Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[The following information applies to the questions displayed below.] Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts

[The following information applies to the questions displayed below.]

Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions.

| May 11 | Sydney accepts delivery of $40,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy $30,000. Sydney pays $345 cash to Express Shipping for delivery charges on the merchandise. |

|---|---|

| May 12 | Sydney returns $1,400 of the $40,000 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $1,050. |

| May 20 | Sydney pays Troy for the amount owed. Troy receives the cash immediately. |

(Both Sydney and Troy use a perpetual inventory system and the net method.)

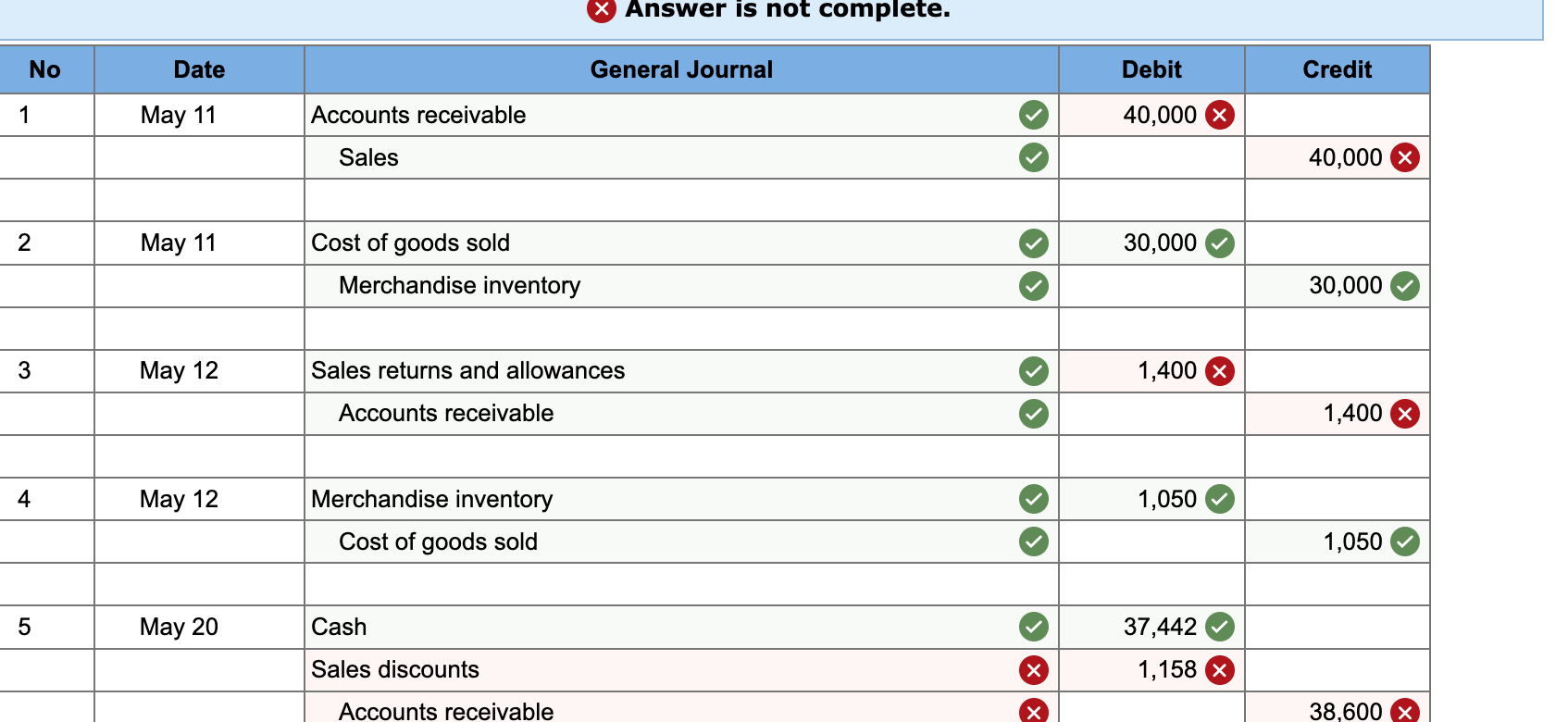

2. Prepare journal entries that Troy Wholesalers (seller) records for these three transactions.

Answer is not complete. \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{|l|} No \\ 1 \\ \end{tabular}} & \multirow{2}{*}{\begin{tabular}{r} Date \\ May 11 \end{tabular}} & \multicolumn{2}{|c|}{ General Journal } & \multirow{2}{*}{\begin{tabular}{l} Debit \\ 40,000 \end{tabular}} & \multirow[t]{2}{*}{ Credit } \\ \hline & & Accounts receivable & & & \\ \hline & & Sales & & & 40,000 \\ \hline \multirow[t]{2}{*}{2} & May 11 & Cost of goods sold & & 30,000 & \\ \hline & & Merchandise inventory & & & 30,000 \\ \hline \multirow[t]{2}{*}{3} & May 12 & Sales returns and allowances & & 1,400 & \\ \hline & & Accounts receivable & & & 1,400 \\ \hline \multirow[t]{2}{*}{4} & May 12 & Merchandise inventory & & 1,050 & \\ \hline & & Cost of goods sold & & & 1,050 \\ \hline \multirow[t]{2}{*}{5} & May 20 & Cash & & 37,442 & \\ \hline & & Sales discounts & & 1,158 & \\ \hline \end{tabular}

Answer is not complete. \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{|l|} No \\ 1 \\ \end{tabular}} & \multirow{2}{*}{\begin{tabular}{r} Date \\ May 11 \end{tabular}} & \multicolumn{2}{|c|}{ General Journal } & \multirow{2}{*}{\begin{tabular}{l} Debit \\ 40,000 \end{tabular}} & \multirow[t]{2}{*}{ Credit } \\ \hline & & Accounts receivable & & & \\ \hline & & Sales & & & 40,000 \\ \hline \multirow[t]{2}{*}{2} & May 11 & Cost of goods sold & & 30,000 & \\ \hline & & Merchandise inventory & & & 30,000 \\ \hline \multirow[t]{2}{*}{3} & May 12 & Sales returns and allowances & & 1,400 & \\ \hline & & Accounts receivable & & & 1,400 \\ \hline \multirow[t]{2}{*}{4} & May 12 & Merchandise inventory & & 1,050 & \\ \hline & & Cost of goods sold & & & 1,050 \\ \hline \multirow[t]{2}{*}{5} & May 20 & Cash & & 37,442 & \\ \hline & & Sales discounts & & 1,158 & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started