Question

[The following information applies to the questions displayed below.] Hafnaoui Company reported pretax net income from continuing operations of $903,500 and taxable income of

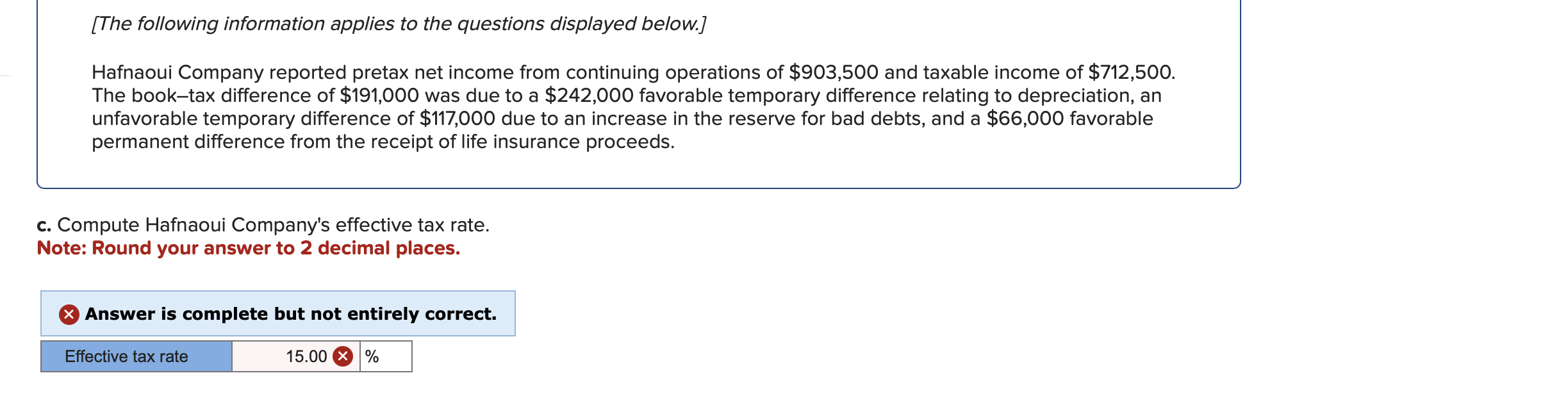

[The following information applies to the questions displayed below.] Hafnaoui Company reported pretax net income from continuing operations of $903,500 and taxable income of $712,500. The book-tax difference of $191,000 was due to a $242,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $117,000 due to an increase in the reserve for bad debts, and a $66,000 favorable permanent difference from the receipt of life insurance proceeds. c. Compute Hafnaoui Company's effective tax rate. Note: Round your answer to 2 decimal places. Answer is complete but not entirely correct. Effective tax rate 15.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

11th edition

538480289, 978-0538480284

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App