Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation:

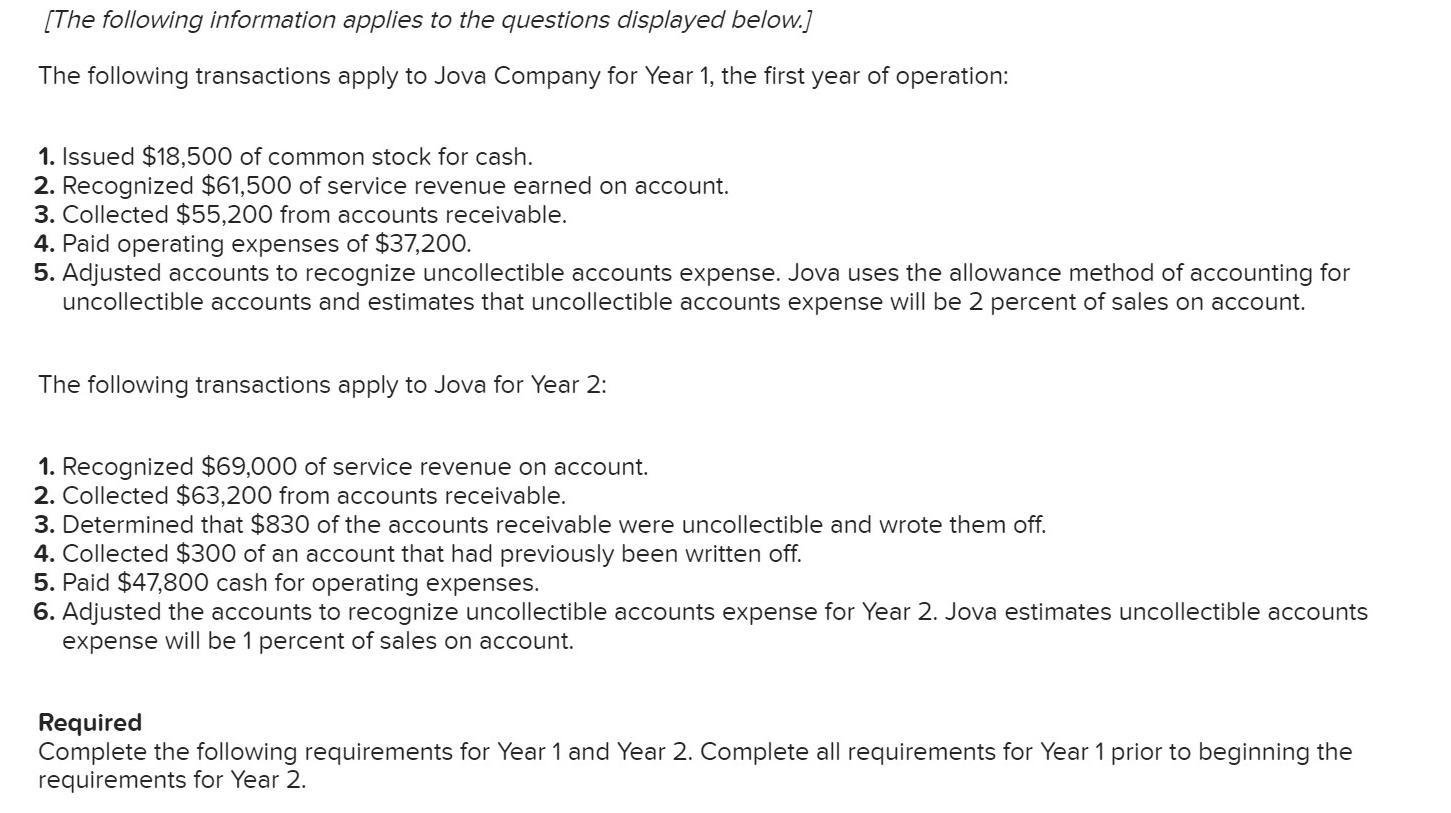

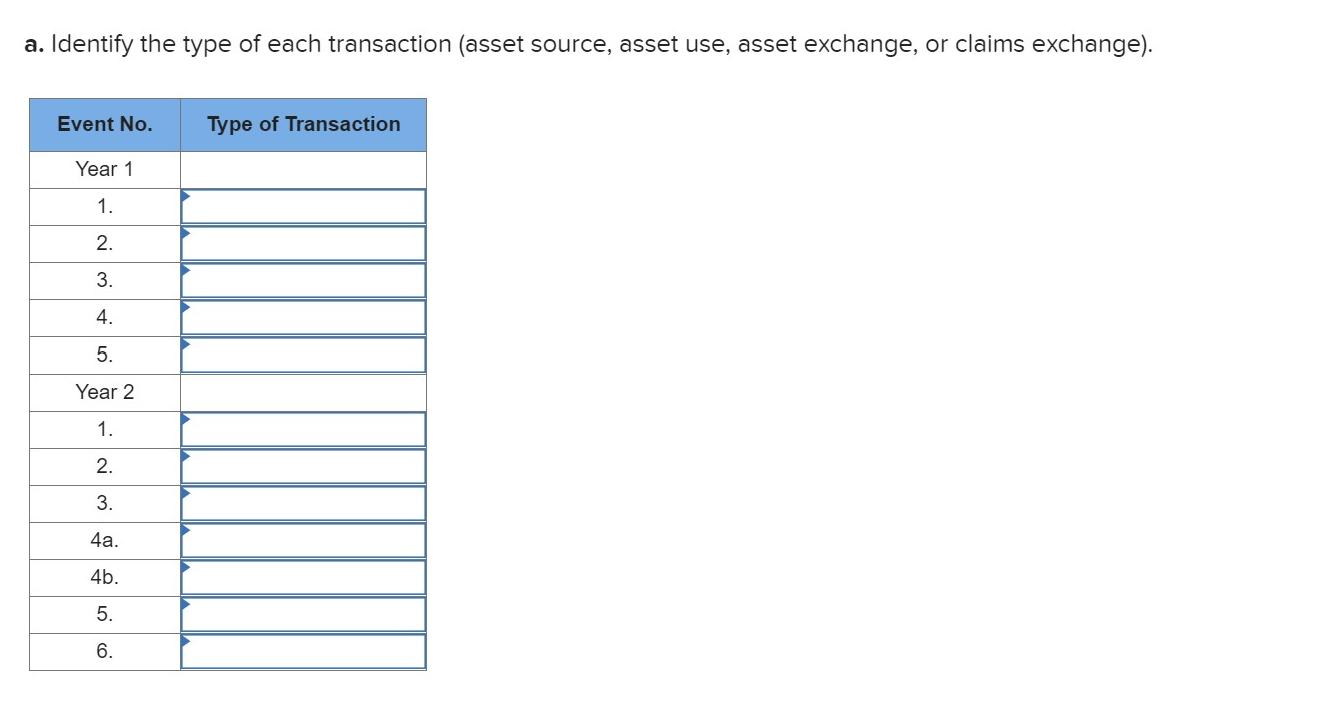

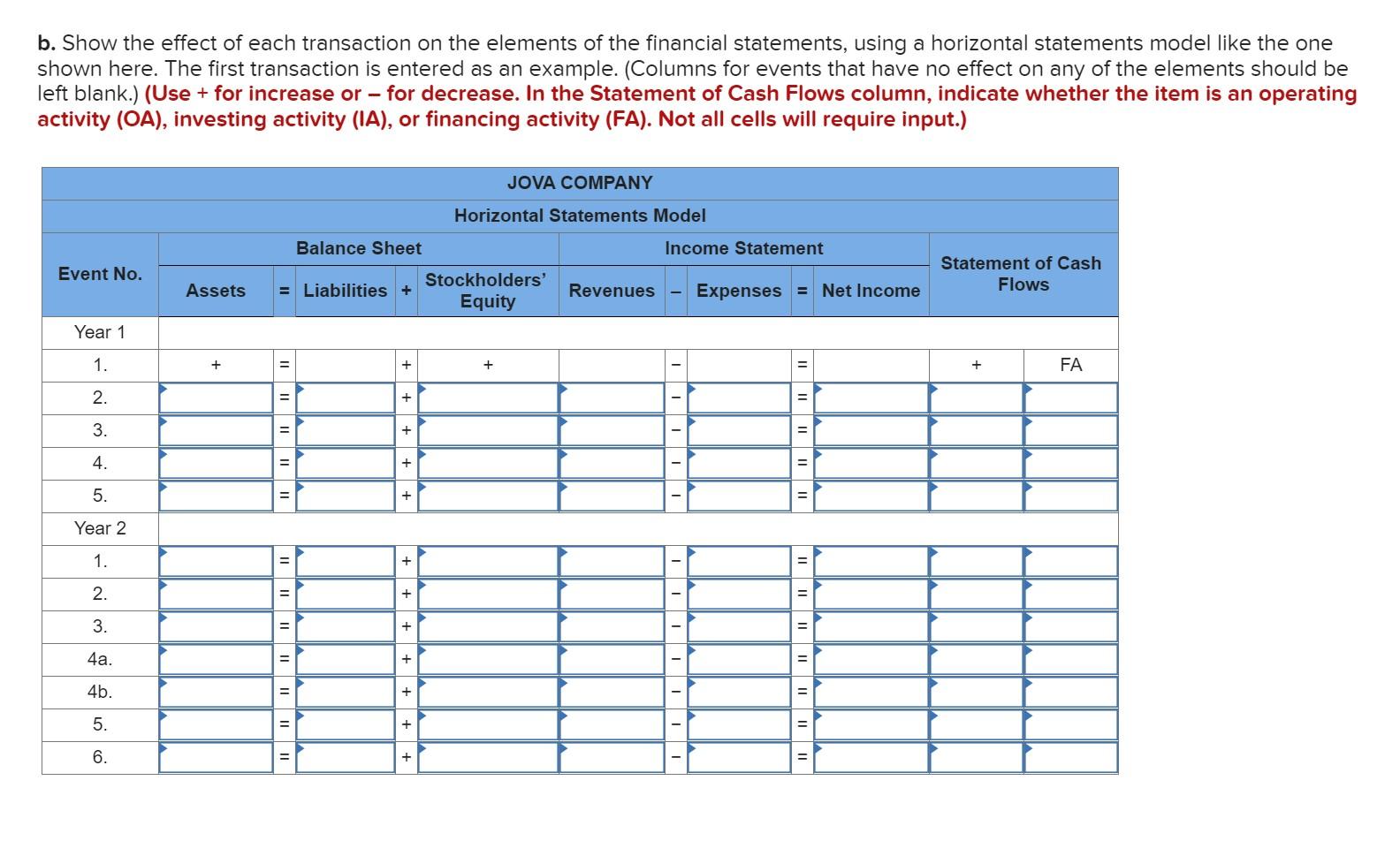

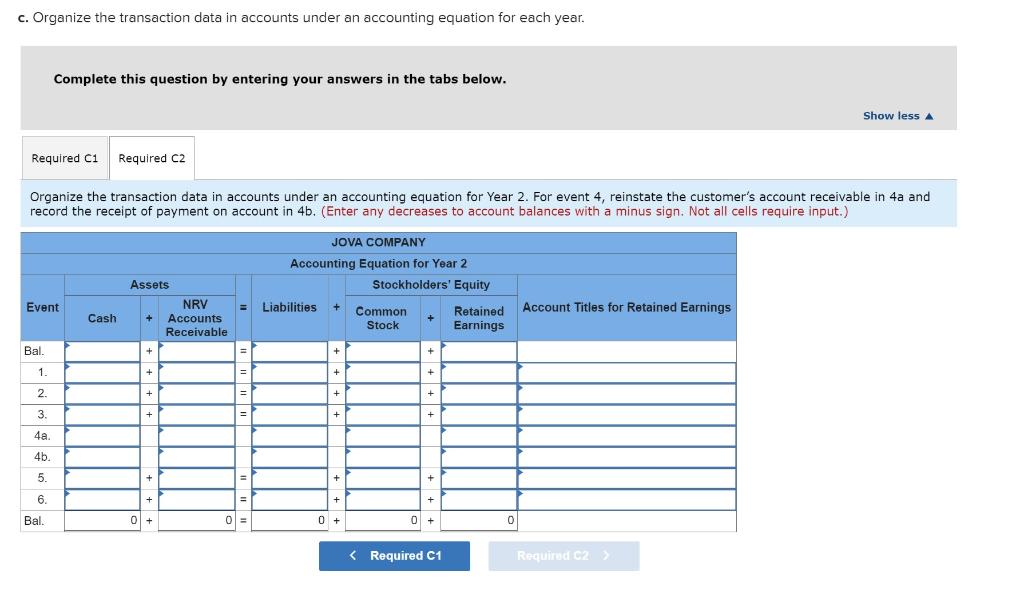

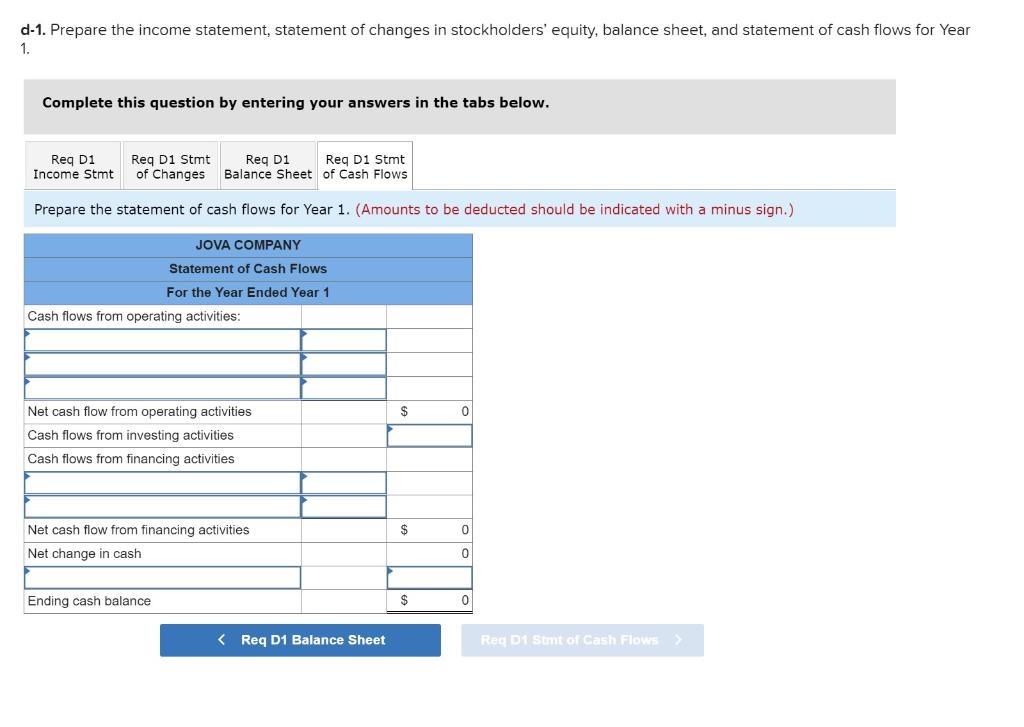

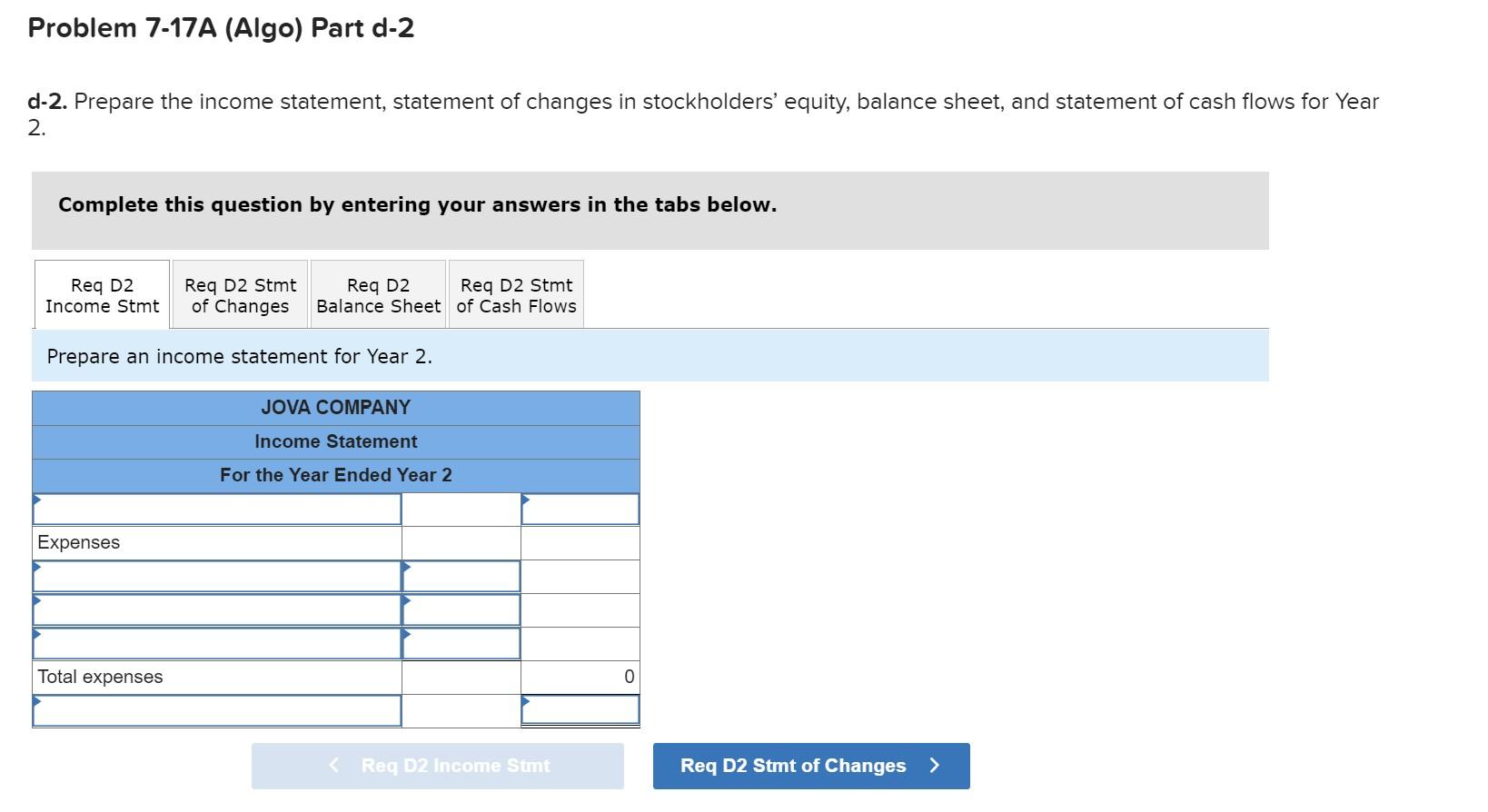

[The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $18,500 of common stock for cash. 2. Recognized $61,500 of service revenue earned on account. 3. Collected $55,200 from accounts receivable. 4. Paid operating expenses of $37,200. 5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $69,000 of service revenue on account. 2. Collected $63,200 from accounts receivable. 3. Determined that $830 of the accounts receivable were uncollectible and wrote them off. 4. Collected $300 of an account that had previously been written off. 5. Paid $47,800 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1 percent of sales on account. Required Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. a. Identify the type of each transaction (asset source, asset use, asset exchange, or claims exchange). Event No. Year 1 1. 2. W N 3. 4. 5. Year 2 1. 2. 3. 4a. 4b. 5. 6. Type of Transaction b. Show the effect of each transaction on the elements of the financial statements, using a horizontal statements model like the one shown here. The first transaction is entered as an example. (Columns for events that have no effect on any of the elements should be left blank.) (Use + for increase or - for decrease. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Not all cells will require input.) Event No. Year 1 1. 2. 3. 4. 5. Year 2 1. 2. 3. 4a. 4b. 5. 6. Assets + = Liabilities + = = = = Balance Sheet = + +++ + +++++++ JOVA COMPANY Horizontal Statements Model Stockholders' Equity + Revenues Income Statement Expenses = Net Income = ||||||||| |||||||||||| ||||||| Statement of Cash Flows + FA c. Organize the transaction data in accounts under an accounting equation for each year. Required C1 Required C2 Complete this question by entering your answers in the tabs below. Organize the transaction data in accounts under an accounting equation for Year 2. For event 4, reinstate the customer's account receivable in 4a and record the receipt of payment on account in 4b. (Enter any decreases to account balances with a minus sign. Not all cells require input.) Event Bal. 1. 2. 3. 4a. 4b. 5. 6. Bal. Cash Assets + + + + 0 + NRV Accounts Receivable = Liabilities + = = JOVA COMPANY Accounting Equation for Year 2 0 = 0 + + Stockholders' Equity Common Stock + + + + 0+ < Required C1 Retained Earnings 0 Account Titles for Retained Earnings Show less A Required C2 > d-1. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 1. Complete this question by entering your answers in the tabs below. Req D1 Income Stmt Req D1 Stmt of Changes Req D1 Req D1 Stmt Balance Sheet of Cash Flows Prepare the statement of cash flows for Year 1. (Amounts to be deducted should be indicated with a minus sign.) JOVA COMPANY Statement of Cash Flows For the Year Ended Year 1 Cash flows from operating activities: Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net cash flow from financing activities Net change in cash Ending cash balance < Req D1 Balance Sheet $ $ $ 0 0 0 0 Req D1 Stmt of Cash Flows > Problem 7-17A (Algo) Part d-2 d-2. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. Complete this question by entering your answers in the tabs below. Req D2 Req D2 Stmt Income Stmt of Changes Req D2 Balance Sheet Prepare an income statement for Year 2. Expenses Total expenses JOVA COMPANY Income Statement For the Year Ended Year 2 Req D2 Stmt of Cash Flows < Req D2 Income Stmt 0 Req D2 Stmt of Changes >

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started