Question

[The following information applies to the questions displayed below.] Mels Meals 2 Go purchases cookies that it includes in the 10,000 box lunches it prepares

[The following information applies to the questions displayed below.]

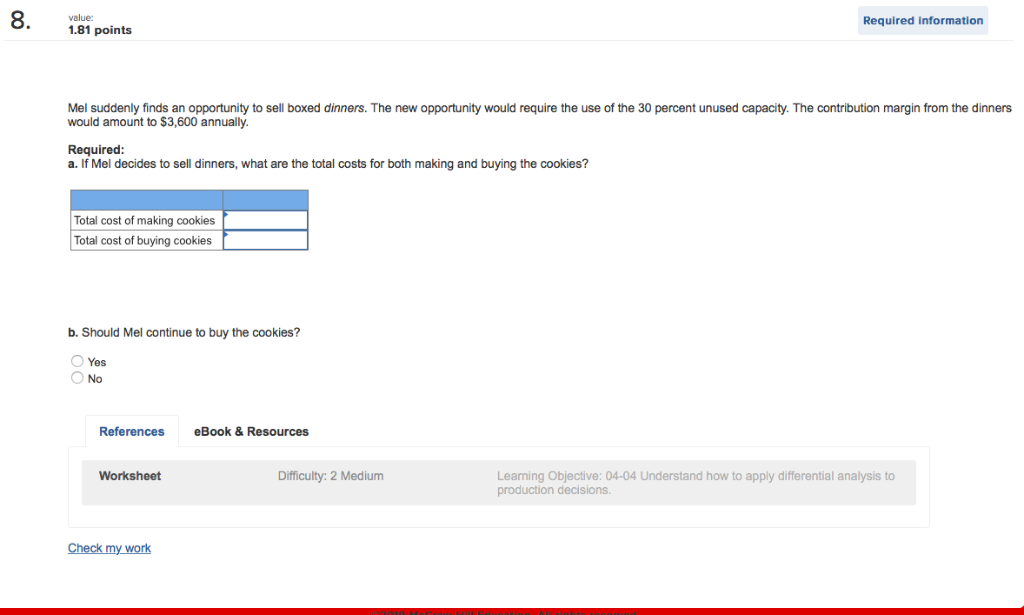

Mels Meals 2 Go purchases cookies that it includes in the 10,000 box lunches it prepares and sells annually. Mels kitchen and adjoining meeting room operate at 70 percent of capacity. Mels purchases the cookies for $0.84 each but is considering making them instead. Mels can bake each cookie for $0.26 for materials, $0.21 for direct labor, and $0.57 for overhead without increasing its capacity. The $0.57 for overhead includes an allocation of $0.36 per cookie for fixed overhead. However, total fixed overhead for the company would not increase if Mels makes thecookies.

Mel himself has come to you for advice. It would cost me $1.04 to make the cookies, but only $0.84 to buy. Should I continue buying them? Materials and labor are variable costs, but variable overhead would be only $0.21 per cookie. Two cookies are put into every lunch.

Required information 1.81 points Mel suddenly finds an opportunity to sell boxed dinners. The new opportunity would require the use of the 30 percent unused capacity. The contribution margin from the dinners would amount to $3,600 annually. Required a. If Mel decides to sell dinners, what are the total costs for both making and buying the cookies? Total cost of making cookies Total cost of buying cookies b. Should Mel continue to buy the cookies? O Yes O No References eBook & Resources Worksheet Difficulty: 2 Medium Learning Objective: 04-04 Understand how to apply differential analysis to production decisionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started