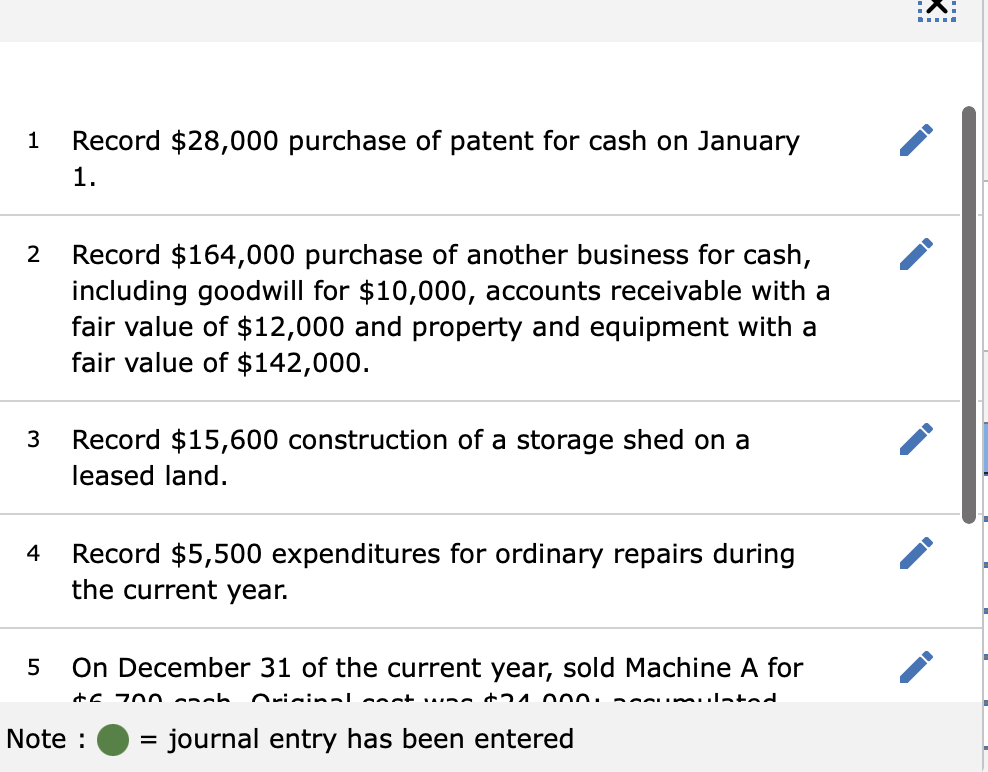

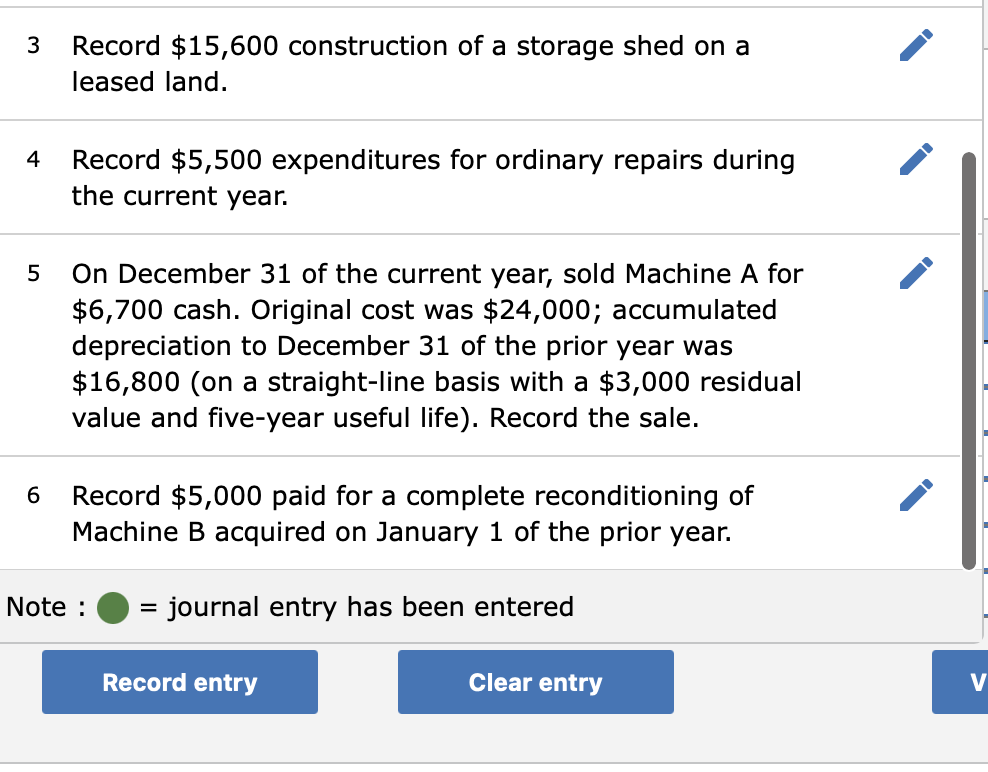

[The following information applies to the questions displayed below.] During the current year ending on December 31, BSP Company completed the following transactions: a. On January 1 , purchased a patent for $28,000 cash (estimated useful life, seven years). b. On January 1 , purchased another business for $164,000cash, including $10,000 for goodwill. The assets included accounts receivable with a fair value of $12,000 and property and equipment with a fair value of $142,000 (with a residual value of $15,000 and estimated useful life of 10 years). The company assumed no liabilities. Goodwill has an indefinite life. c. On December 31, constructed a storage shed on land leased from D. Heald. The cost of the shed was $15,600. The company uses straight-line depreciation. The lease will expire in three years. (Amounts spent to enhance leased property are capitalized as intangible assets called Leasehold Improvements.) d. Total expenditures for ordinary repairs were $5,500 during the current year. e. On December 31 of the current year, sold Machine A for $6,000cash. Original cost was $25,000; accumulated depreciation to December 31 of the prior year was $16,000 (on a straight-line basis with a $5,000 residual value and five-year useful life). Record the depreciation expense in transaction e(1) and the sale in transaction e(2). f. On December 31 of the current year, paid $5,000 for a complete reconditioning of Machine B acquired on January 1 of the prior year. Original cost, $31,000; accumulated depreciation to December 31 of the prior year was $1,600 (on a straight-line basis with a $7,000 residual value and 15 year useful life). 1 Record $28,000 purchase of patent for cash on January 1. 2 Record $164,000 purchase of another business for cash, including goodwill for $10,000, accounts receivable with a fair value of $12,000 and property and equipment with a fair value of $142,000. 3 Record $15,600 construction of a storage shed on a leased land. 4 Record $5,500 expenditures for ordinary repairs during the current year. 5 On December 31 of the current year, sold Machine A for te 7 nn ..oh nuininnl a.ot..... tha nnn. ......m..1ntad Note : = journal entry has been entered 3 Record $15,600 construction of a storage shed on a leased land. 4 Record $5,500 expenditures for ordinary repairs during the current year. 5 On December 31 of the current year, sold Machine A for $6,700 cash. Original cost was $24,000; accumulated depreciation to December 31 of the prior year was $16,800 (on a straight-line basis with a $3,000 residual value and five-year useful life). Record the sale. 6 Record $5,000 paid for a complete reconditioning of Machine B acquired on January 1 of the prior year