Answered step by step

Verified Expert Solution

Question

1 Approved Answer

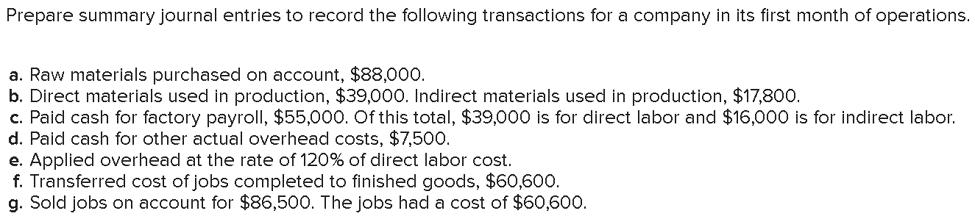

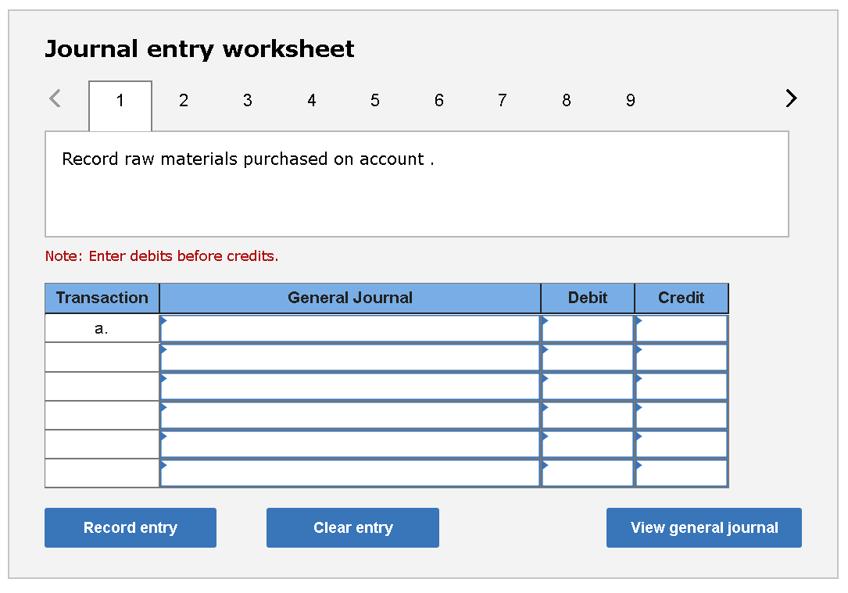

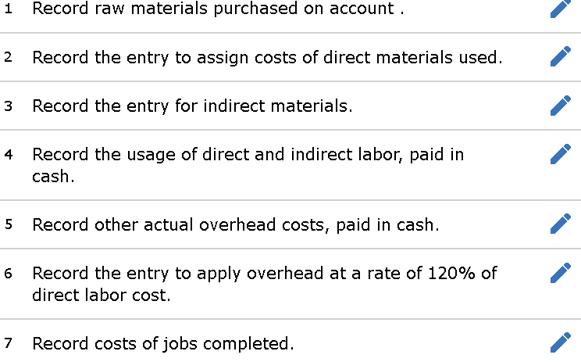

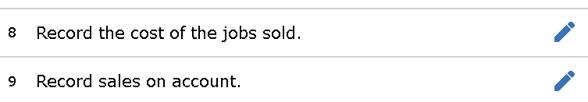

Prepare summary journal entries to record the following transactions for a company in its first month of operations. a. Raw materials purchased on account,

Prepare summary journal entries to record the following transactions for a company in its first month of operations. a. Raw materials purchased on account, $88,000. b. Direct materials used in production, $39,000. Indirect materials used in production, $17,800. c. Paid cash for factory payroll, $55,000. Of this total, $39,000 is for direct labor and $16,000 is for indirect labor. d. Paid cash for other actual overhead costs, $7,500. e. Applied overhead at the rate of 120% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $60,600. g. Sold jobs on account for $86,500. The jobs had a cost of $60,600. Journal entry worksheet 1 2 Transaction a. 3 Note: Enter debits before credits. Record raw materials purchased on account. Record entry 4 5 6 7 8 9 General Journal Clear entry Debit Credit View general journal > 1 2 Record the entry to assign costs of direct materials used. 3 Record the entry for indirect materials. 4 Record the usage of direct and indirect labor, paid in cash. Record raw materials purchased on account. 5 Record other actual overhead costs, paid in cash. Record the entry to apply overhead at a rate of 120% of direct labor cost. Record costs of jobs completed. 6 7 8 Record the cost of the jobs sold. 9 Record sales on account. Prepare summary journal entries to record the following transactions for a company in its first month of operations. a. Raw materials purchased on account, $88,000. b. Direct materials used in production, $39,000. Indirect materials used in production, $17,800. c. Paid cash for factory payroll, $55,000. Of this total, $39,000 is for direct labor and $16,000 is for indirect labor. d. Paid cash for other actual overhead costs, $7,500. e. Applied overhead at the rate of 120% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $60,600. g. Sold jobs on account for $86,500. The jobs had a cost of $60,600. Journal entry worksheet 1 2 Transaction a. 3 Note: Enter debits before credits. Record raw materials purchased on account. Record entry 4 5 6 7 8 9 General Journal Clear entry Debit Credit View general journal > 1 2 Record the entry to assign costs of direct materials used. 3 Record the entry for indirect materials. 4 Record the usage of direct and indirect labor, paid in cash. Record raw materials purchased on account. 5 Record other actual overhead costs, paid in cash. Record the entry to apply overhead at a rate of 120% of direct labor cost. Record costs of jobs completed. 6 7 8 Record the cost of the jobs sold. 9 Record sales on account. Prepare summary journal entries to record the following transactions for a company in its first month of operations. a. Raw materials purchased on account, $88,000. b. Direct materials used in production, $39,000. Indirect materials used in production, $17,800. c. Paid cash for factory payroll, $55,000. Of this total, $39,000 is for direct labor and $16,000 is for indirect labor. d. Paid cash for other actual overhead costs, $7,500. e. Applied overhead at the rate of 120% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $60,600. g. Sold jobs on account for $86,500. The jobs had a cost of $60,600. Journal entry worksheet 1 2 Transaction a. 3 Note: Enter debits before credits. Record raw materials purchased on account. Record entry 4 5 6 7 8 9 General Journal Clear entry Debit Credit View general journal > 1 2 Record the entry to assign costs of direct materials used. 3 Record the entry for indirect materials. 4 Record the usage of direct and indirect labor, paid in cash. Record raw materials purchased on account. 5 Record other actual overhead costs, paid in cash. Record the entry to apply overhead at a rate of 120% of direct labor cost. Record costs of jobs completed. 6 7 8 Record the cost of the jobs sold. 9 Record sales on account. Prepare summary journal entries to record the following transactions for a company in its first month of operations. a. Raw materials purchased on account, $88,000. b. Direct materials used in production, $39,000. Indirect materials used in production, $17,800. c. Paid cash for factory payroll, $55,000. Of this total, $39,000 is for direct labor and $16,000 is for indirect labor. d. Paid cash for other actual overhead costs, $7,500. e. Applied overhead at the rate of 120% of direct labor cost. f. Transferred cost of jobs completed to finished goods, $60,600. g. Sold jobs on account for $86,500. The jobs had a cost of $60,600. Journal entry worksheet 1 2 Transaction a. 3 Note: Enter debits before credits. Record raw materials purchased on account. Record entry 4 5 6 7 8 9 General Journal Clear entry Debit Credit View general journal > 1 2 Record the entry to assign costs of direct materials used. 3 Record the entry for indirect materials. 4 Record the usage of direct and indirect labor, paid in cash. Record raw materials purchased on account. 5 Record other actual overhead costs, paid in cash. Record the entry to apply overhead at a rate of 120% of direct labor cost. Record costs of jobs completed. 6 7 8 Record the cost of the jobs sold. 9 Record sales on account.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Transaction General Journal a b 1 b 2 C d e f g 1 g 2 R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started