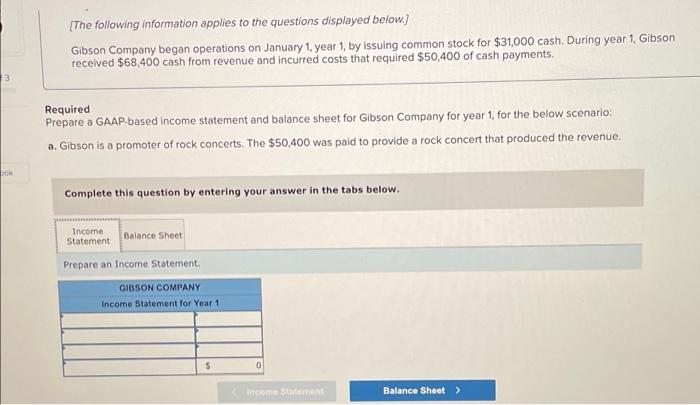

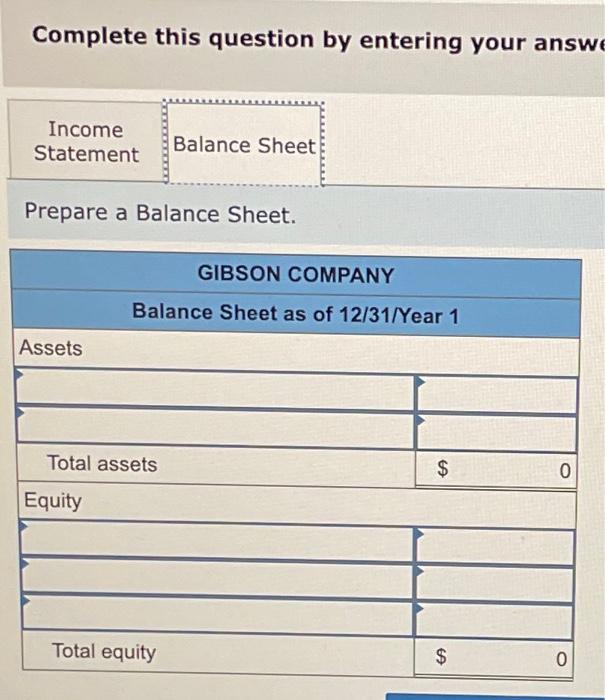

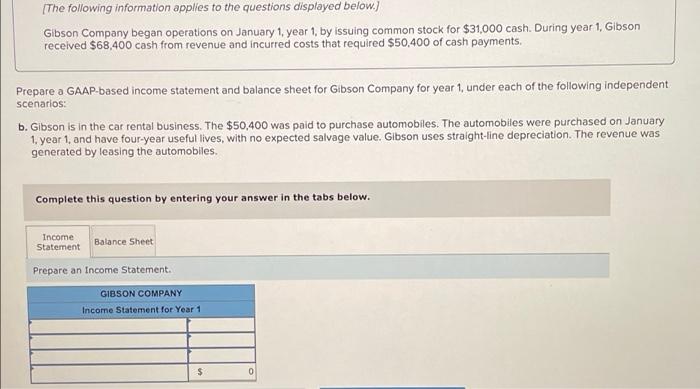

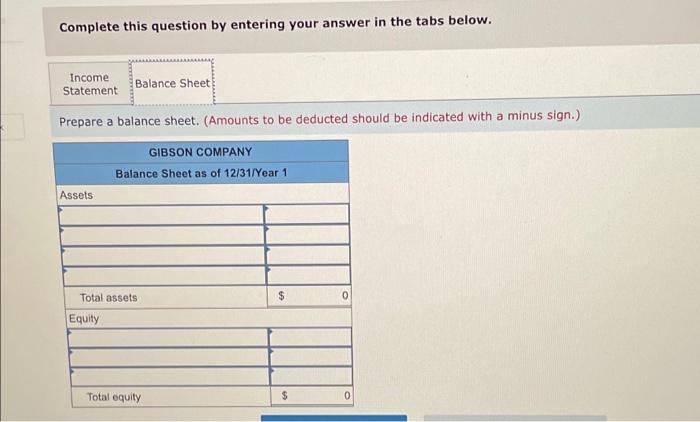

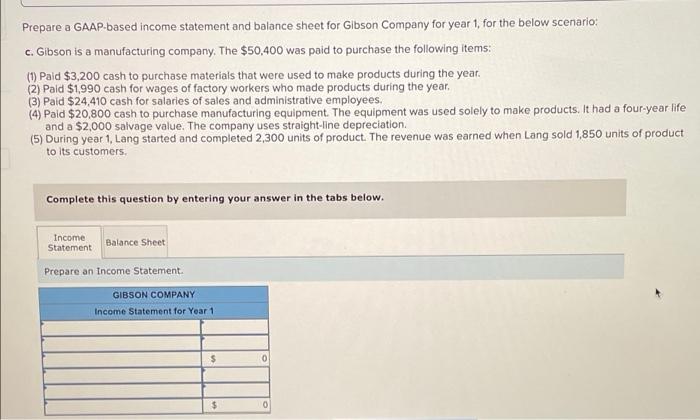

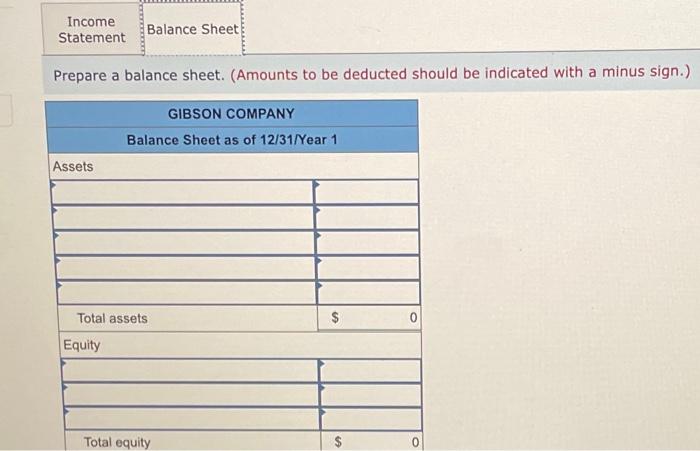

The following information applies to the questions displayed below.) Gibson Company began operations on January 1, year 1, by issuing common stock for $31,000 cash. During year 1, Gibson received $68,400 cash from revenue and incurred costs that required $50,400 of cash payments. 3 Required Prepare a GAAP-based income statement and balance sheet for Gibson Company for year 1, for the below scenario: a. Gibson is a promoter of rock concerts. The $50,400 was paid to provide a rock concert that produced the revenue DOR Complete this question by entering your answer in the tabs below. Income Statement Balance Sheet Prepare an Income Statement GIBSON COMPANY Income Statement for Year 1 $ 0 reme Daten Balance Sheet > Complete this question by entering your answe Income Statement Balance Sheet Prepare a Balance Sheet. GIBSON COMPANY Balance Sheet as of 12/31/Year 1 Assets Total assets $ 0 Equity Total equity $ 0 The following information applies to the questions displayed below.) Gibson Company began operations on January 1, year 1, by issuing common stock for $31.000 cash. During year 1, Gibson received $68,400 cash from revenue and incurred costs that required $50,400 of cash payments. Prepare a GAAP-based income statement and balance sheet for Gibson Company for year 1, under each of the following independent scenarios: b. Gibson is in the car rental business. The $50,400 was paid to purchase automobiles. The automobiles were purchased on January 1. year 1, and have four-year useful lives, with no expected salvage value. Gibson uses straight-line depreciation. The revenue was generated by leasing the automobiles Complete this question by entering your answer in the tabs below. Income Statement Balance Sheet Prepare an Income Statement. GIBSON COMPANY Income Statement for Year 1 $ 0 Complete this question by entering your answer in the tabs below. Income Statement Balance Sheet Prepare a balance sheet. (Amounts to be deducted should be indicated with a minus sign.) GIBSON COMPANY Balance Sheet as of 12/31/Year 1 Assets Total assets $ 0 Equity Total equity $ 0 Prepare a GAAP-based income statement and balance sheet for Gibson Company for year 1, for the below scenario: c. Gibson is a manufacturing company. The $50,400 was paid to purchase the following items: (1) Pald $3,200 cash to purchase materials that were used to make products during the year. (2) Pald $1,990 cash for wages of factory workers who made products during the year. (3) Paid $24,410 cash for salaries of sales and administrative employees, (4) Paid $20,800 cash to purchase manufacturing equipment. The equipment was used solely to make products. It had a four-year life and a $2,000 salvage value. The company uses straight-line depreciation. (5) During year 1, Lang started and completed 2,300 units of product. The revenue was earned when Lang sold 1,850 units of product to its customers Complete this question by entering your answer in the tabs below. Income Statement Balance Sheet Prepare an Income Statement GIBSON COMPANY Income Statement for Year 1 0 $ 0 Income Statement Balance Sheet Prepare a balance sheet. (Amounts to be deducted should be indicated with a minus sign.) GIBSON COMPANY Balance Sheet as of 12/31/Year 1 Assets $ 0 Total assets Equity Total equity $ o