Question

The following information has also been provided by Silver and Stone: Hendrys inventory includes items purchased from Stevens for 1,950,000. Which had cost Stevens 1,410,000

The following information has also been provided by Silver and Stone:

-

Hendrys inventory includes items purchased from Stevens for 1,950,000. Which had cost Stevens 1,410,000 to manufacture. Hendry has yet to pay for these.

-

The land and buildings of Stevens were considered at the time of acquisition to have a fair value of 5,969,000 over and above the carrying value. Its other assets and liabilities were considered to have fair values equal to book value. The balance sheet of Stevens given above does not reflect the fair value exercise. No additional depreciation is deemed to arise on this revaluation.

-

Recent impairment tests show that goodwill is not impaired.

-

Hendry PLC values non-controlling interest at full (fair) value method. At the date of acquisition, the non-controlling interest was valued at 6,000,000.

Required:

-

a) Prepare a consolidated statement of profit or loss for the year-ending 31 December 2019 for the Hendry PLC Group.

-

b) Prepare a consolidated statement of financial position as at 31 December 2019 for the Hendry PLC Group.

(30 marks)

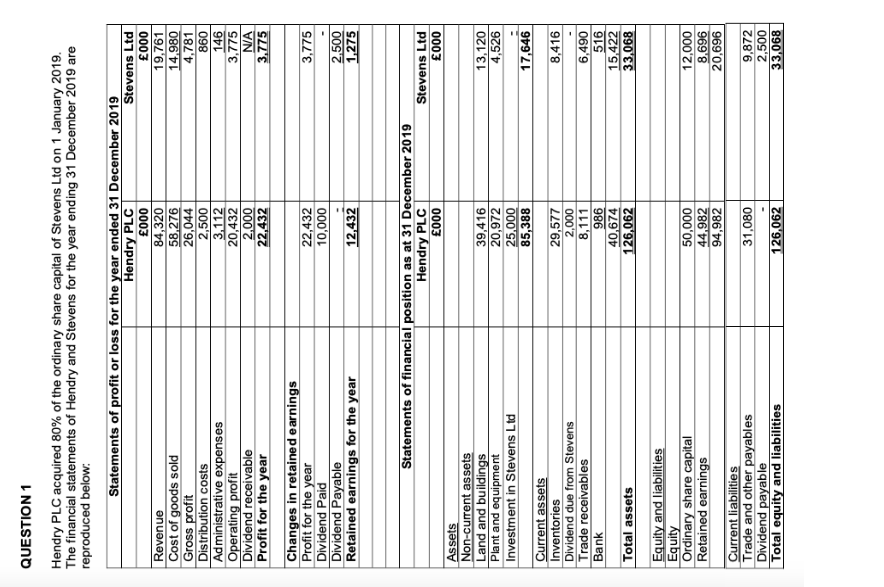

QUESTION 1 Hendry PLC acquired 80% of the ordinary share capital of Stevens Ltd on 1 January 2019. The financial statements of Hendry and Stevens for the year ending 31 December 2019 are reproduced below: Statements of profit or loss for the year ended 31 December 2019 Hendry PLC Stevens Ltd 000 000 Revenue 84,320 19,761 Cost of goods sold 58,276 14,980 Gross profit 26,044 4,781 Distribution costs 2,500 860 Administrative expenses 3,112 146 Operating profit 20,432 3,775 Dividend receivable 2.000 NA Profit for the year 22,432 3.775 3,775 Changes in retained earnings Profit for the year Dividend Paid Dividend Payable Retained earnings for the year 22,432 10,000 12,432 2,500 1,275 Stevens Ltd 000 13,120 4,526 Statements of financial position as at 31 December 2019 Hendry PLC 000 Assets Non-current assets Land and buildings 39,416 Plant and equipment 20,972 Investment in Stevens Ltd 25,000 85,388 Current assets Inventories 29,577 Dividend due from Stevens 2,000 Trade receivables 8,111 Bank 986 40,674 Total assets 126,062 17,646 8,416 6,490 516 15,422 33,068 Equity and liabilities Equity Ordinary share capital Retained earnings 50,000 44,982 94,982 12,000 8,696 20,696 31,080 Current liabilities Trade and other payables Dividend payable Total equity and liabilities 9,872 2,500 33,068 126,062 QUESTION 1 Hendry PLC acquired 80% of the ordinary share capital of Stevens Ltd on 1 January 2019. The financial statements of Hendry and Stevens for the year ending 31 December 2019 are reproduced below: Statements of profit or loss for the year ended 31 December 2019 Hendry PLC Stevens Ltd 000 000 Revenue 84,320 19,761 Cost of goods sold 58,276 14,980 Gross profit 26,044 4,781 Distribution costs 2,500 860 Administrative expenses 3,112 146 Operating profit 20,432 3,775 Dividend receivable 2.000 NA Profit for the year 22,432 3.775 3,775 Changes in retained earnings Profit for the year Dividend Paid Dividend Payable Retained earnings for the year 22,432 10,000 12,432 2,500 1,275 Stevens Ltd 000 13,120 4,526 Statements of financial position as at 31 December 2019 Hendry PLC 000 Assets Non-current assets Land and buildings 39,416 Plant and equipment 20,972 Investment in Stevens Ltd 25,000 85,388 Current assets Inventories 29,577 Dividend due from Stevens 2,000 Trade receivables 8,111 Bank 986 40,674 Total assets 126,062 17,646 8,416 6,490 516 15,422 33,068 Equity and liabilities Equity Ordinary share capital Retained earnings 50,000 44,982 94,982 12,000 8,696 20,696 31,080 Current liabilities Trade and other payables Dividend payable Total equity and liabilities 9,872 2,500 33,068 126,062Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started