Question

[The following information applies to the questions displayed below.] Georgia Orchards produced a good crop of peaches this year. After preparing the following income statement,

[The following information applies to the questions displayed below.] Georgia Orchards produced a good crop of peaches this year. After preparing the following income statement, the company is concerned about the net loss on its No. 3 peaches.

| GEORGIA ORCHARDS Income Statement For Year Ended December 31, 2019 | |||||||||||||

| No. 1 | No. 2 | No. 3 | Combined | ||||||||||

| Sales (by grade) | |||||||||||||

| No. 1: 350,000 Ibs. @ $1.50/lb | $ | 525,000 | |||||||||||

| No. 2: 350,000 Ibs. @ $0.90/lb | $ | 315,000 | |||||||||||

| No. 3: 600,000 Ibs. @ $0.35/lb | $ | 210,000 | |||||||||||

| Total sales | $ | 1,050,000 | |||||||||||

| Costs | |||||||||||||

| Tree pruning and care @ $0.30/lb | 105,000 | 105,000 | 180,000 | 390,000 | |||||||||

| Picking, sorting, and grading @ $0.20/lb | 70,000 | 70,000 | 120,000 | 260,000 | |||||||||

| Delivery costs | 15,300 | 15,300 | 37,800 | 68,400 | |||||||||

| Total costs | 190,300 | 190,300 | 337,800 | 718,400 | |||||||||

| Net income (loss) | $ | 334,700 | $ | 124,700 | $ | (127,800 | ) | $ | 331,600 | ||||

In preparing this statement, the company allocated joint costs among the grades on a physical basis as an equal amount per pound. The companys delivery cost records show that $30,600 of the $68,400 relates to crating the No. 1 and No. 2 peaches and hauling them to the buyer. The remaining $37,800 of delivery costs is for crating the No. 3 peaches and hauling them to the cannery.

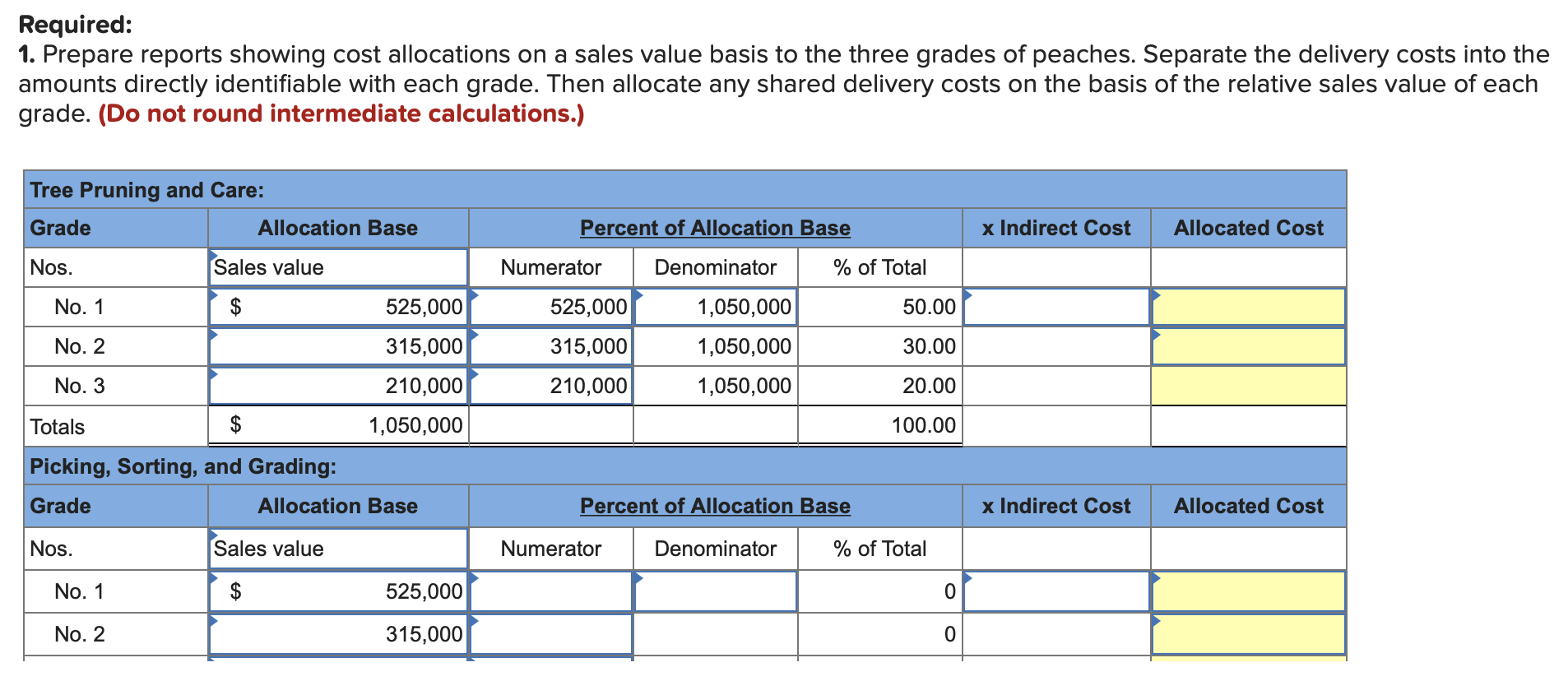

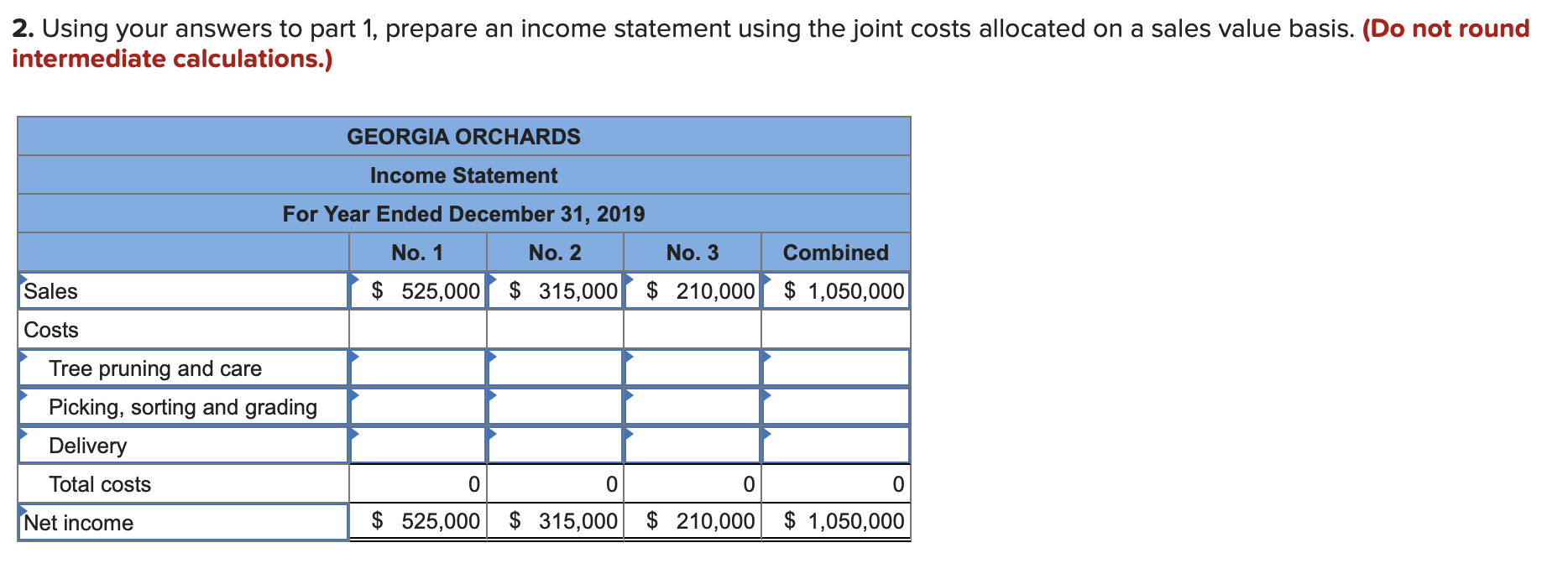

Required: 1. Prepare reports showing cost allocations on a sales value basis to the three grades of peaches. Separate the delivery costs into the amounts directly identifiable with each grade. Then allocate any shared delivery costs on the basis of the relative sales value of each grade. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started