Question

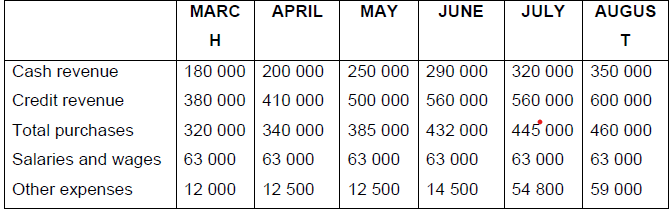

The following information for ABF Projects is available: Additional information: (1) Credit revenues are collected as follows: 50% within 30 days (the next month) 25%

The following information for ABF Projects is available:

Additional information: (1) Credit revenues are collected as follows: 50% within 30 days (the next month) 25% within 60 days 15% within 30 days 10% uncollectible (bad debt) (2) The following discount is given on revenues: 10% on all cash revenue 5% on credit revenue paid within 30 days (3) Salaries, wages and other expenses are paid in cash. (4) Other expenses include depreciation of R4 000 per month.

(5) 55% of all purchases are on credit and are paid for in the following month. The rest represents cash purchases. (6) The bank balance of ABF Projects on 1 June is R200 000. (7) A dividend of R3 000 will be declared on 31 August. Required: Prepare the cash budget for the months June, July and August (Use separate columns for June, July and August).

MARC APRIL MAY JUNE JULY AUGUS H T Cash revenue 180 000 200 000 250 000 290 000 320 000 350 000 Credit revenue 380 000 410 000 500 000 560 000 560 000 600 000 Total purchases 320 000 340 000 385 000 432 000 445000 460 000 Salaries and wages 63 000 63 000 63 000 63 000 63 000 63 000 Other expenses 12 000 12 500 12 500 14 500 54 800 59 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started