Answered step by step

Verified Expert Solution

Question

1 Approved Answer

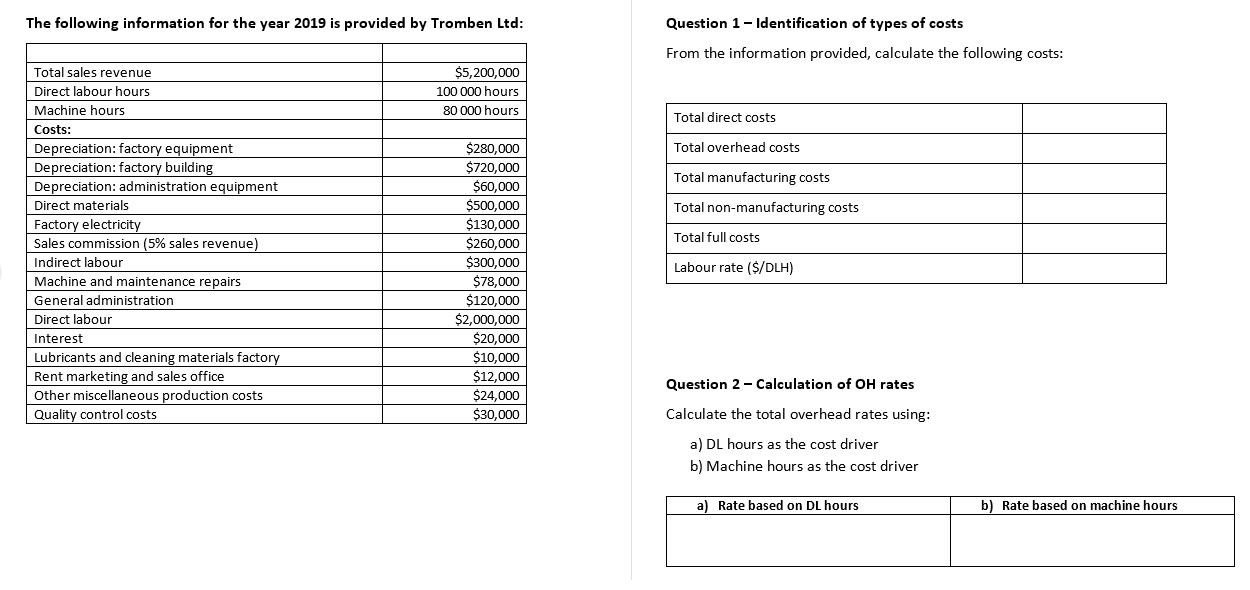

The following information for the year 2019 is provided by Tromben Ltd: Question 1- lIdentification of types of costs From the information provided, calculate

The following information for the year 2019 is provided by Tromben Ltd: Question 1- lIdentification of types of costs From the information provided, calculate the following costs: Total sales revenue $5,200,000 Direct labour hours 100 000 hours Machine hours 80 000 hours Total direct costs Costs: Depreciation: factory equipment Depreciation: factory building Depreciation: administration equipment $280,000 Total overhead costs $720,000 Total manufacturing costs $60,000 Direct materials $500,000 Total non-manufacturing costs $130,000 Factory electricity Sales commission (5% sales revenue) Total full costs $260,000 Indirect labour $300.000 Labour rate ($/DLH) Machine and maintenance repairs $78,000 General administration $120.000 $2,000,000 $20,000 $10,000 $12,000 Direct labour Interest Lubricants and cleaning materials factory Rent marketing and sales office Other miscellaneous production costs Question 2 - Calculation of OH rates $24,000 Quality control costs $30,000 Calculate the total overhead rates using: a) DL hours as the cost driver b) Machine hours as the cost driver a) Rate based on DL hours b) Rate based on machine hours

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Direct Cost Overhead Cost Non Manufacturing Cost Direct Material 50000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started