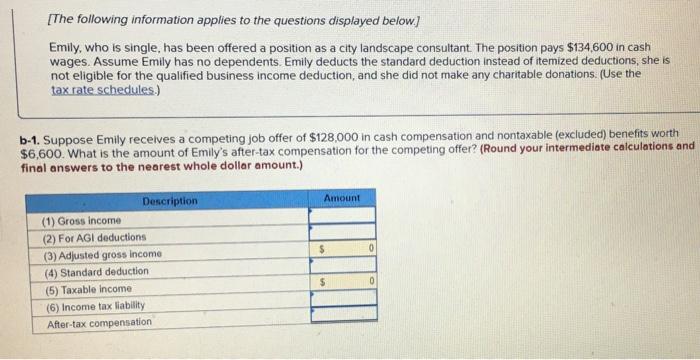

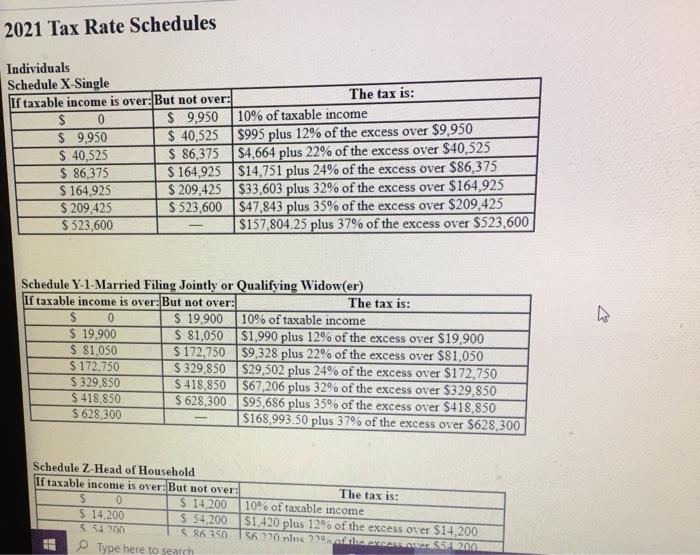

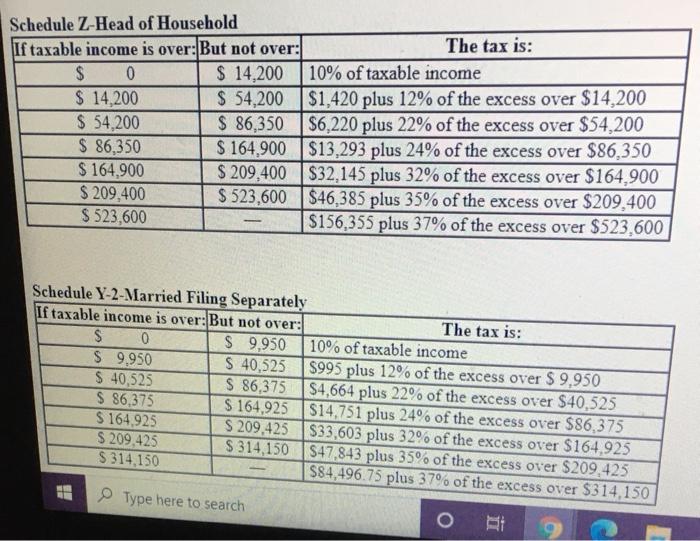

[The following information applies to the questions displayed below) Emily, who is single, has been offered a position as a city landscape consultant. The position pays $134,600 in cash wages. Assume Emily has no dependents. Emily deducts the standard deduction instead of itemized deductions, she is not eligible for the qualified business income deduction, and she did not make any charitable donations (Use the tax rate schedules.) b-1. Suppose Emily receives a competing job offer of $128,000 in cash compensation and nontaxable (excluded) benefits worth $6,600. What is the amount of Emily's after-tax compensation for the competing offer? (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Amount $ 0 Description (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Taxable income (6) Income tax liability After-tax compensation $ 0 2021 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $9.950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $ 164,925 $14,751 plus 24% of the excess over $86,375 $164.925 $ 209,425 $33,603 plus 32% of the excess over $164.925 $ 209,425 S 523,600 $47,843 plus 35% of the excess over $209,425 $ 523,600 $157,804.25 plus 37% of the excess over $523,600 Schedule Y 1- Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: S 0 $ 19,900 10% of taxable income S 19.900 S 81,050 $1.990 plus 12% of the excess over $19.900 $ 81,050 S 172,750 $9,328 plus 22% of the excess over $81,050 $ 172,750 S 329.850 529,502 plus 24% of the excess over $172.750 S 329,850 S 418,850 $67,206 plus 32% of the excess over $329,850 $ 418,850 S 628,300 595,686 plus 35% of the excess over $418,850 S 628,300 $168.993.50 plus 37% of the excess over $628,300 Schedule Z-Head of Household If taxable income is over:But not over: S 0 S 14,200 $ 14,200 S 54,200 S5200 S86350 Type here to search The tax is: 10% of taxable income $1.420 plus 12% of the excess over $14,200 56270 ning of the c50200 E Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,200 10% of taxable income $ 14,200 $ 54,200 $1,420 plus 12% of the excess over $14,200 $ 54,200 $ 86,350 $6,220 plus 22% of the excess over $54,200 $ 86,350 $ 164,900 $13,293 plus 24% of the excess over $86,350 $164,900 $ 209,400 $32,145 plus 32% of the excess over $164,900 $ 209,400 $ 523,600 $46,385 plus 35% of the excess over $209,400 $ 523,600 $156,355 plus 37% of the excess over $523,600 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $ 9,950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $ 164,925 $14.751 plus 24% of the excess over $86,375 $164.925 $ 209.425 $33,603 plus 32% of the excess over $164.925 $ 209,425 $ 314,150 $47,843 plus 35% of the excess over $209,425 $ 314,150 $84.496.75 plus 37% of the excess over $314.150 Type here to search RE