Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[The following information applies to the questions displayed below.] Ken is 63 years old and unmarried. He retired at age 55 when he sold his

[The following information applies to the questions displayed below.] Ken is 63 years old and unmarried. He retired at age 55 when he sold his business, Understock.com. Though Ken is retired, he is still very active. Ken reported the following financial information this year. Assume Ken files as a single taxpayer.

- Ken won $1,560 in an illegal game of poker (the game was played in Utah, where gambling is illegal).

- Ken sold 1,360 shares of stock for $32 a share. He inherited the stock two years ago. His tax basis (or investment) in the stock was $31 per share.

- Ken received $28,600 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for 20 years, for $240,240.

- Ken received $13,900 in disability benefits for the year. He purchased the disability insurance policy last year.

- Ken decided to go back to school to learn about European history. He received a $860 cash scholarship to attend. He used $480 to pay for his books and tuition, and he applied the rest toward his new car payment.

- Kens son, Mike, instructed his employer to make half of his final paycheck of the year payable to Ken as a gift from Mike to Ken. Ken received the check on December 30 in the amount of $1,640.

- Ken received a $790 refund of the $3,960 in state income taxes his employer withheld from his pay last year. Ken claimed $12,810 in itemized deductions last year (the standard deduction for a single filer was $12,400).

- Ken received $33,600 of interest from corporate bonds and money market accounts.

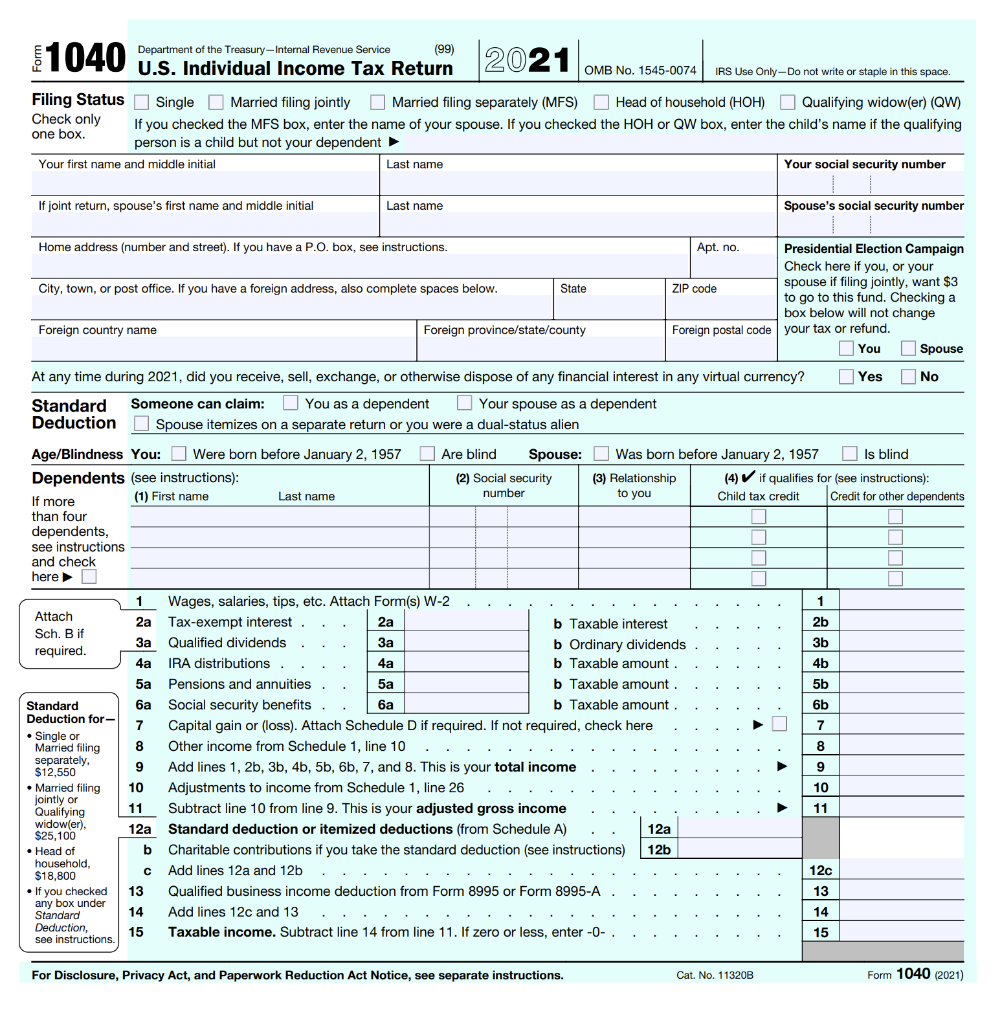

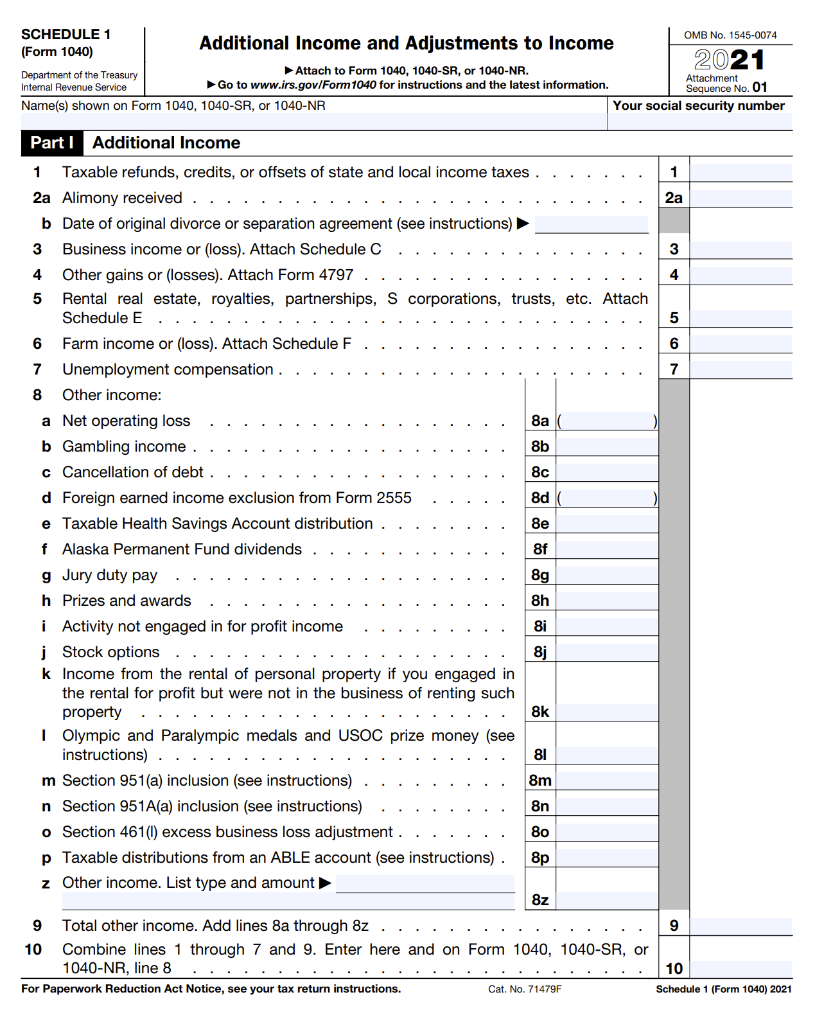

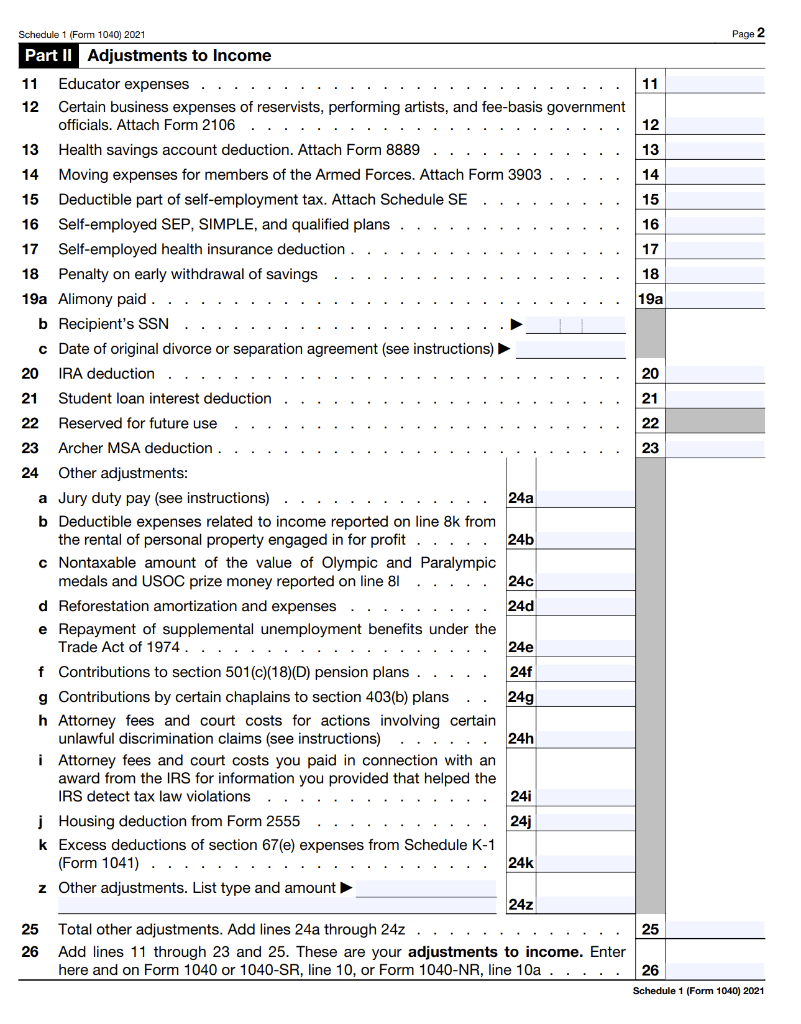

Task: Complete page 1 of Form 1040 (through line 9) and Schedule 1 for Ken.

Please use the form to fill out. Thank You

Department of the Treasury-Internal Revenue Service (99) 1040 2021 U.S. Individual Income Tax Return OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is a child but not your dependent Check only one box. Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change City, town, or post office. If you have a foreign address, also complete spaces below. State Foreign country name. Foreign province/state/county Spouse No At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Standard Someone can claim: You as a dependent Deduction Your spouse as a dependent Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1957 Dependents (see instructions): Are blind Spouse: (2) Social security number Was born before January 2, 1957 (3) Relationship to you (1) First name Last name If more than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach 2a Tax-exempt interest 2a b Taxable interest Sch. B if required. 3a Qualified dividends 3a b Ordinary dividends IRA distributions . 4a b Taxable amount. 4a 5a Pensions and annuities 6a 5a b Taxable amount. Social security benefits. 6a b Taxable amount. Standard Deduction for- 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here Other income from Schedule 1, line 10 8 Single or Married filing separately, $12,550 9 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income Adjustments to income from Schedule 1, line 26 Married filing 10 jointly or Qualifying widow(er), 11 Subtract line 10 from line 9. This is your adjusted gross income 12a Standard deduction or itemized deductions (from Schedule A) 12a $25,100 Head of b 12b household, $18,800 Charitable contributions if you take the standard deduction (see instructions) Add lines 12a and 12b . . 13 If you checked any box under Standard Deduction, Qualified business income deduction from Form 8995 or Form 8995-A Add lines 12c and 13. 14 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- see instructions. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. ZIP code Foreign postal code your tax or refund. You Yes Is blind (4) if qualifies for (see instructions): Child tax credit Credit for other dependents [ K L 1 2b 3b 4b 5b 6b 7 8 9 10 11 12c 13 14 15 Cat. No. 11320B Form 1040 (2021) OMB No. 1545-0074 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2021 Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.irs.gov/Form 1040 for instructions and the latest information. Name(s) shown on Form 1040, 1040-SR, or 1040-NR Department of the Treasury Internal Revenue Service Attachment Sequence No. 01 Your social security number Part I Additional Income 1 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received 2a b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 3 4 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 5 6 Farm income or (loss). Attach Schedule F 6 7 7 Unemployment compensation. 8 Other income: a Net operating loss 8a b Gambling income 8b c Cancellation of debt. 8c d Foreign earned income exclusion from Form 2555 8d e Taxable Health Savings Account distribution. 8e f Alaska Permanent Fund dividends 8f g Jury duty pay 8g h Prizes and awards 8h 8i i Activity not engaged in for profit income j Stock options 8j k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property 8k I Olympic and Paralympic medals and USOC prize money (see instructions) 81 m Section 951(a) inclusion (see instructions) 8m n Section 951A(a) inclusion (see instructions) 8n o Section 461(1) excess business loss adjustment. 80 p Taxable distributions from an ABLE account (see instructions) 8p z Other income. List type and amount 8z 9 Total other income. Add lines 8a through 8z 9 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 10 Cat. No. 71479F Schedule 1 (Form 1040) 2021 For Paperwork Reduction Act Notice, see your tax return instructions. Page 2 Schedule 1 (Form 1040) 2021 Part II Adjustments to Income 11 Educator expenses 11 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 12 13 Health savings account deduction. Attach Form 8889 13 14 Moving expenses for members of the Armed Forces. Attach Form 3903 14 15 Deductible part of self-employment tax. Attach Schedule SE 15 16 Self-employed SEP, SIMPLE, and qualified plans 16 17 Self-employed health insurance deduction. 17 18 Penalty on early withdrawal of savings 18 19a Alimony paid. 19a b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 20 21 Student loan interest deduction 21 22 Reserved for future use 22 23 Archer MSA deduction. 23 24 Other adjustments: 24a a Jury duty pay (see instructions) b Deductible expenses related to income reported on line 8k from the rental of personal property engaged in for profit 24b c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 81 24c 24d d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974. 24e f Contributions to section 501(c)(18)(D) pension plans 24f g Contributions by certain chaplains to section 403(b) plans 24g h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) 24h i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations 24i 24j j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041). 24k z Other adjustments. List type and amount 24z 25 Total other adjustments. Add lines 24a through 24z 25 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a 26 Schedule 1 (Form 1040) 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started