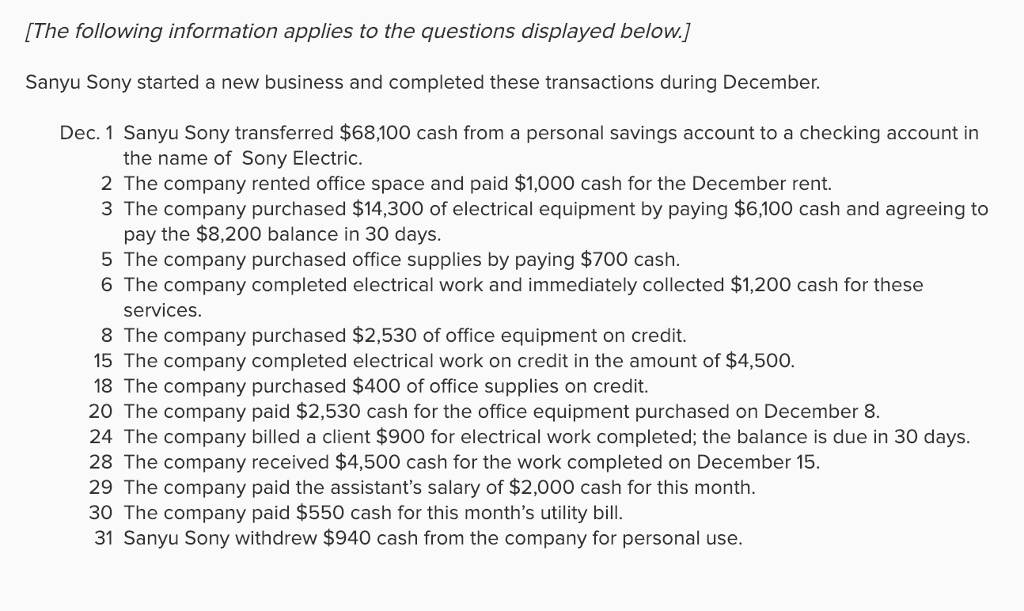

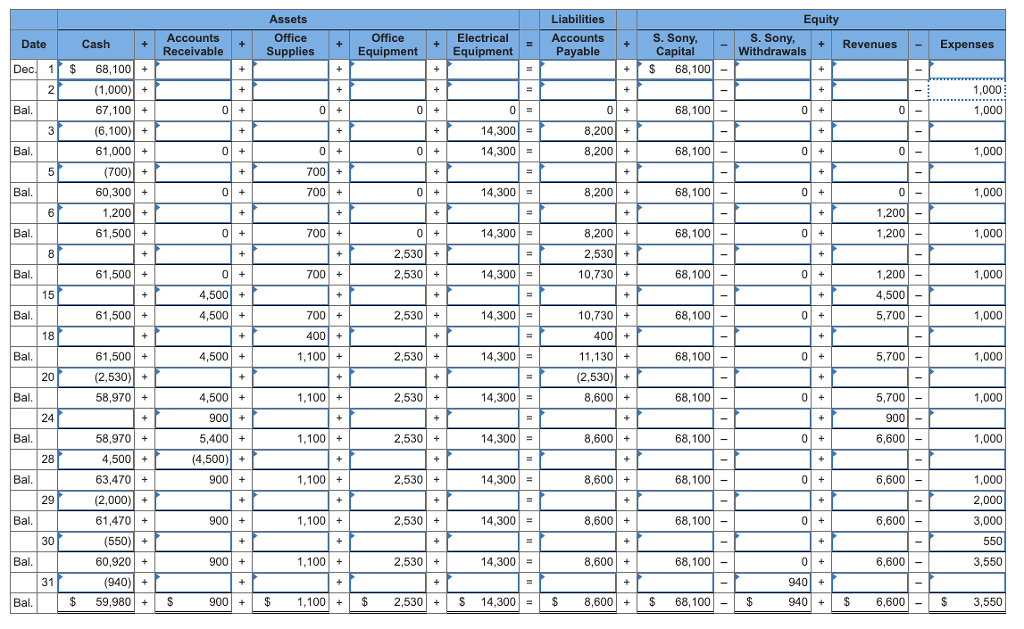

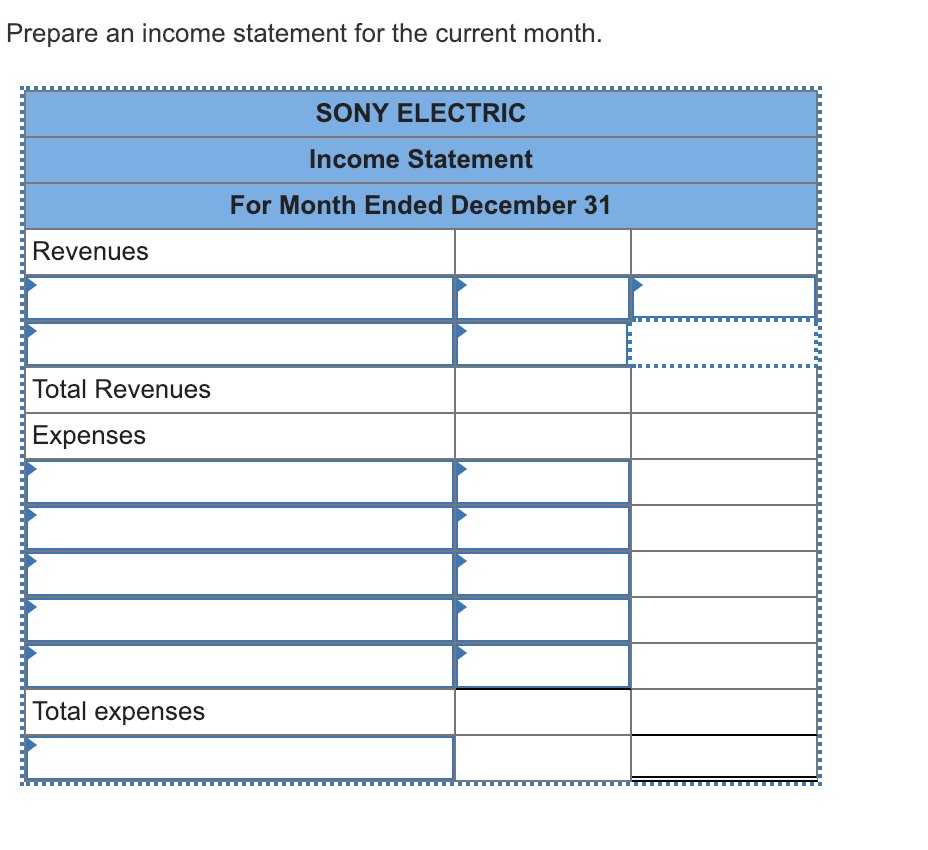

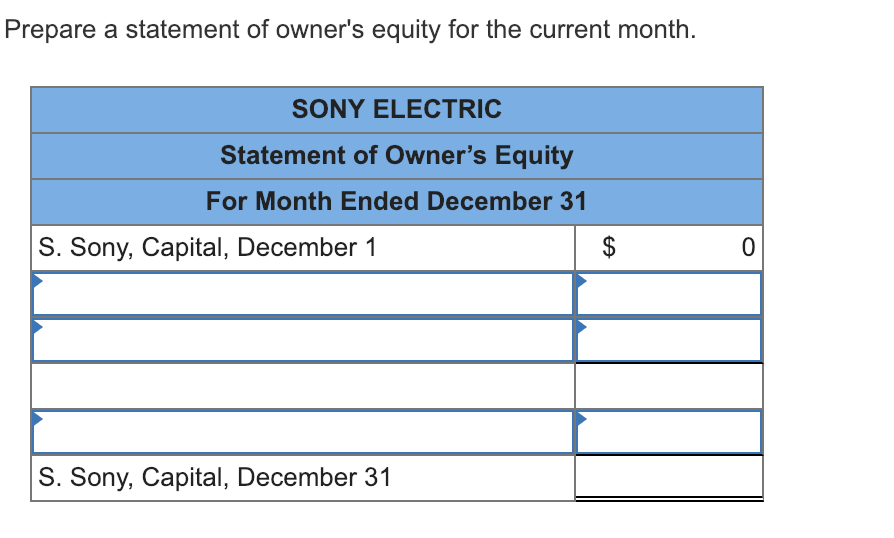

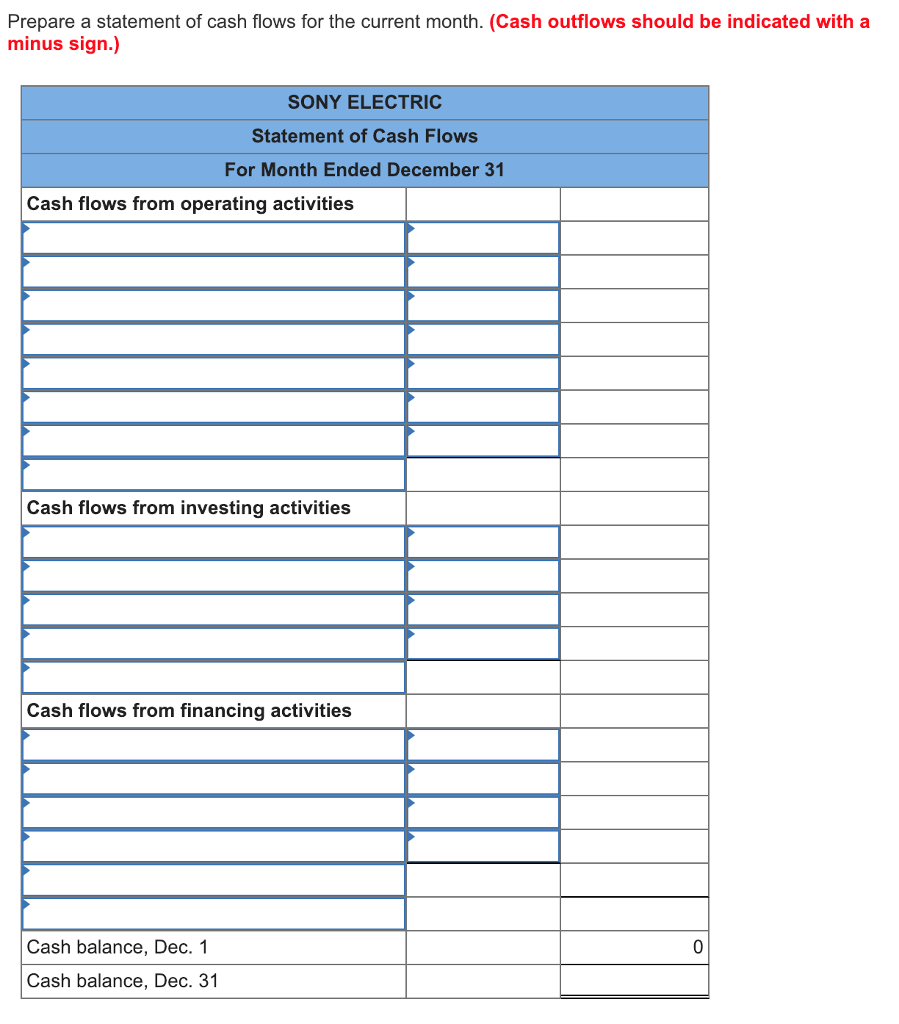

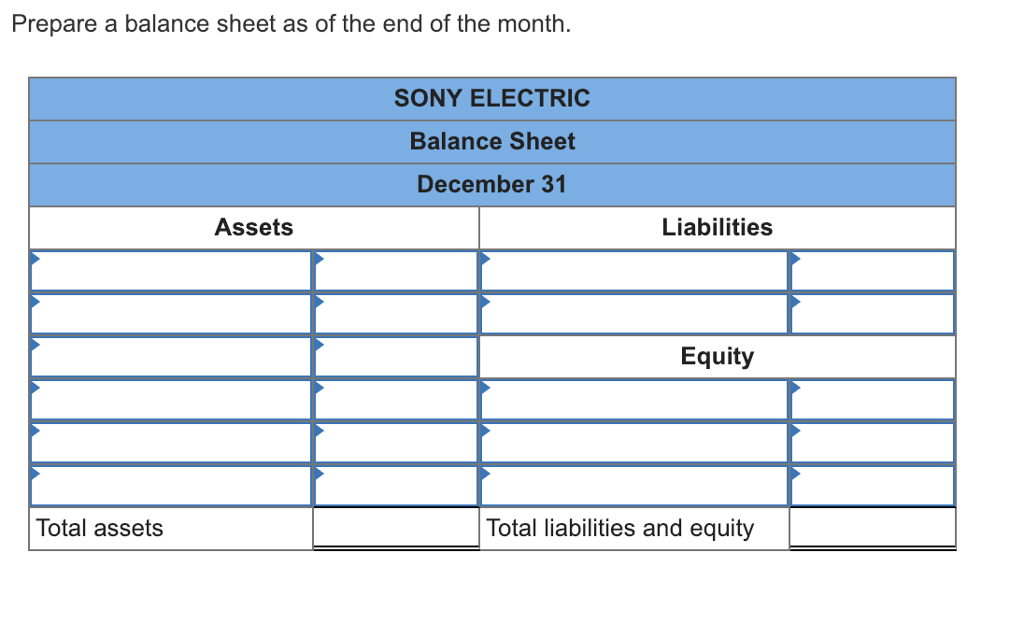

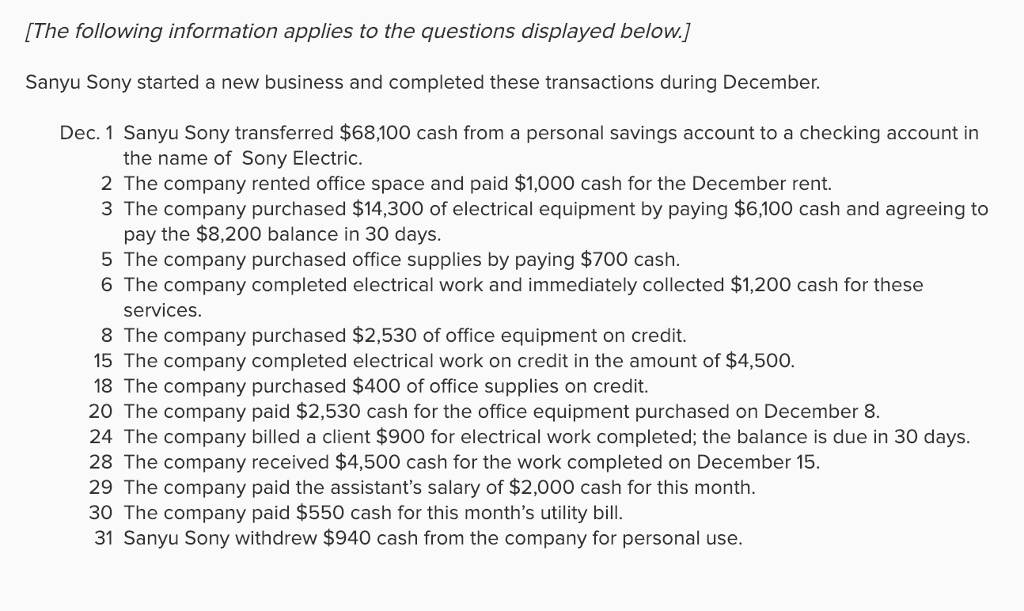

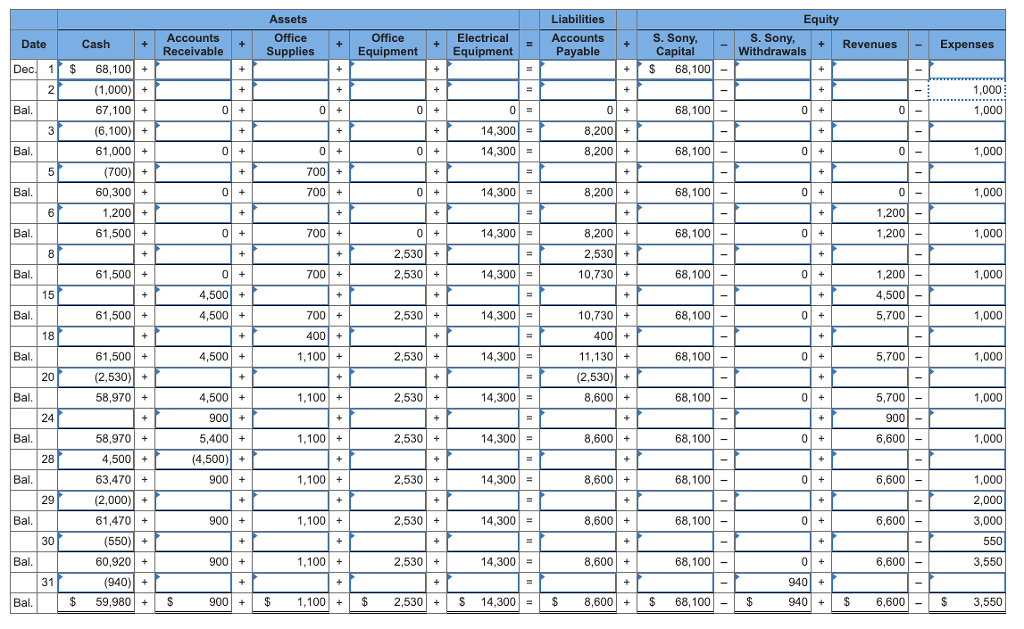

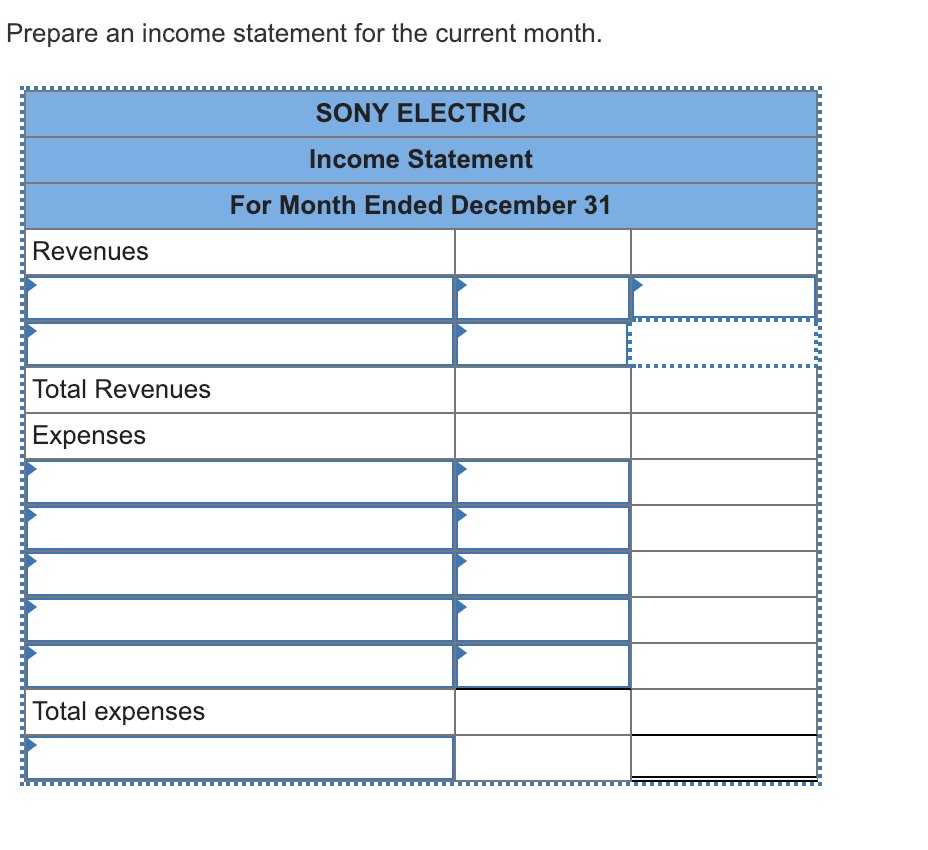

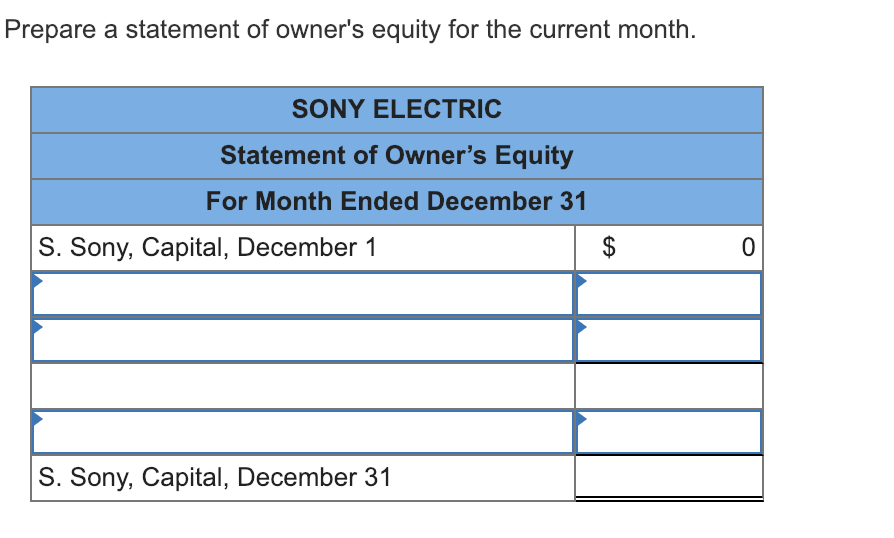

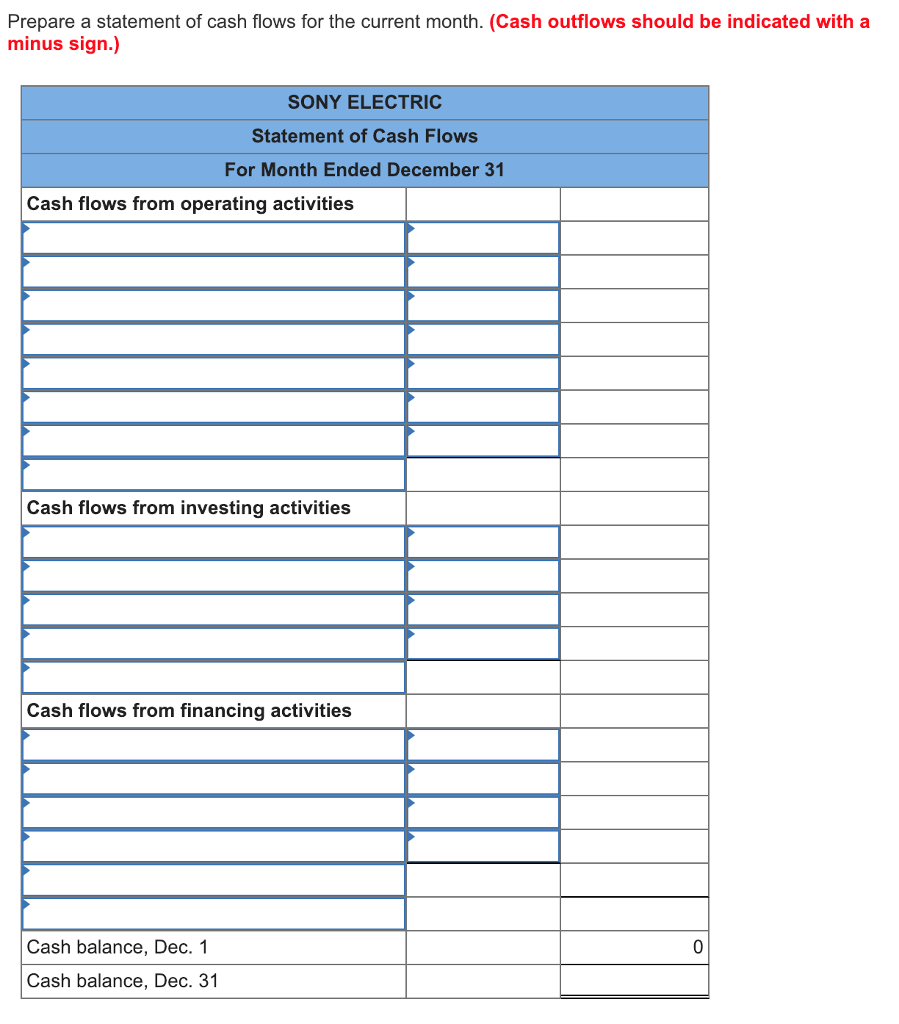

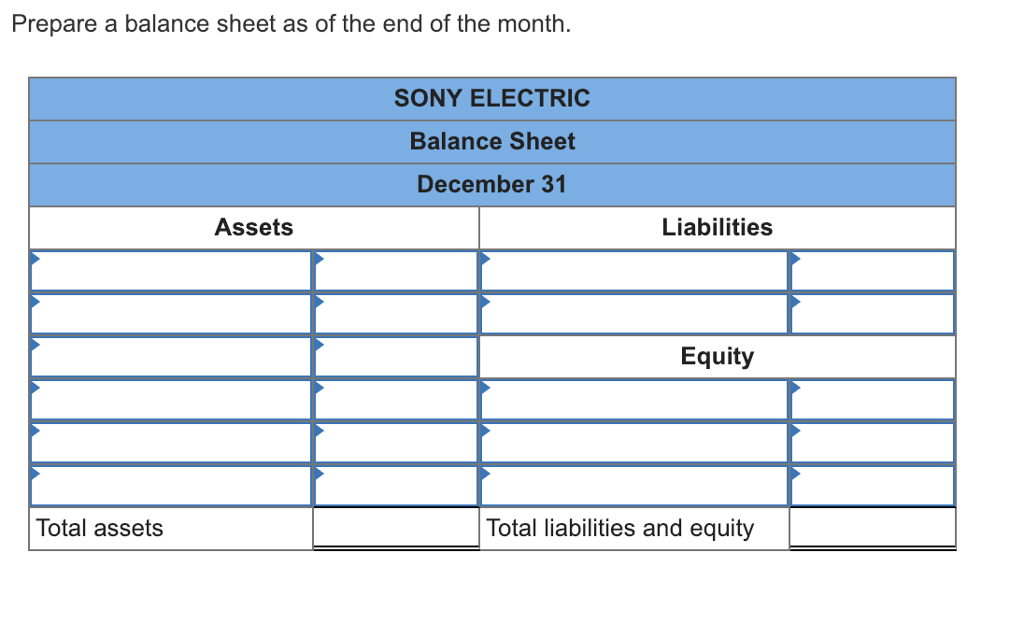

The following information applies to the questions displayed below.] Sanyu Sony started a new business and completed these transactions during December. Dec. 1 Sanyu Sony transferred $68,100 cash from a personal savings account to a checking account in the name of Sony Electric. 2 The company rented office space and paid $1,000 cash for the December rent. 3 The company purchased $14,300 of electrical equipment by paying $6,100 cash and agreeing to pay the $8,200 balance in 30 days. 5 The company purchased office supplies by paying $700 cash. 6 The company completed electrical work and immediately collected $1,200 cash for these services. 8 The company purchased $2,530 of office equipment on credit. 15 The company completed electrical work on credit in the amount of $4,500 18 The company purchased $400 of office supplies on credit. 20 The company paid $2,530 cash for the office equipment purchased on December 8. 24 The company billed a client $900 for electrical work completed; the balance is due in 30 days. 28 The company received $4,500 cash for the work completed on December 15. 29 The company paid the assistant's salary of $2,000 cash for this month. 30 The company paid $550 cash for this month's utility bill. 31 Sanyu Sony withdrew $940 cash from the company for personal use. Assets Liabilities Accounts ble Equity OfficeEqui Accounts Receivable Office + Supplies Electrical Equipment S. Sony, Withdrawals Date RevenuesExpenses Dec 1 $ 68,100+ +68,100 (1,000)+ 67,100+ (6,100) + 61,000+ (700) 60,300 + 1,200+ 61,500+ 1,000 Bal 68,100 1,000 14.3001 = 8,200+ 8,200 Bal 14.3001 = 68,100- 1,000 Bal 14.3001 = 8,200+ 68,100- 1,000 1,200 1,200 8,200+ 2,530+ 10,730+ Bal. 14.3001 = 68,100- 1,000 2,530+ 2,530+ 2,530+ 2,530+ 2,530+ 2,530+ 2,530+ 14.3001 = 1,200 4,500 5,700 61,500 + 68,100- 1,000 4,500+ 4,500+ Bal. 61,500 + 14.3001 = 10,730+ 68,100 1,000 1,100 1,100 1,100 1,100 1,100+ 1,100 61,500 (2,530) 58,970 + 14.3001 = 68,100 11,130+ (2,530)+ 8,600+ Bal. 4,500+ 5,700 1,000 Bal 4,500+ 14.3001 = 68,100- 5,700 1,000 Bal 5,400+ (4,500)+ 58,970 + 4,500+ 63,470+ (2,000)+ 61,470+ (550)+ 60,920 + (940)+ $ 59,980S 68,100 68,100 68,100 68,100 14.3001 = 8,600+ 6,600 1,000 28 Bal. 14.300 8,600+ 6,600 1,000 2,000 3,000 550 3,550 29 Bal. 2,530+ 14.3001 = 8,600+ 6,600 Bal 2,530+ 14.3001 = 8,600+ 6,600 Bal 900| +| $ 1.100| +| $ 2.530| +|$ 14.300|=| $ 8,600| +| $ 68,100|-| $ 940 6,600 S3,550 Prepare an income statement for the current month. SONY ELECTRIC Income Statement For Month Ended December 31 Revenues Total Revenues Expenses Total expenses Prepare a statement of owner's equity for the current month. SONY ELECTRIC Statement of Owner's Equity For Month Ended December 31 S. Sony, Capital, December 1 0 S. Sony, Capital, December 31 Prepare a statement of cash flows for the current month. (Cash outflows should be indicated with a minus sign.) SONY ELECTRIC Statement of Cash Flows For Month Ended December 31 Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Cash balance, Dec. 1 Cash balance, Dec. 31 Prepare a balance sheet as of the end of the month. SONY ELECTRIC Balance Sheet December 31 Assets Liabilities Equity Total assets Total liabilities and equity