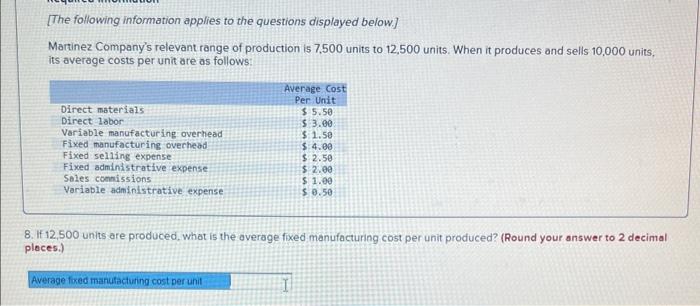

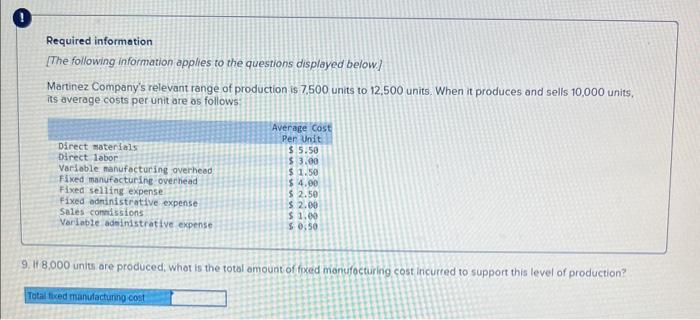

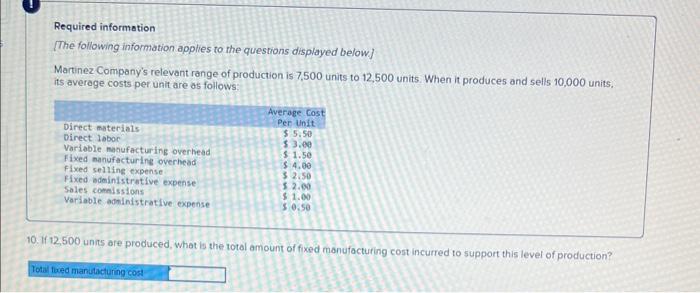

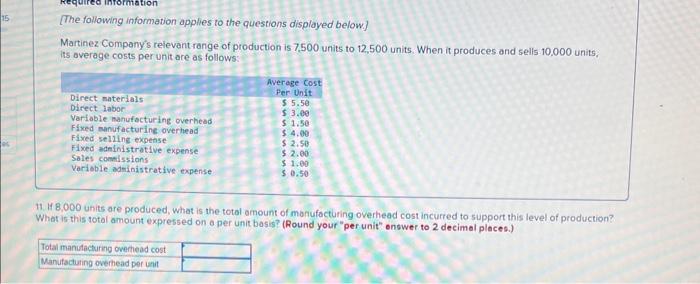

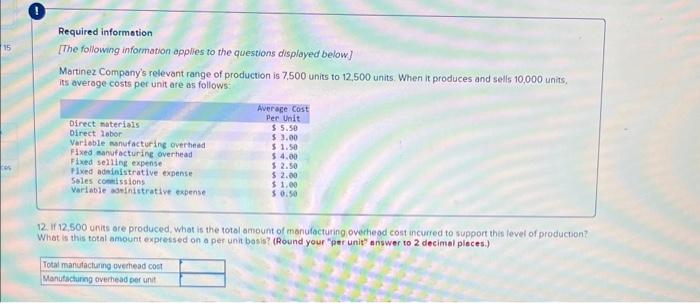

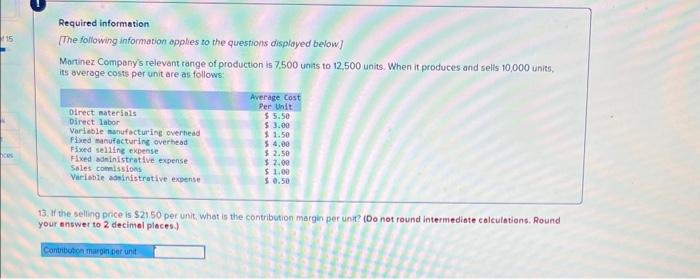

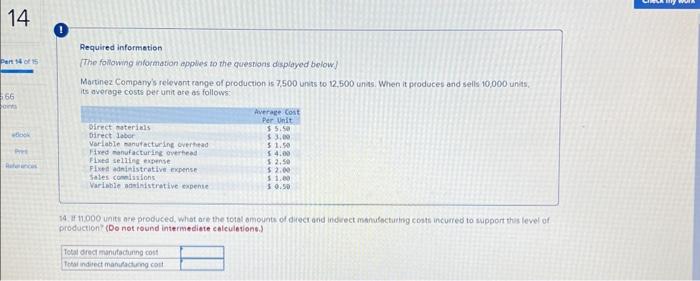

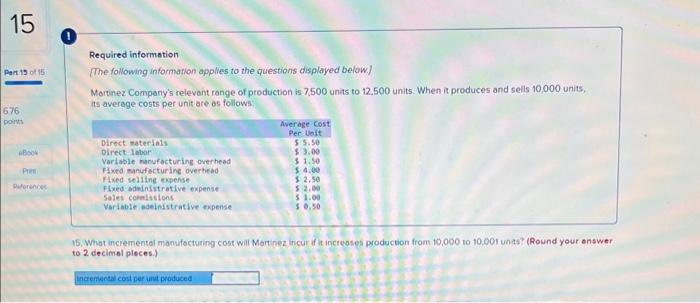

[The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: If 12,500 units are produced, what is the average fixed manufacturing cost per unit produced? (Round your answer to 2 decimal ces.) Required information [The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: If 8,000 units are produced; whot is the total amount of friced manufocturing cost incurred to support this level of production? Required information [The following information applies to the questrons displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: If 12,500 unis are produced, what is the total amount of fixed manufactufing cost incurred to support this level of production? [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its overage costs per unit are as follows: If 8,000 units are produced, what is the total amount of monufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? (Round your "per unit" enswer to 2 decimal places.) Required information [The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units. its average costs per unit are as follows: 12. If 12,500 units ore produced. What is the total ansount of manufacturing overheod cost incurred to suppont this level of producbon? What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) Required information [The following information opplies to the questions displayed below] Martinez Compeny's relevant range of production is 7,500 unas to 12,500 units. When it produces and selis 10,000 units, its overage costs per unit are as follows: 13. If the selling pnce is $21.50 per unit, what is the contribution margin per unit? (Do not round intermediate calculations. Round your answer to 2 decimel pleces.) Required informetion (The following inlormation applies to the questions displayed below\}) Martinez Company's relevent range of production is 7,500 units to 12,600 unts. When it produces and sells 10,000 uniss its averoge costs per unit are as follows: 4. If 11,000 units are produced, what are the total omounte of diect and indiect manufacturing costs incurred to wipport thes level of sroduction' (Do not round intermediete ealculetions.) Required information The following information applies to the questions displayed below.) Nartinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: 15. What incremental monufactuting cost will Martinez incur if it increases production from t0,000 to 10,001 unas? (Round your answer to 2 decimel pieces.)