Answered step by step

Verified Expert Solution

Question

1 Approved Answer

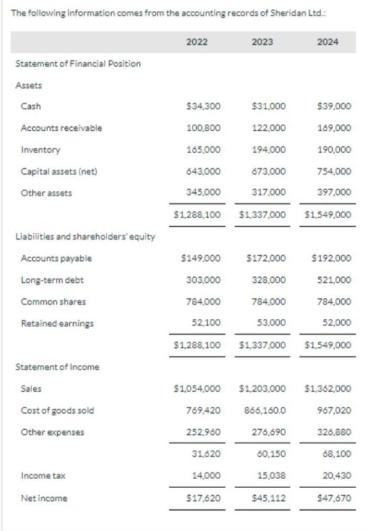

The following information comes from the accounting records of Sheridan Ltd Statement of Financial Position Assets Cash Accounts receivable Inventory Capital assets (net) Other

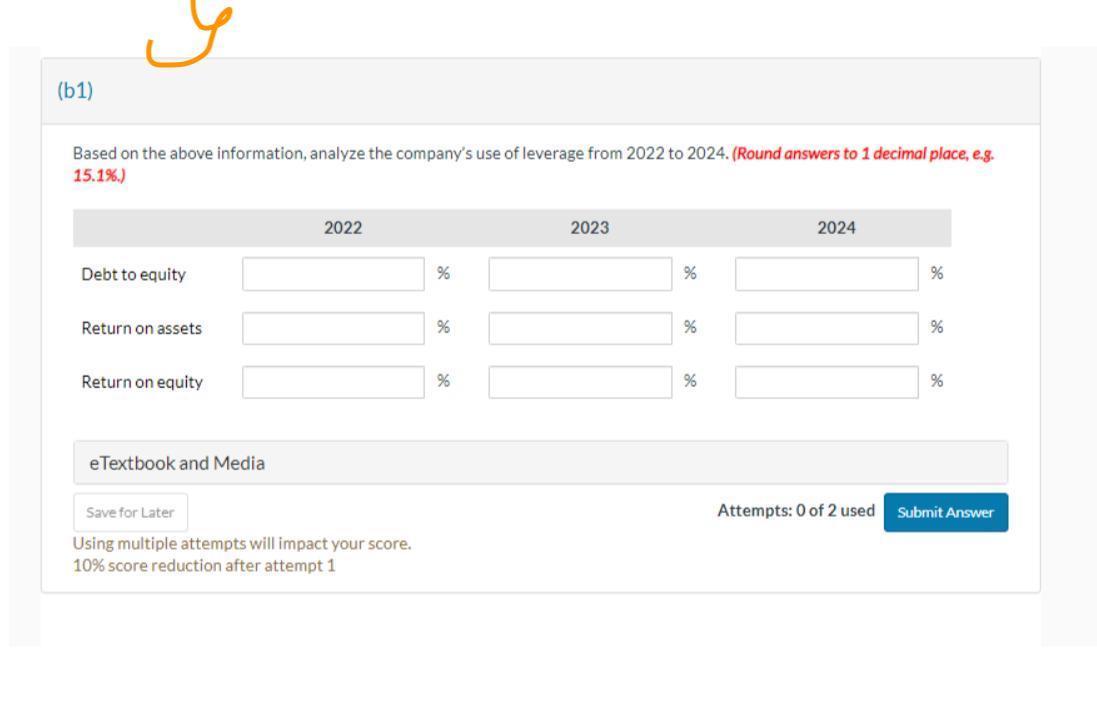

The following information comes from the accounting records of Sheridan Ltd Statement of Financial Position Assets Cash Accounts receivable Inventory Capital assets (net) Other assets Liabilities and shareholders equity Accounts payable Long-term debt Common shares Retained earnings Statement of Income Sales Cost of goods sold Other expenses Income tax Net income 2022 $34,300 100,800 165,000 643.000 345,000 $1,288,100 2023 $31,000 122,000 $17,620 194,000 673,000 317,000 $1,337,000 $149.000 $172,000 303,000 328,000 764,000 784.000 52.100 53.000 $1,288,100 $1,337,000 $1,054,000 $1.203.000 769,420 866,160.0 252,960 276,690 31.620 60,150 14,000 15,038 $45,112 2024 $39,000 169,000 190,000 754,000 397,000 $1.549,000 $192,000 521,000 784,000 52,000 $1,549,000 $1,362,000 967,020 326,680 68,100 20,430 $47,670 (b1) Based on the above information, analyze the company's use of leverage from 2022 to 2024. (Round answers to 1 decimal place, e.g. 15.1%) Debt to equity Return on assets Return on equity eTextbook and Media 2022 Save for Later Using multiple attempts will impact your score. 10% score reduction after attempt 1 % % % 2023 % % % 2024 Attempts: 0 of 2 used % % % Submit Answer

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To analyze Sheridan Ltds use of leverage from 2022 to 2024 we need to calculate the debttoequity rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started