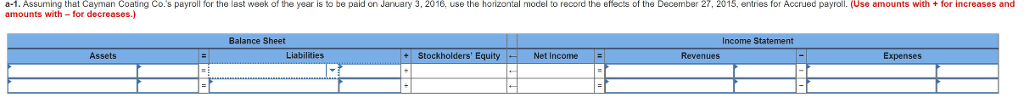

Question

[The following information applies to the questions displayed below.] The following summary data for the payroll period ended December 27, 2015, are available for Cayman

[The following information applies to the questions displayed below.]

The following summary data for the payroll period ended December 27, 2015, are available for Cayman Coating Co.:

| Gross pay | $ | 172,000 |

| FICA tax withholdings | ? | |

| Income tax withholdings | 20,640 | |

| Group hospitalization insurance | 2,540 | |

| Employee contributions to pension plan | ? | |

| Total deductions | 41,650 | |

| Net pay | ? | |

Additional information:

For employees, FICA tax rates for 2015 were 7.65% on the first $118,500 of each employees annual earnings. However, no employees had accumulated earnings for the year in excess of the $118,500 limit.

For employers, FICA tax rates for 2015 were also 7.65% on the first $118,500 of each employees annual earnings.

The federal and state unemployment compensation tax rates are 0.6% and 5.4%, respectively. These rates are levied against the employer for the first $7,000 of each employees annual earnings. Only $18,000 of the gross pay amount for the December 27, 2015, pay period was owed to employees who were still under the annual limit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started