Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par

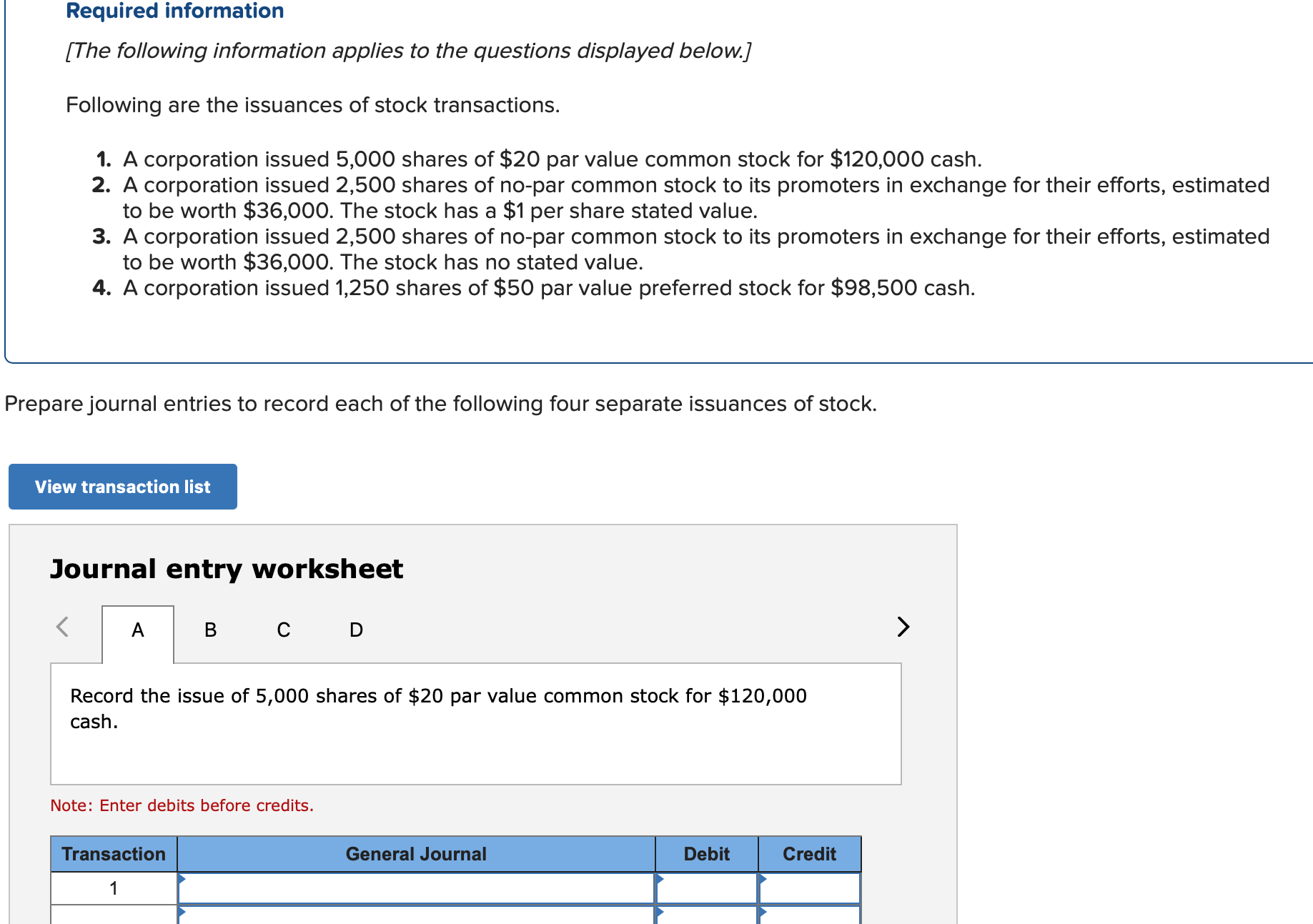

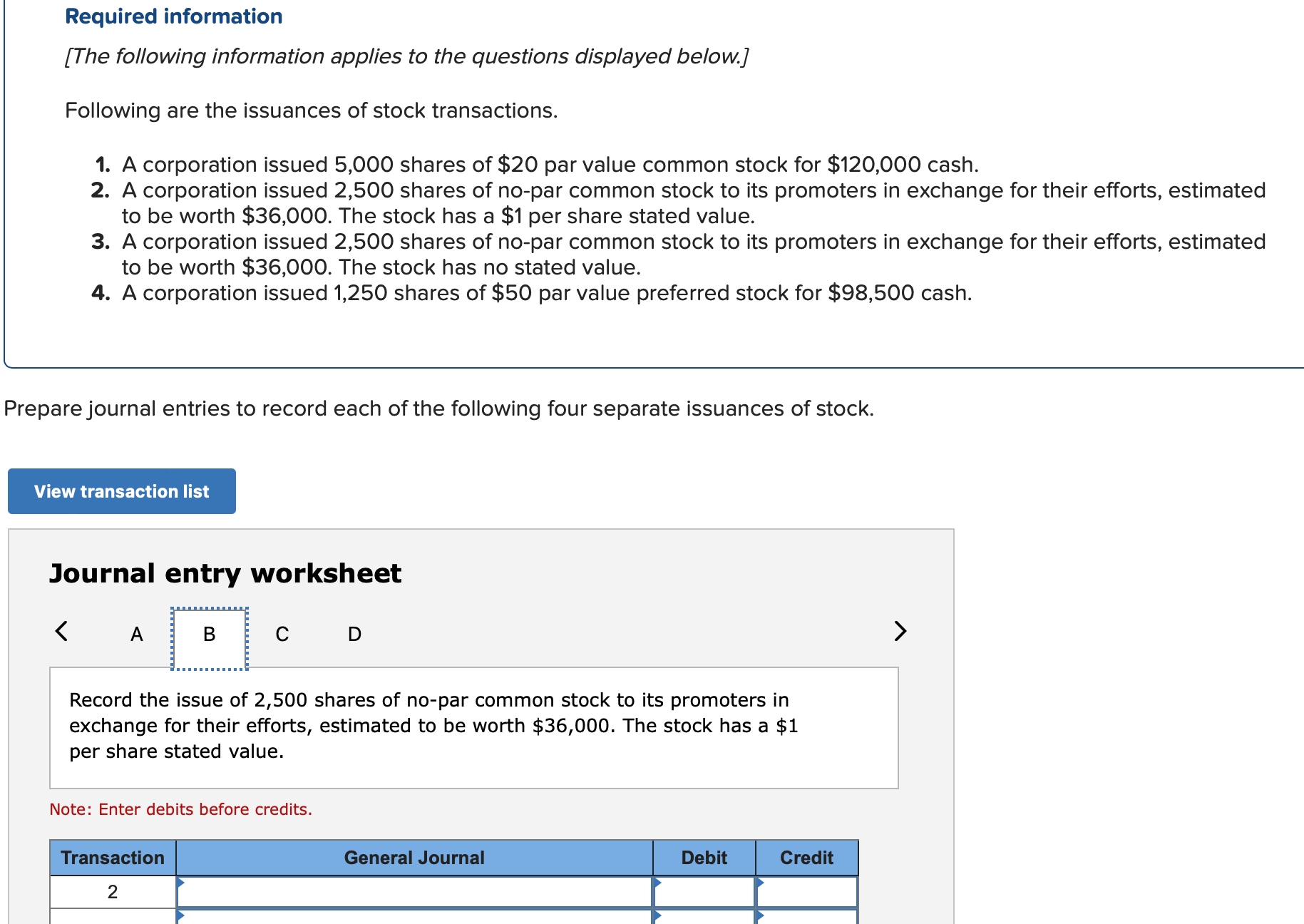

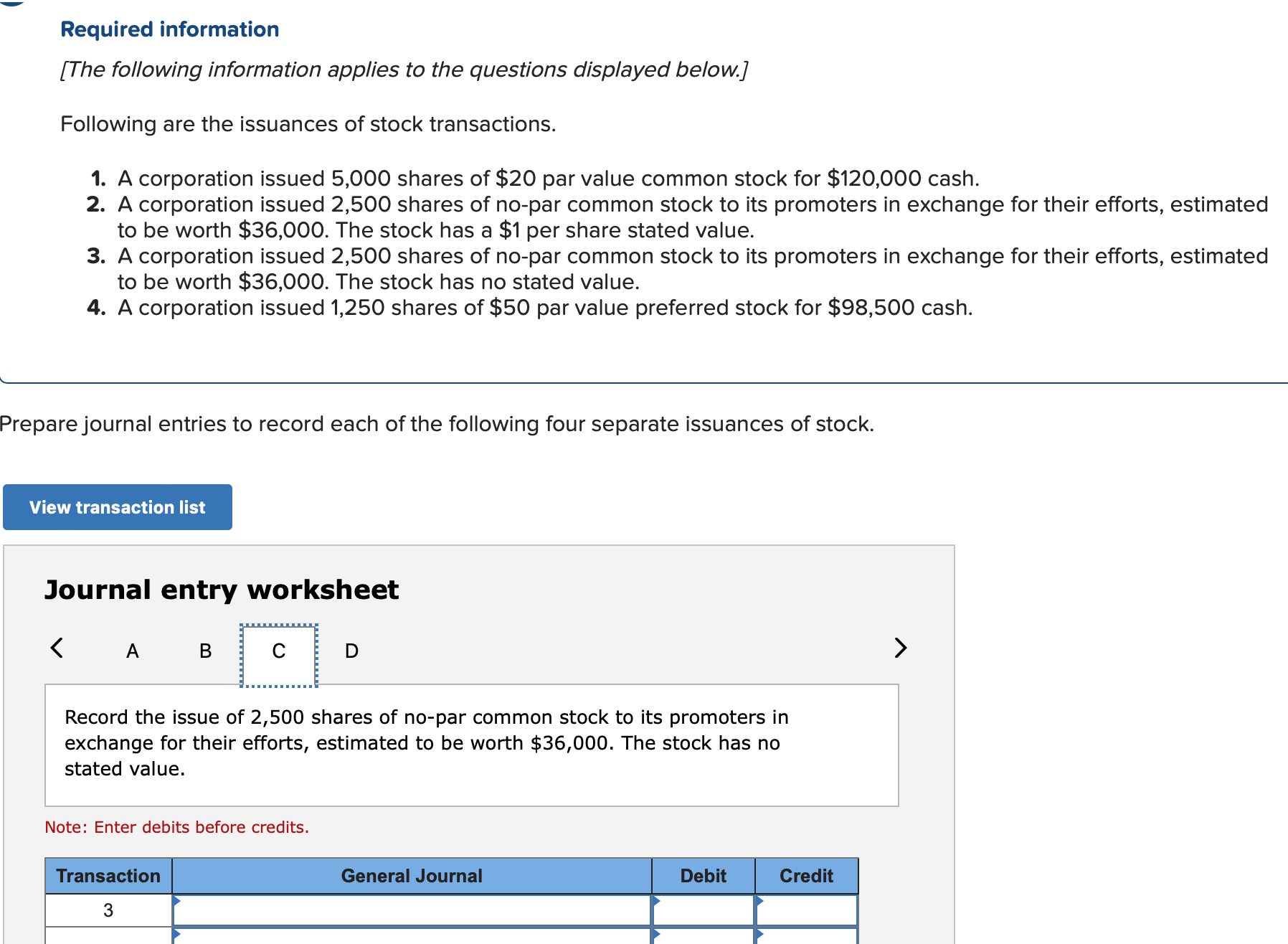

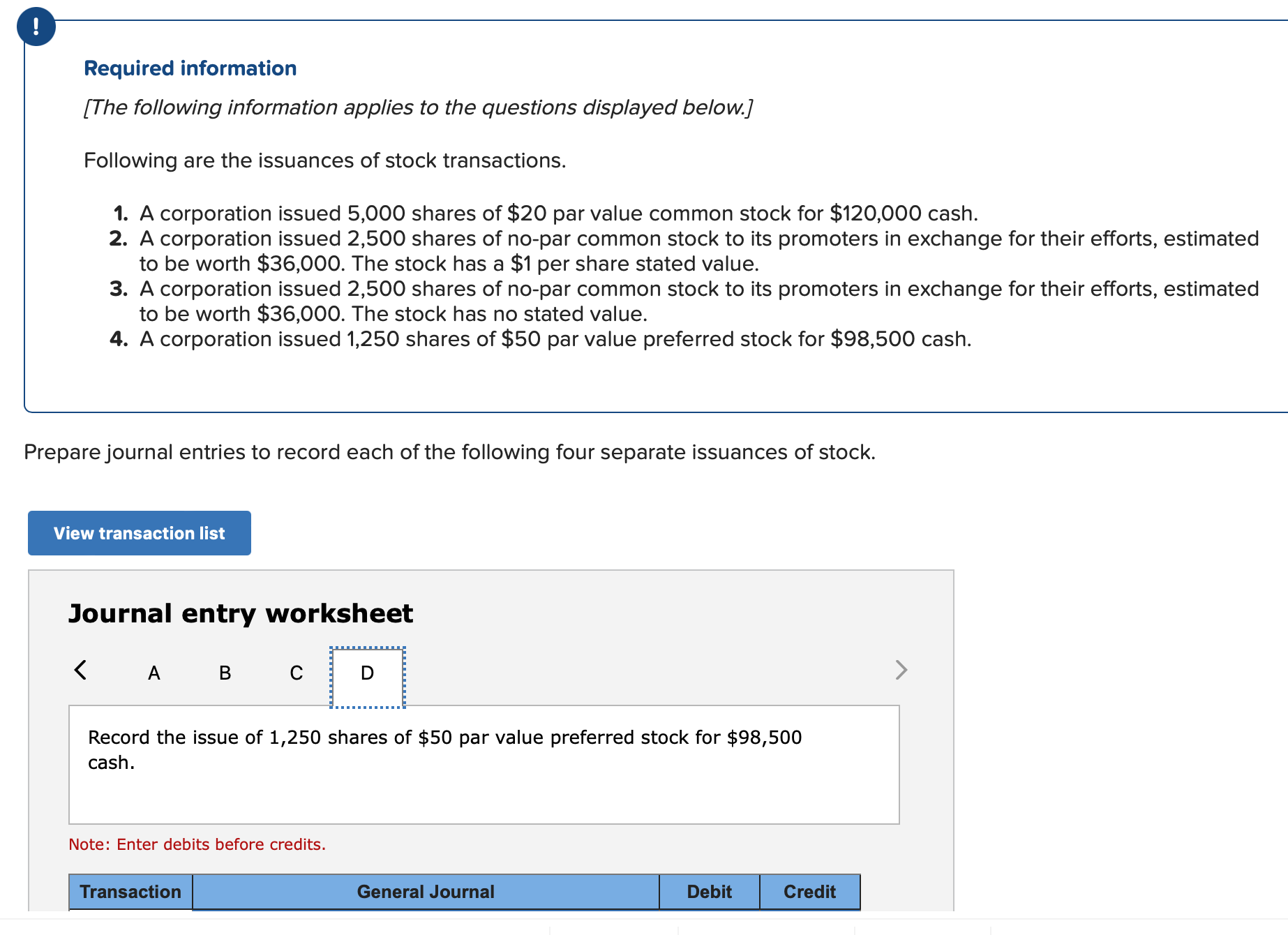

[The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 5,000 shares of $20 par value common stock for $120,000 cash. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. repare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 1,250 shares of $50 par value preferred stock for $98,500 cash. Note: Enter debits before credits

[The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 5,000 shares of $20 par value common stock for $120,000 cash. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. repare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Following are the issuances of stock transactions. 1. A corporation issued 5,000 shares of $20 par value common stock for $120,000 cash. 2. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has a $1 per share stated value. 3. A corporation issued 2,500 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $36,000. The stock has no stated value. 4. A corporation issued 1,250 shares of $50 par value preferred stock for $98,500 cash. Prepare journal entries to record each of the following four separate issuances of stock. Journal entry worksheet Record the issue of 1,250 shares of $50 par value preferred stock for $98,500 cash. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started