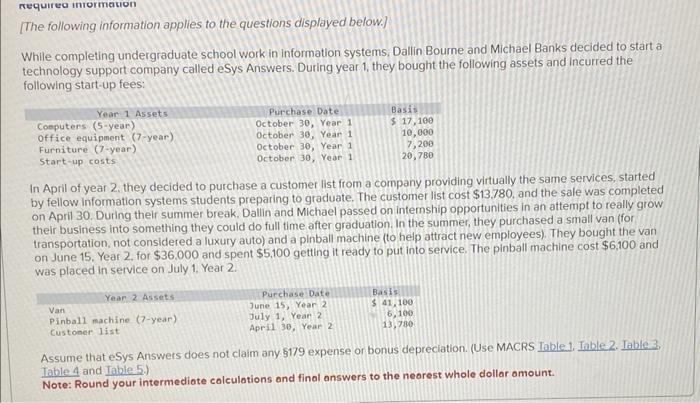

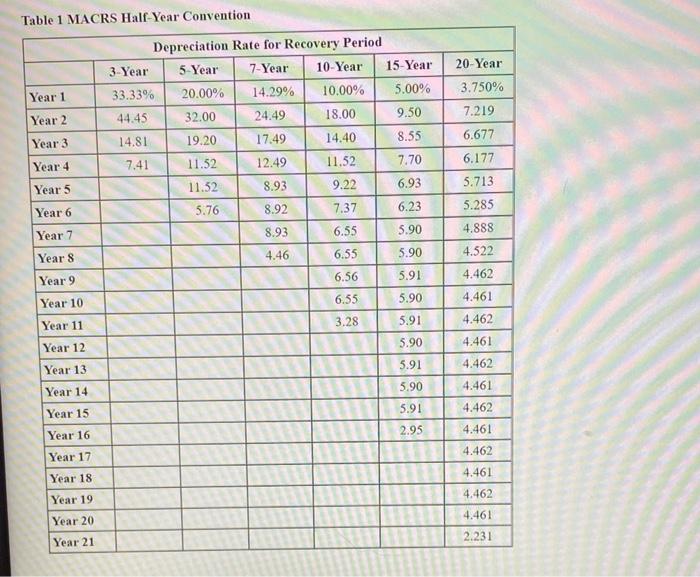

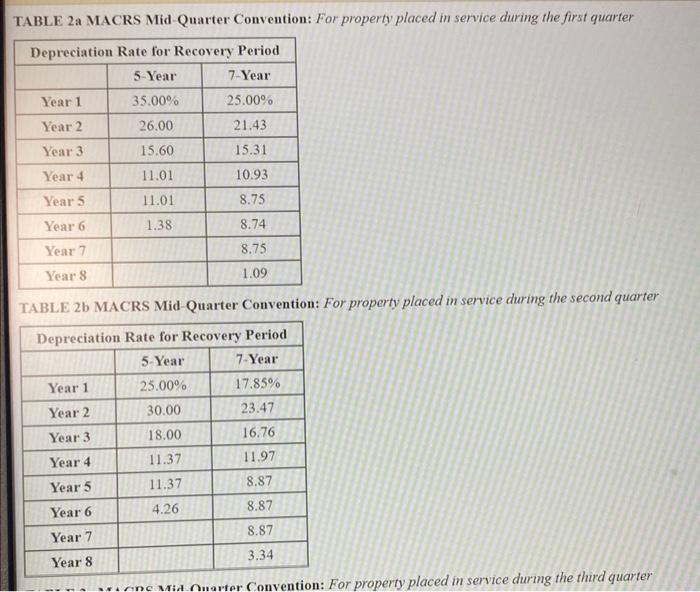

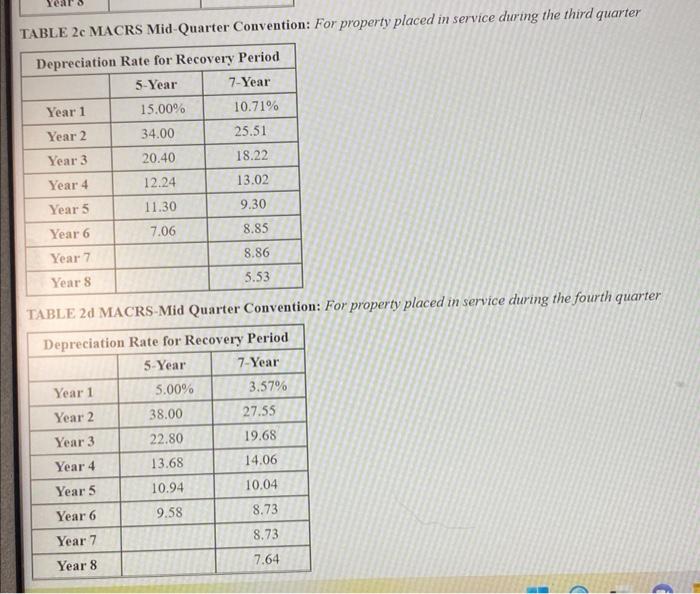

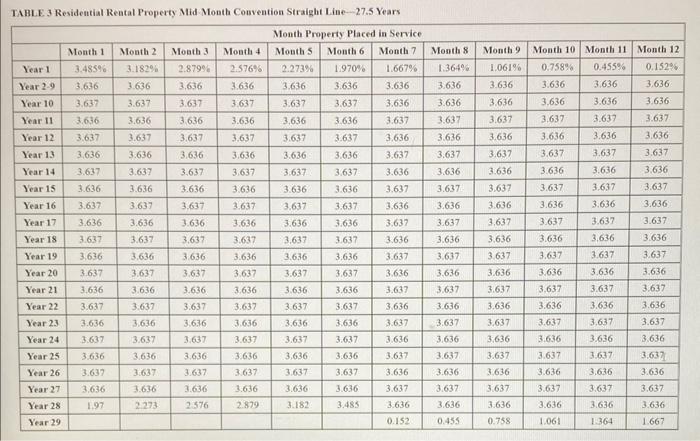

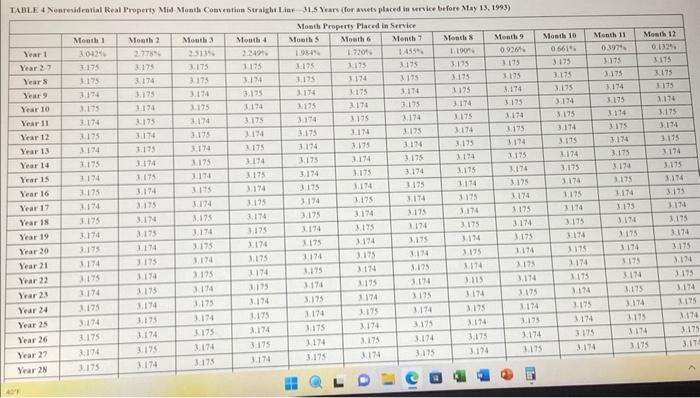

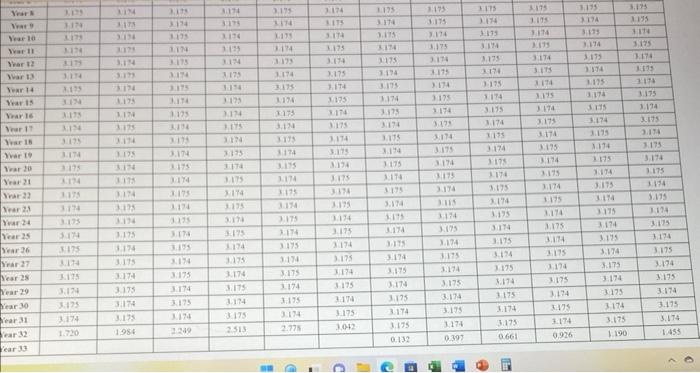

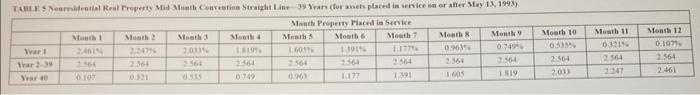

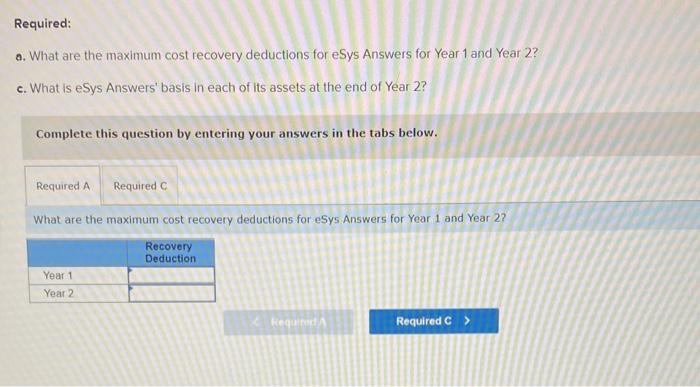

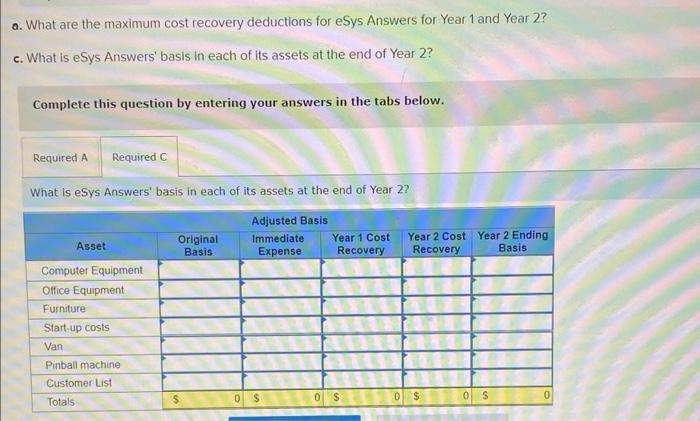

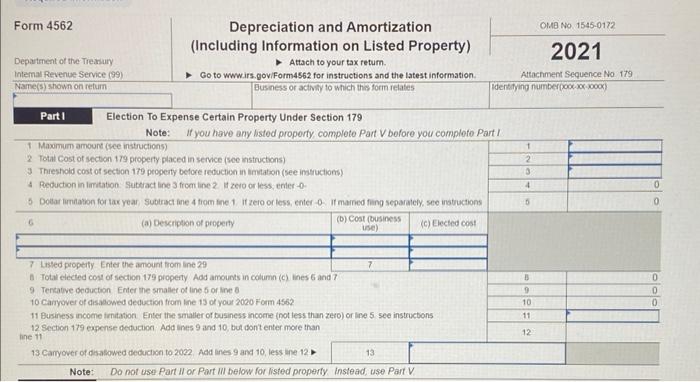

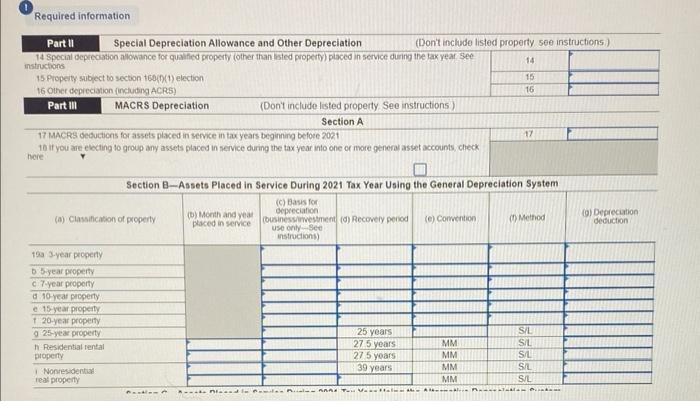

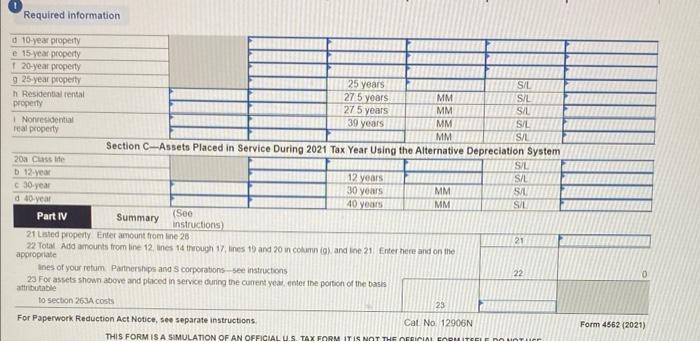

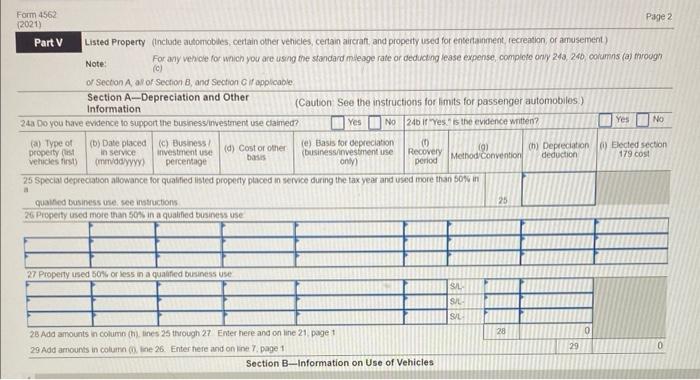

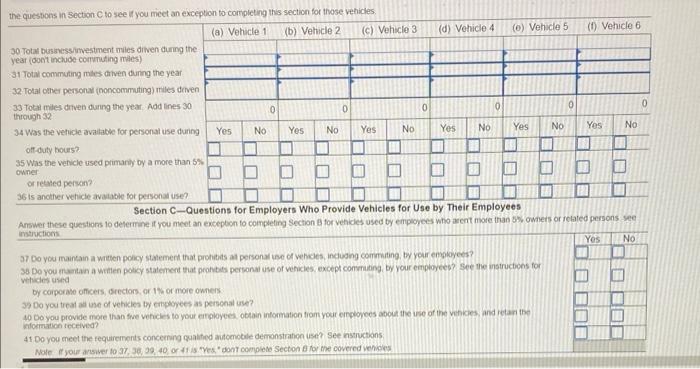

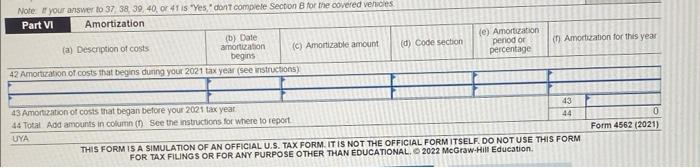

[The following information applies to the questions displayed below.] While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called esys Answers. During year 1 , they bought the following assets and incurred the following start-up fees: In April of year 2. they decided to purchase a customer list from a company providing virtually the same services, started by fellow information systems students preparing to graduate. The customer list cost $13.780, and the sale was completed on April 30. During their summer break. Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation. In the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine (to help attract new employees). They bought the van on June 15. Year 2. for $36,000 and spent $5,100 getting it ready to put into service. The pinball machine cost $6,100 and was placed in service on July 1. Year 2. Assume that eSys Answers does not claim any $179 expense or bonus depreciation. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Iable 5 .) Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Table 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE.3 Residential Rental Property Mid Month Convention Straight Line-27.5 Years Required: a. What are the maximum cost recovery deductions for eSys Answers for Year 1 and Year 2? c. What is eSys Answers' basis in each of its assets at the end of Year 2? Complete this question by entering your answers in the tabs below. What are the maximum cost recovery deductions for eSys Answers for Year 1 and Year 2 ? a. What are the maximum cost recovery deductions for eSys Answers for Year 1 and Year 2 ? c. What is eSys Answers' basis in each of its assets at the end of Year 2? Complete this question by entering your answers in the tabs below. What is esys Answers' basis in each of its assets at the end of Year 2? Note: Do not use Part II or Part ill below for listed property. Instead, use Part V. 1 Required information 1 Required information attibuhable to secton 2634cost For Paperwork Reduction Act Notice, see separate instructions. Cat No 12906N Form 4862 (2021) 26. Property issed moie than 50 in in a qualifed bisiness use 27 Property used 5074 or less in a qualifed business use the questons in Section c to see if you meet an exception to completing this secticn for those vehicles. Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees instructions wehicles uned by coiporase uficers, drectors, or 1th of noie owners. 3) Do you treal as ine of vehicies ty enployees as personal use? 40 Do you provide more than twe veficles to your erroloyees. oblain intormation trom your erployees about the wise of the vehicies, and retari the nformaticn teceived? 41 Do you meet the requirements conceming gualifed automobie demonstration ise? See nstructons: Note if your arsiver to 37,30,29,40 or th is thes. "dont complete Secton 8 for the covered venters Note. I" your-answer to 37,38,39,40, or 41 is "yes, "doft compele section 8 for the covered verbctes. \begin{tabular}{|l|c|c|c|c|c|} \hline Part VI Amortization & (b) Date & (c) Amortizable amount & (d) Coce section & (e) Amortization \\ period of \\ (a) Description of costs & (i) Amortization for this yeas \\ \hline \end{tabular} 42 Amortization of costs that begins during yout 2021 tax year (see instructions) FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. O 2022 MoGraW-Hill Eduestion. [The following information applies to the questions displayed below.] While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called esys Answers. During year 1 , they bought the following assets and incurred the following start-up fees: In April of year 2. they decided to purchase a customer list from a company providing virtually the same services, started by fellow information systems students preparing to graduate. The customer list cost $13.780, and the sale was completed on April 30. During their summer break. Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation. In the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine (to help attract new employees). They bought the van on June 15. Year 2. for $36,000 and spent $5,100 getting it ready to put into service. The pinball machine cost $6,100 and was placed in service on July 1. Year 2. Assume that eSys Answers does not claim any $179 expense or bonus depreciation. (Use MACRS Table 1. Table 2. Table 3. Table 4 and Iable 5 .) Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Table 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE.3 Residential Rental Property Mid Month Convention Straight Line-27.5 Years Required: a. What are the maximum cost recovery deductions for eSys Answers for Year 1 and Year 2? c. What is eSys Answers' basis in each of its assets at the end of Year 2? Complete this question by entering your answers in the tabs below. What are the maximum cost recovery deductions for eSys Answers for Year 1 and Year 2 ? a. What are the maximum cost recovery deductions for eSys Answers for Year 1 and Year 2 ? c. What is eSys Answers' basis in each of its assets at the end of Year 2? Complete this question by entering your answers in the tabs below. What is esys Answers' basis in each of its assets at the end of Year 2? Note: Do not use Part II or Part ill below for listed property. Instead, use Part V. 1 Required information 1 Required information attibuhable to secton 2634cost For Paperwork Reduction Act Notice, see separate instructions. Cat No 12906N Form 4862 (2021) 26. Property issed moie than 50 in in a qualifed bisiness use 27 Property used 5074 or less in a qualifed business use the questons in Section c to see if you meet an exception to completing this secticn for those vehicles. Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees instructions wehicles uned by coiporase uficers, drectors, or 1th of noie owners. 3) Do you treal as ine of vehicies ty enployees as personal use? 40 Do you provide more than twe veficles to your erroloyees. oblain intormation trom your erployees about the wise of the vehicies, and retari the nformaticn teceived? 41 Do you meet the requirements conceming gualifed automobie demonstration ise? See nstructons: Note if your arsiver to 37,30,29,40 or th is thes. "dont complete Secton 8 for the covered venters Note. I" your-answer to 37,38,39,40, or 41 is "yes, "doft compele section 8 for the covered verbctes. \begin{tabular}{|l|c|c|c|c|c|} \hline Part VI Amortization & (b) Date & (c) Amortizable amount & (d) Coce section & (e) Amortization \\ period of \\ (a) Description of costs & (i) Amortization for this yeas \\ \hline \end{tabular} 42 Amortization of costs that begins during yout 2021 tax year (see instructions) FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. O 2022 MoGraW-Hill Eduestion