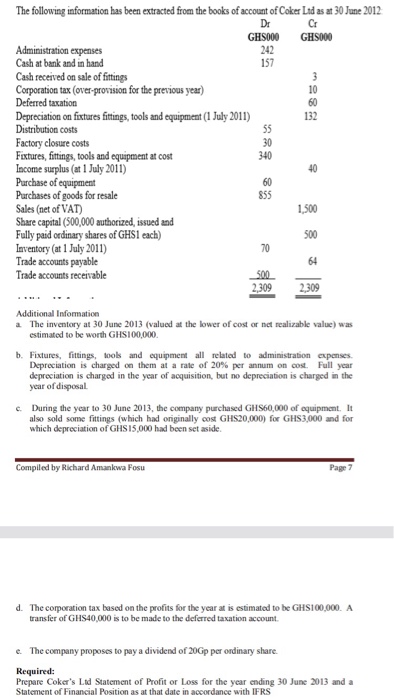

The following information has been extracted from the books of account of Coker Ltd as at 30 June 2012 GHS000 GHS000 242 157 Administration expenses Cash at bank and in hand Cash received on sale of fittings Corporation tax (over-provision for the previous year) Deferred taxation Depreciation on fixtares fittings, tools and equipment (1 July 2011) Distribution costs Factory closure costs Fixtures, fittings, tools and equipment at cot Income surplus (at 1 July 2011) Purchase of equipment Purchases of goods for resale Sales (net of VAT) Share capital (500,000 authorized, issued and Fully paid ordinary shares of GHSI each) nventory (at 1 July 2011) Trade accounts paryable Trade accounts receivable 10 60 132 30 340 60 855 1,500 70 64 500 2309 2309 Additional Information The inventory at 30 June 2013 (valued at the lower of cost or net realizable value) was estimated to be worth GHS100,000 b. Fixtures, fittings, ools and equipment all related to administration expeanses Depreciation is charged on them at a rate of 20% per annum on cost. Full year depreciation is charged in the year of acquisition, but no depreciation is charged in the year of disposal c During the year to 30 June 2013, the company purchased GHS60,000 of equipment. It also sold some fittings (which had oniginally cost GHS20,000) for GHS3,000 and for which depreciation of GHS 15,000 had been set aside. Compiled by Richard Amankwa Fosu Page 7 d. The corporation tax based on the profits for the year at is estimated to be GHS100,000. A transfer of GHS40,000 is to be made to the deferred taxation account e. The company proposes to pay a dividend of 20Gp per ordinary share Required: Prepare Coker's Ltd Statement of Profit or Loss for the year ending 30 June 2013 and a Statement of Financial Position as at that date in accordance with IFRS The following information has been extracted from the books of account of Coker Ltd as at 30 June 2012 GHS000 GHS000 242 157 Administration expenses Cash at bank and in hand Cash received on sale of fittings Corporation tax (over-provision for the previous year) Deferred taxation Depreciation on fixtares fittings, tools and equipment (1 July 2011) Distribution costs Factory closure costs Fixtures, fittings, tools and equipment at cot Income surplus (at 1 July 2011) Purchase of equipment Purchases of goods for resale Sales (net of VAT) Share capital (500,000 authorized, issued and Fully paid ordinary shares of GHSI each) nventory (at 1 July 2011) Trade accounts paryable Trade accounts receivable 10 60 132 30 340 60 855 1,500 70 64 500 2309 2309 Additional Information The inventory at 30 June 2013 (valued at the lower of cost or net realizable value) was estimated to be worth GHS100,000 b. Fixtures, fittings, ools and equipment all related to administration expeanses Depreciation is charged on them at a rate of 20% per annum on cost. Full year depreciation is charged in the year of acquisition, but no depreciation is charged in the year of disposal c During the year to 30 June 2013, the company purchased GHS60,000 of equipment. It also sold some fittings (which had oniginally cost GHS20,000) for GHS3,000 and for which depreciation of GHS 15,000 had been set aside. Compiled by Richard Amankwa Fosu Page 7 d. The corporation tax based on the profits for the year at is estimated to be GHS100,000. A transfer of GHS40,000 is to be made to the deferred taxation account e. The company proposes to pay a dividend of 20Gp per ordinary share Required: Prepare Coker's Ltd Statement of Profit or Loss for the year ending 30 June 2013 and a Statement of Financial Position as at that date in accordance with IFRS