Question

The following information deals with considerations regarding a new product. If the product in question is to be manufactured, it will be necessary to build

The following information deals with considerations regarding a new product. If the product in question is to be manufactured, it will be necessary to build a new production line, which will require the following capital investments:

• Injection molding machine: RM2.7 million

• Molds: RM2.7 million

• Vision system: RM1.7 million

• Automation equipment: RM4.7 million

• Interior furnishings, etc.: RM1.7 million

Assume the company's MARR is 15% per year.

1) In the foregoing, the investment is estimated based on a life of 5 years. However, after the fifth year, parts of the production line are expected to be used in the construction of new production lines, and therefore they will continue to have value:

• Injection molding machine: RM1.0 million

• Vision system: RM1.0 million.

• Automation equipment: RM2.0 million.

Estimate the investment’s internal rate of return.

2) Determine the net present value of the investment if taking into account the value that the three parts of the production line as in above (Question 1) are expected to have after the 5 years.

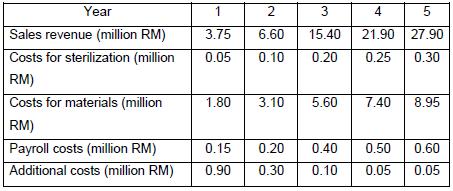

Year 2 3 4 Sales revenue (million RM) 3.75 6.60 15.40 21.90 27.90 Costs for sterilization (million 0.05 0.10 0.20 0.25 0.30 RM) Costs for materials (million 5.60 7.40 8.95 1.80 3.10 RM) Payroll costs (million RM) Additional costs (million RM) 0.15 0.20 0.40 0.50 0.60 0.90 0.30 0.10 0.05 0.05

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

NOTE Though parts of the new system will be continued to be used having values as mentioned but th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started