Answered step by step

Verified Expert Solution

Question

1 Approved Answer

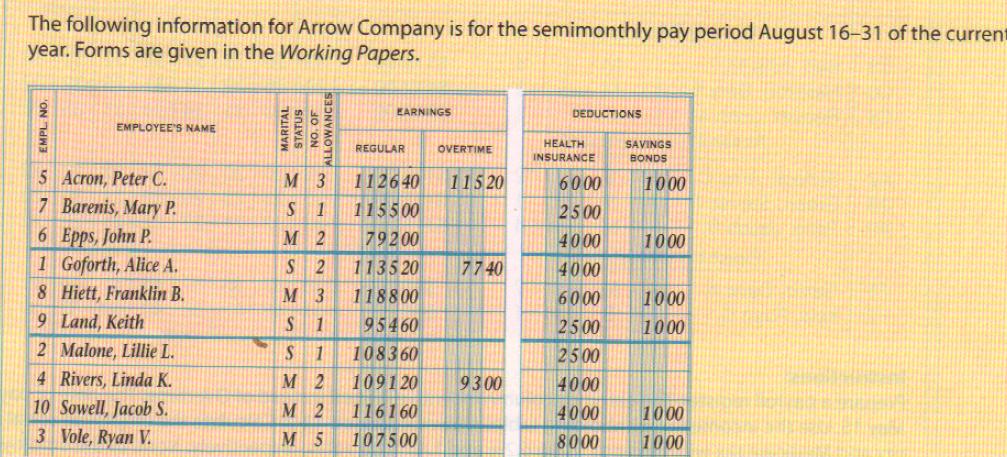

The following information for Arrow Company is for the semimonthly pay period August 16-31 of the current year. Forms are given in the Working

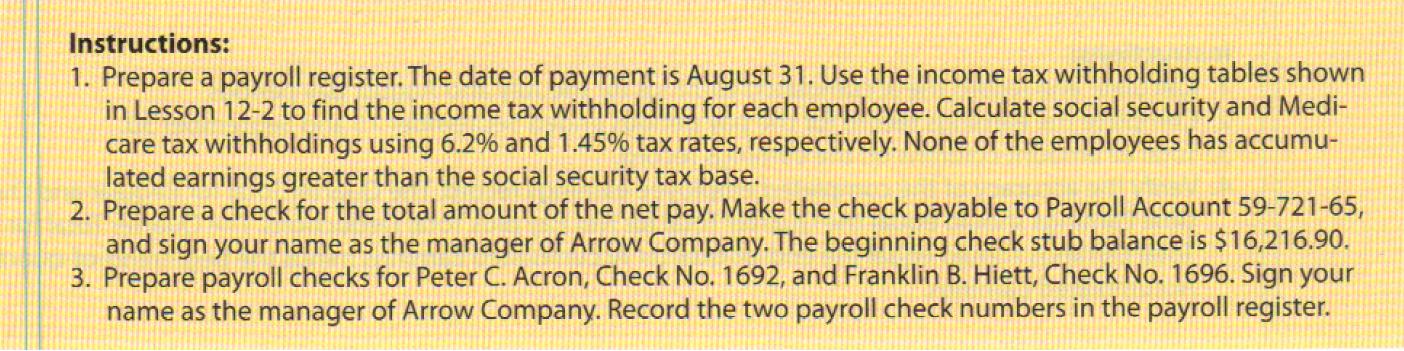

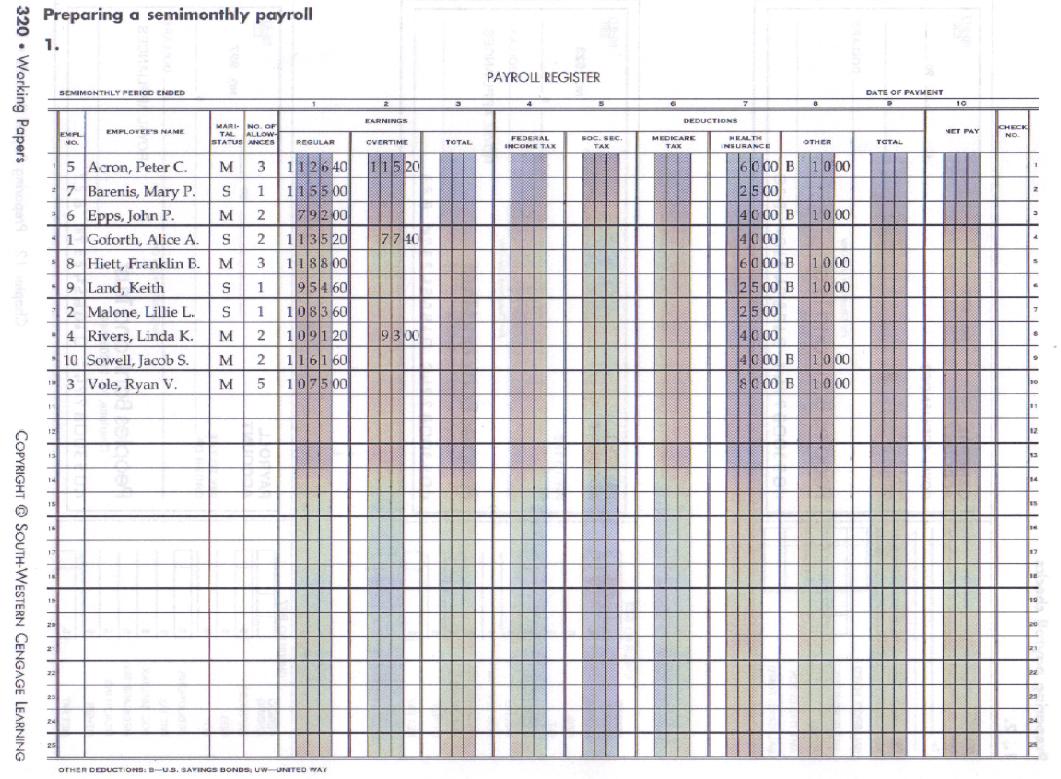

The following information for Arrow Company is for the semimonthly pay period August 16-31 of the current year. Forms are given in the Working Papers. EMPLOYEE'S NAME 5 Acron, Peter C. 7 Barenis, Mary P. 6 Epps, John P. 1 Goforth, Alice A. 8 Hiett, Franklin B. 9 Land, Keith 2 Malone, Lillie L. 4 Rivers, Linda K. 10 Sowell, Jacob S. 3 Vole, Ryan V. STATUS NO. OF ALLOWANCES EARNINGS REGULAR M 3 112640 S1 115500 M 2 79200 S2 1135 20 M 3 118800 S 1 95460 S 1 108360 M 2 109120 M 2 116160 M 5 107500 OVERTIME 11520 7740 93.00 DEDUCTIONS HEALTH INSURANCE 6000 2500 4000 4000 6000 2500 2500 4000 4000 8000 SAVINGS BONDS 1000 1000 1000 1000 1000 1000 Instructions: 1. Prepare a payroll register. The date of payment is August 31. Use the income tax withholding tables shown in Lesson 12-2 to find the income tax withholding for each employee. Calculate social security and Medi- care tax withholdings using 6.2% and 1.45% tax rates, respectively. None of the employees has accumu- lated earnings greater than the social security tax base. 2. Prepare a check for the total amount of the net pay. Make the check payable to Payroll Account 59-721-65, and sign your name as the manager of Arrow Company. The beginning check stub balance is $16,216.90. 3. Prepare payroll checks for Peter C. Acron, Check No. 1692, and Franklin B. Hiett, Check No. 1696. Sign your name as the manager of Arrow Company. Record the two payroll check numbers in the payroll register. 320. Working Papers COPYRIGHTSOUTH-WESTERN CENGAGE LEARNING Preparing a semimonthly payroll 1. 11 12 13 14 15 16 17 18 29 SEMIMONTHLY PERIOD ENDED EMPL NO. EMPLOYEE'S NAME 5 Acron, Peter C. 7 Barenis, Mary P. 6 Epps, John P. 1 Goforth, Alice A. 8 Hiett, Franklin B. 9 Land, Keith 2 Malone, Lillie L. 4 Rivers, Linda K. 10 Sowell, Jacob S. 3 Vole, Ryan V. MARI NO. OF TAL ALLOW- STATUS ANCES M 3 S 1 M 2 S 2 M 3 S 1 S 1 M 2 REGULAR 79200 113520 H 1188.00 95460 1083 60 109120 T M 2 116160 M 5 1075,00 11 2640 115 20 DEE 1155.00 EARNINGS OTHER DEDUCTIONS: BUS. SAVINGS BONDS, UW UNITED WA OVERTIME 7740 9300 TOTAL PAYROLL REGISTER FEDERAL INCOME TAX SOC. SEC. TAX DEDUCTIONS MEDICARE TAX HEALTH INSURANCE 8 4000 4000 B 8000 B OTHER 60 CO B1000 ITI 2500 4000 B 10 00 4000 6000 B 2500 B 2500 1000 10 00 10 00 1000 DATE OF PAYMENT D TOTAL 10 NET PAY CHECK NO 1 2 3 2., 3. NO 928 Late THI For 20 BAL.BROT, FORD AMI.DEPOSITED TOTAL AMT THIG OF CON RAL CARD FORD HEU. O.T. PERIOD ENDING FARNINGS DEDUCTIONS INC. TAX 300. SEC. TAX MED TAX CHECK NO. 1592 HEALTH INS. OTHER NET PAY REG. O.T. 5 PERIOD ENDING EARNINGS DEDUCTIONS INO. TAK SOC. SEC. TAX MED, TAX HEALTH ING UTHEN NET PAY S $ $ CHECK NO 1606 6 $ B $ $ $ $ $ $ $ $ S $ $ $ $ GENERAL ACCOUNT ARROW COMPANY PAY TO THE ORDER OF For my First Security Bank of Pittsburgh Pittsburgh, PA 10210-3402 C043083356 005972164 928 PAYROLL ACCOUNT PAY TO THE ORDER OF NO. 928 For Classroom Use Only First Security Bank of Pittsburgh Pittsburgh, PA 15210-3402 C043083356 005972165 1692 PAYROLL ACCOUNT PAY TO THE ORDER OF For Classroom Use Only 20 20 First Security Bank of Pittsburgh Pittsburgh, PA 15210-3402 C0430833564 005972165 1696 8-8335 430 DOLLARS 0-8226 430 NO. 1692 DOLLARS AHHOW COMPANY NO. 1696 ARROW COMPANY DOLLANG Chapter 12 Preparing Payroll Records 321

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Payroll Register Semimonthly Period Ended August 31 2023 Date of Payment August 31 2023 Employees Na...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started