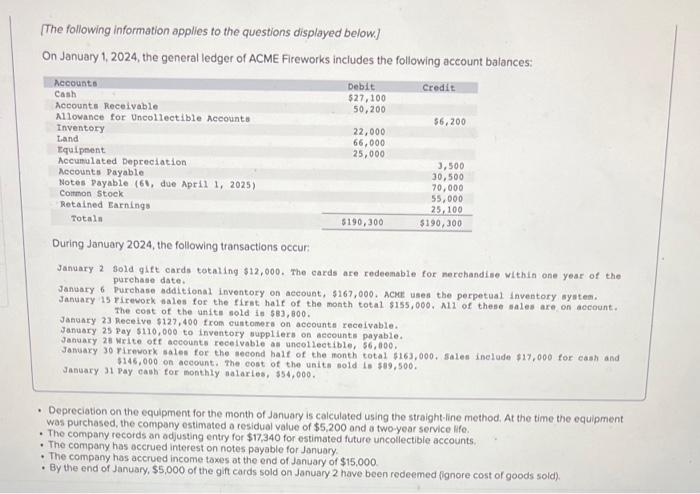

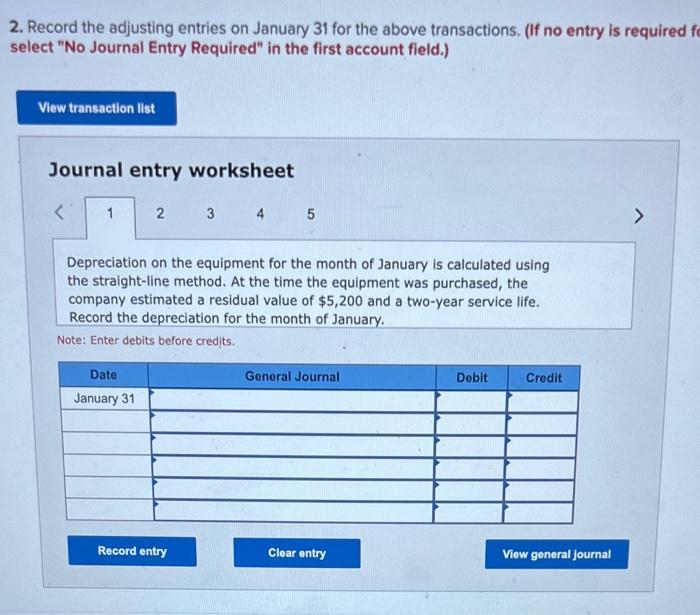

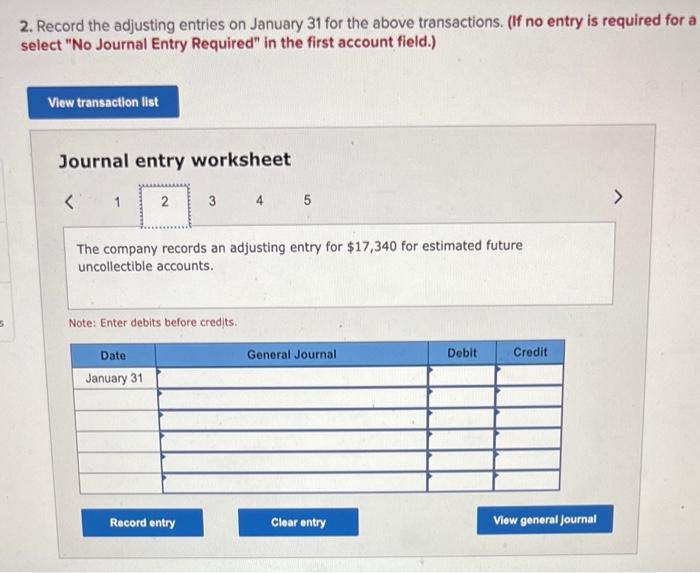

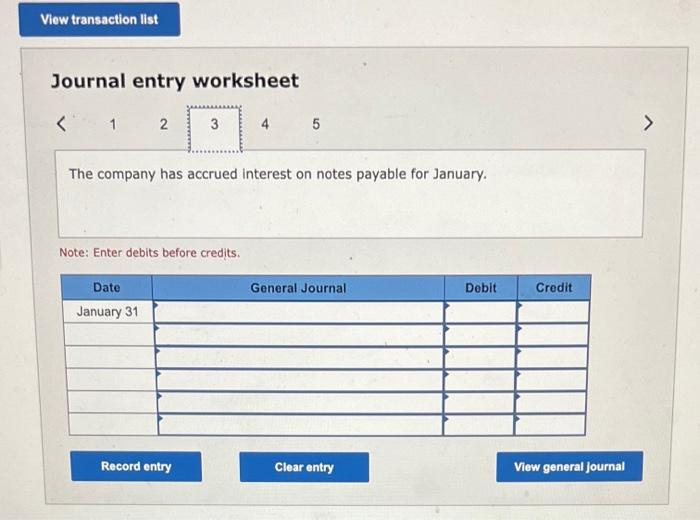

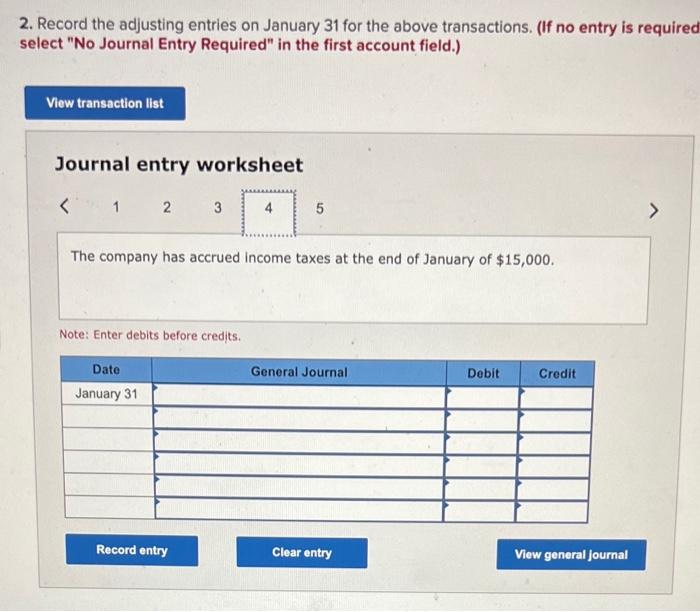

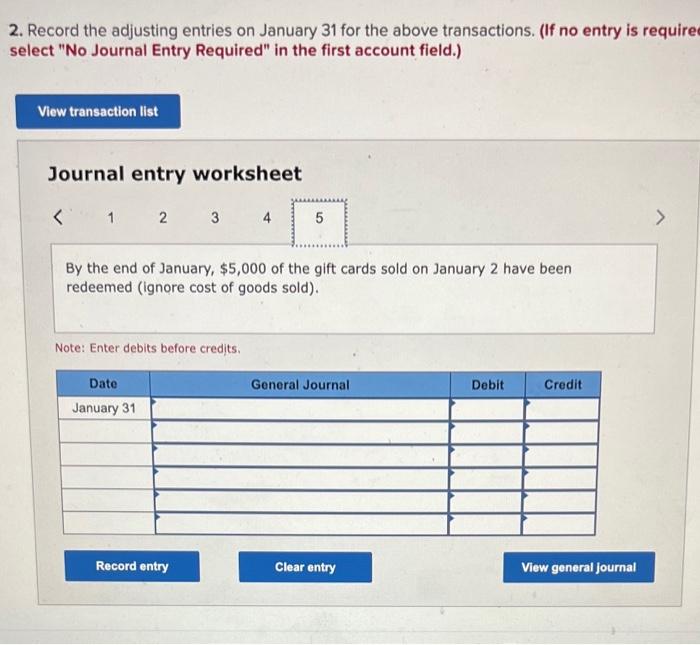

[The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 \$old glft cards totaling $12,000. The cards are redeemable for nerchandise within one year of the Janwary 6 purchase date. Jantary 6 purchase datditional inventory on account, $167,000. Acke uses the perpetual inventory syatem. January 15 Firework nales for the first half of the month total $155,000, A11 of these sales are on account. Janshaty 23 Receive $127,400 fros sold in 583,800 . January 25 pay ste 510,000,400 from cuntomera on account receivable. 3anuary 23 pay 3110,000 to inventory bupplierb on aecountis payable. January 2t write oft account recelvable as uncollectible, 56,000 . samary 30 Firnwork sales for the second halt of the month total $163,000, salen inelude $17,000 for eash and 3anuary 31 Pay cash tor monthly thalarles, 354,000 . anit nold is 509,500 , - Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $5,200 and a two-year service life. - The company records an odjusting entry for $17,340 for estimated future uncollectible accounts. - The company has occrued interest on notes payable for January. - The company has accrued income toxes ot the end of January of $15,000 - By the end of January, $5,000 of the gift cards sold on January 2 have been redeemed (ignore cost of goods sold). 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required select "No Journal Entry Required" in the first account field.) Journal entry worksheet Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $5,200 and a two-year service life. Record the depreciation for the month of January. Note: Enter debits before credits. 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required for a select "No Journal Entry Required" in the first account field.) Journal entry worksheet The company records an adjusting entry for $17,340 for estimated future uncollectible accounts. Note: Enter debits before credits. Journal entry worksheet The company has accrued interest on notes payable for January. Note: Enter debits before credits. 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is required select "No Journal Entry Required" in the first account field.) Journal entry worksheet The company has accrued income taxes at the end of January of $15,000 2. Record the adjusting entries on January 31 for the above transactions. (If no entry is require select "No Journal Entry Required" in the first account field.) Journal entry worksheet By the end of January, $5,000 of the gift cards sold on January 2 have been redeemed (ignore cost of goods sold). Note: Enter debits before credits