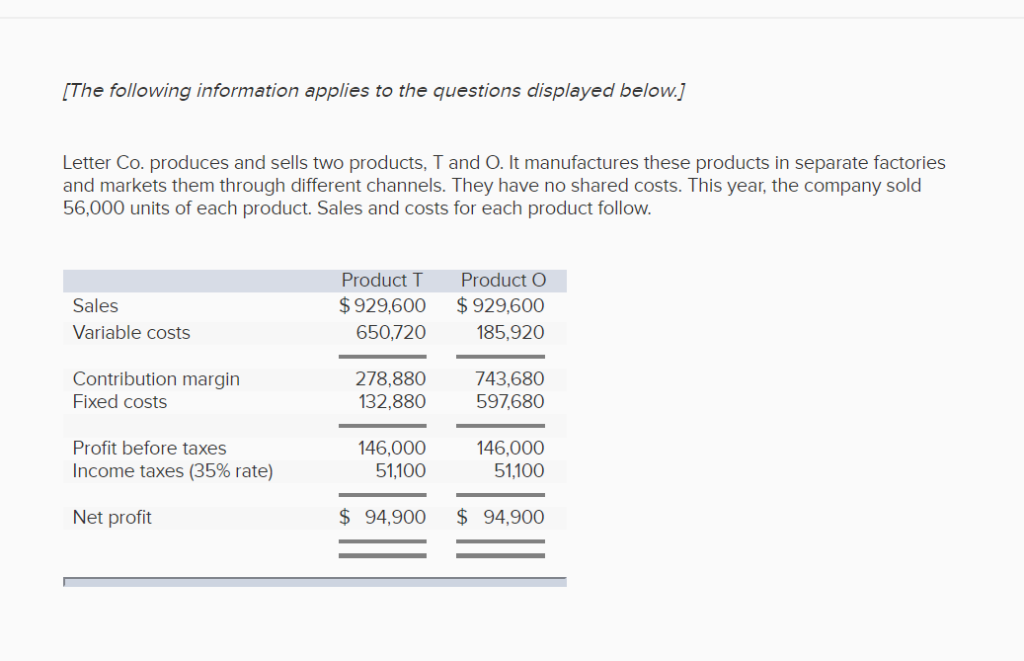

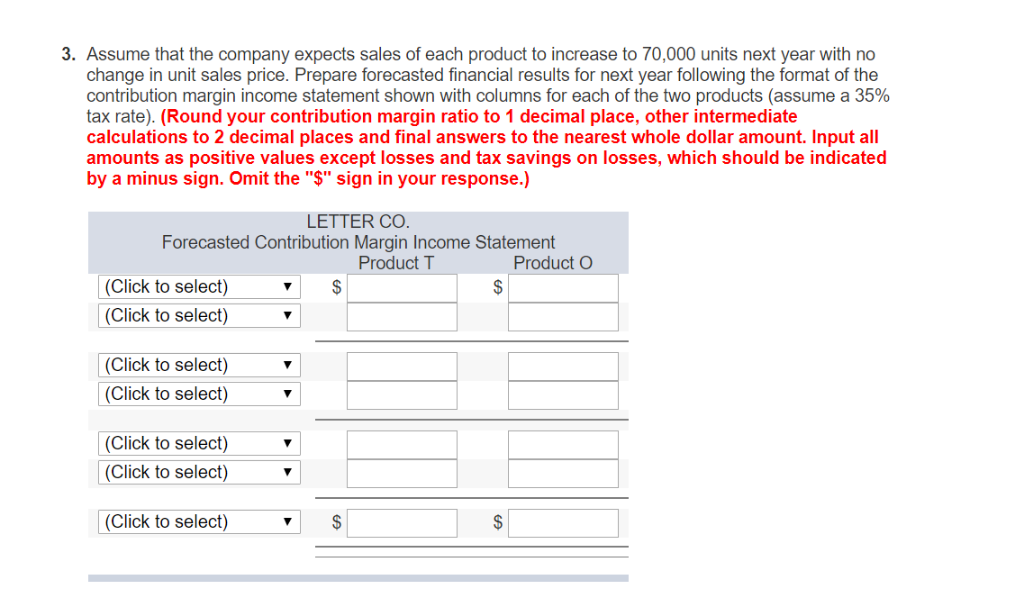

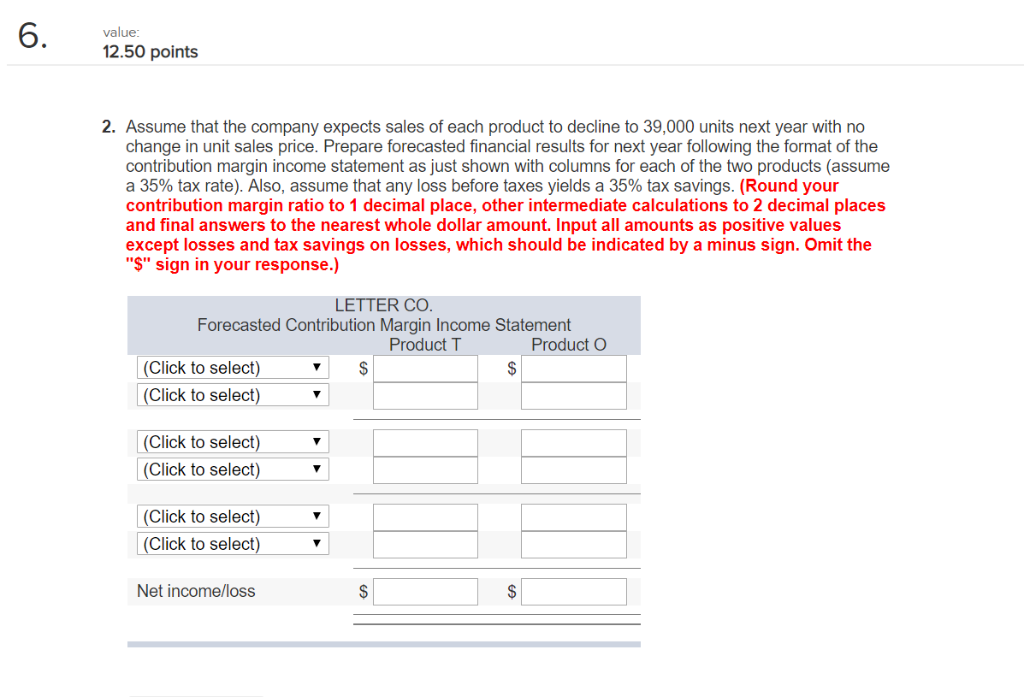

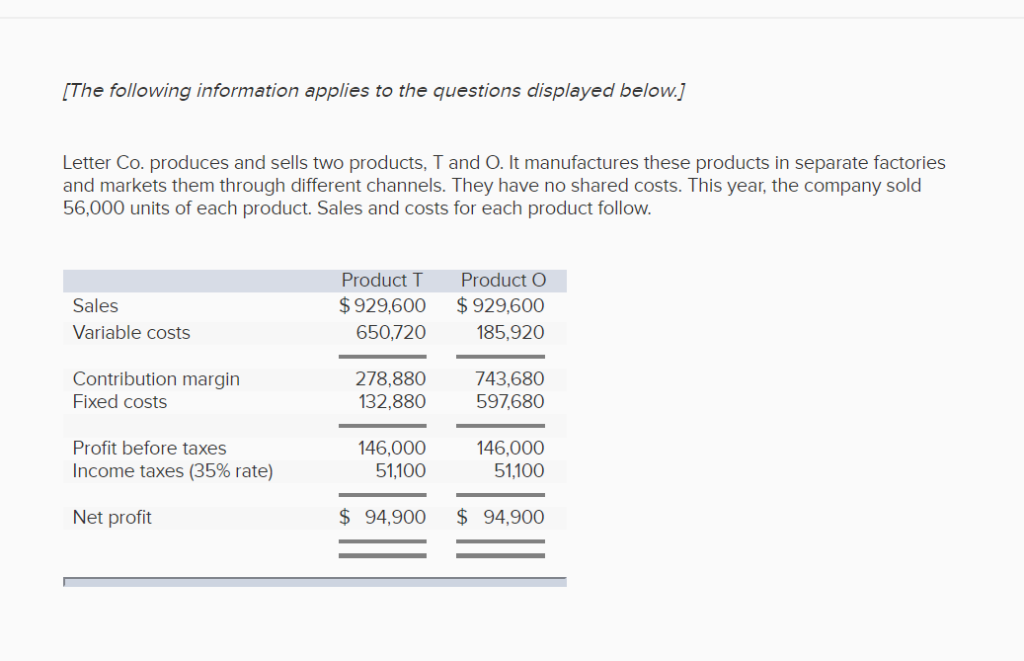

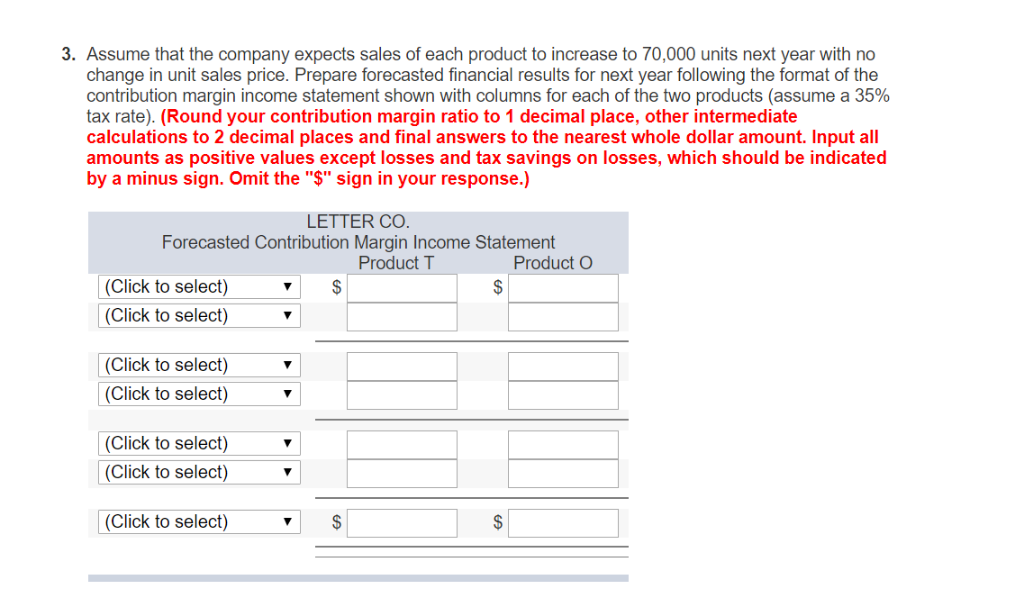

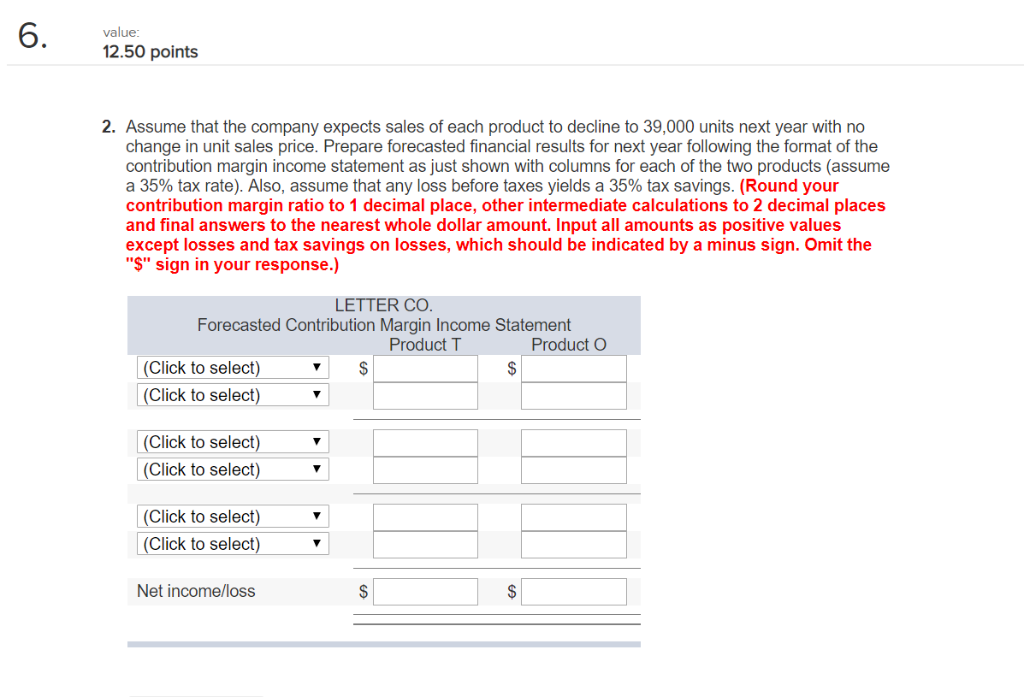

The following information applies to the questions displayed below.] Letter Co. produces and sells two products, T and O. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 56,000 units of each product. Sales and costs for each product follow ProductT ProductO $929,600 929,600 185,920 Sales Variable costs 650,720 Contribution margin Fixed costs 278,880 132,880 743,680 597680 146,000 51,100 Profit before taxes Income taxes (35% rate) 146,000 51,100 94,900 94,900 Net profit 3. Assume that the company expects sales of each product to increase to 70,000 units next year with no change in unit sales price. Prepare forecasted financial results for next year following the format of the contribution margin income statement shown with columns for each of the two products (assume a 35% tax rate). (Round your contribution margin ratio to 1 decimal place, other intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount. Input all amounts as positive values except losses and tax savings on losses, which should be indicated by a minus sign. Omit the "$" sign in your response.) LETTER CO Forecasted Contribution Margin Income Statement Product T Product (Click to select) (Click to select) (Click to select) (Click to select) (Click to select) (Click to select)' (Click to select) value 12.50 points 2. Assume that the company expects sales of each product to decline to 39,000 units next year with no change in unit sales price. Prepare forecasted financial results for next year following the format of the contribution margin income statement as just shown with columns for each of the two products (assume a 35% tax rate). Also, assume that any loss before taxes yields a 35% tax savings. (Round your contribution margin ratio to 1 decimal place, other intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount. Input all amounts as positive values except losses and tax savings on losses, which should be indicated by a minus sign. Omit the "$" sign in your response.) LETTER CO Forecasted Contribution Margin Income Statement Product T Product O Click to select Click to select Click to select Click to select Click to select Click to select Net income/loss