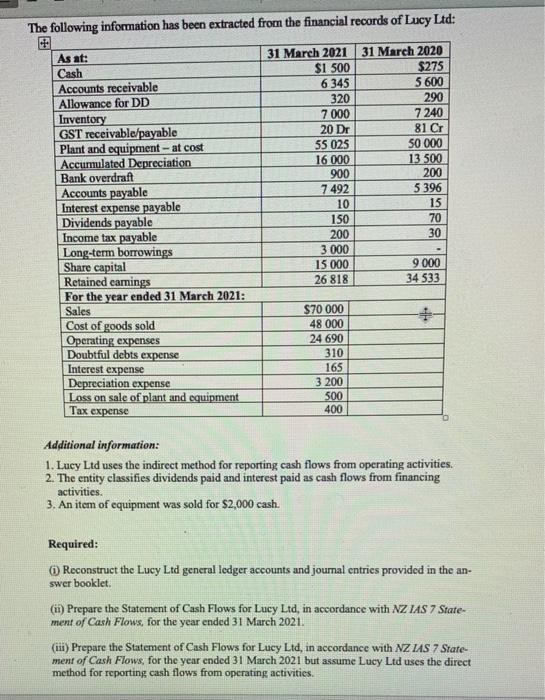

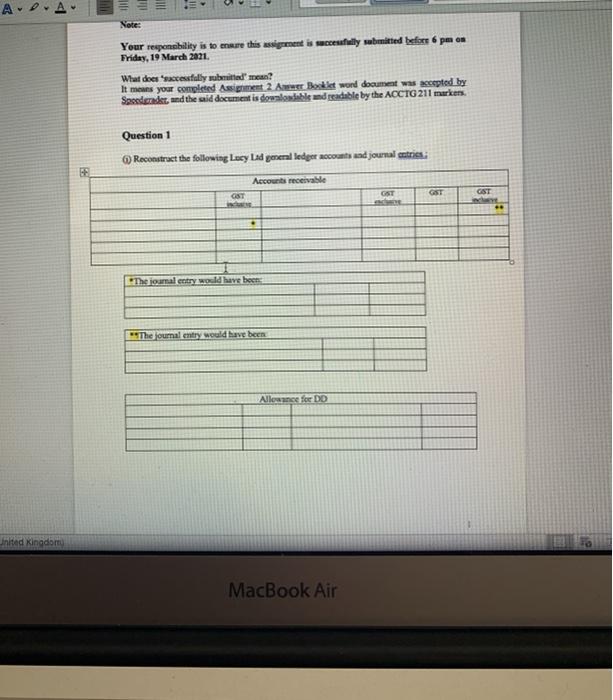

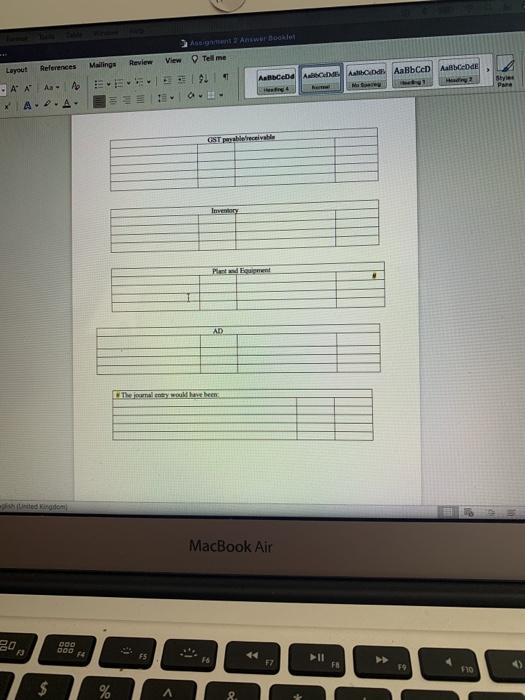

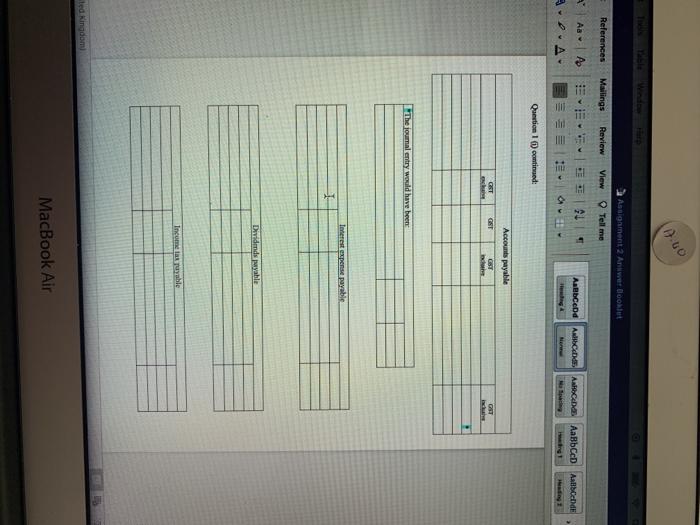

The following information has been extracted from the financial records of Lucy Ltd: As at: Cash Accounts receivable Allowance for DD Inventory GST receivable/payable Plant and equipment - at cost Accumulated Depreciation Bank overdraft Accounts payable Interest expense payable Dividends payable Income tax payable Long-term borrowings Share capital Retained earings For the year ended 31 March 2021: Sales Cost of goods sold Operating expenses Doubtful debts expense Interest expense Depreciation expense Loss on sale of plant and equipment Tax expense 31 March 2021 31 March 2020 $1 500 $275 6 345 5 600 320 290 7 000 7240 20 Dr 81 C 55 025 50 000 16 000 13 500 900 7.492 5 396 10 15 150 70 200 30 3 000 15 000 9 000 26 818 34 533 200 $70 000 48 000 24 690 310 165 3 200 500 400 Additional information: 1. Lucy Ltd uses the indirect method for reporting cash flows from operating activities. 2. The entity classifies dividends paid and interest paid as cash flows from financing activities. 3. An item of equipment was sold for $2,000 cash. Required: Reconstruct the Lucy Ltd general ledger accounts and joumal entries provided in the an- swer booklet (i) Prepare the Statement of Cash Flows for Lucy Ltd, in accordance with NZ IAS 7 State- ment of Cash Flows, for the year ended 31 March 2021. (111) Prepare the Statement of Cash Flows for Lucy Ltd, in accordance with NZ IAS 7 State- ment of Cash Flows, for the year ended 31 March 2021 but assume Lucy Ltd uses the direct method for reporting cash flows from operating activities. A Notes Your responsbility is to me this assignment is successfully submitted before 6pm os Friday, 19 March 2021 What does successfully submitted mean? It means your completed Assignment 2 A Booklet word document was accepted by Saadet and the said document is downloadable and geadable by the AOCTG 211 markers. Question 1 Reconstruct the following Lucy Lad general ledger accounts and journal entries BE Accounts receivable GST GST GST G . The journal entry would have been The journal entry would have been Allowance for DD United Kingdom MacBook Air Sigma 3 Answer Book Tell me Mallings Review View Layout References 9 Acebo ABC Ad AaBbcc Aabende Mao Styles Pare CAA A. A. 2-A- - ONT pieceivable Immo Pew Equipment AD The way that he ed Kingdom MacBook Air DOO 800 FS 18 II F7 FE FO F10 $ % A 2 Assignment 2 Answer out References Mailings Review View Tell me Abced ACD ACD Aalbec Alletid Aa A ADA E- a g Question 1) continued Accounts payable GET OST GST GST The journal entry would have been Interest expense payable Dividends payable Income tax payable led Kingdom MacBook Air The following information has been extracted from the financial records of Lucy Ltd: As at: Cash Accounts receivable Allowance for DD Inventory GST receivable/payable Plant and equipment - at cost Accumulated Depreciation Bank overdraft Accounts payable Interest expense payable Dividends payable Income tax payable Long-term borrowings Share capital Retained earings For the year ended 31 March 2021: Sales Cost of goods sold Operating expenses Doubtful debts expense Interest expense Depreciation expense Loss on sale of plant and equipment Tax expense 31 March 2021 31 March 2020 $1 500 $275 6 345 5 600 320 290 7 000 7240 20 Dr 81 C 55 025 50 000 16 000 13 500 900 7.492 5 396 10 15 150 70 200 30 3 000 15 000 9 000 26 818 34 533 200 $70 000 48 000 24 690 310 165 3 200 500 400 Additional information: 1. Lucy Ltd uses the indirect method for reporting cash flows from operating activities. 2. The entity classifies dividends paid and interest paid as cash flows from financing activities. 3. An item of equipment was sold for $2,000 cash. Required: Reconstruct the Lucy Ltd general ledger accounts and joumal entries provided in the an- swer booklet (i) Prepare the Statement of Cash Flows for Lucy Ltd, in accordance with NZ IAS 7 State- ment of Cash Flows, for the year ended 31 March 2021. (111) Prepare the Statement of Cash Flows for Lucy Ltd, in accordance with NZ IAS 7 State- ment of Cash Flows, for the year ended 31 March 2021 but assume Lucy Ltd uses the direct method for reporting cash flows from operating activities. A Notes Your responsbility is to me this assignment is successfully submitted before 6pm os Friday, 19 March 2021 What does successfully submitted mean? It means your completed Assignment 2 A Booklet word document was accepted by Saadet and the said document is downloadable and geadable by the AOCTG 211 markers. Question 1 Reconstruct the following Lucy Lad general ledger accounts and journal entries BE Accounts receivable GST GST GST G . The journal entry would have been The journal entry would have been Allowance for DD United Kingdom MacBook Air Sigma 3 Answer Book Tell me Mallings Review View Layout References 9 Acebo ABC Ad AaBbcc Aabende Mao Styles Pare CAA A. A. 2-A- - ONT pieceivable Immo Pew Equipment AD The way that he ed Kingdom MacBook Air DOO 800 FS 18 II F7 FE FO F10 $ % A 2 Assignment 2 Answer out References Mailings Review View Tell me Abced ACD ACD Aalbec Alletid Aa A ADA E- a g Question 1) continued Accounts payable GET OST GST GST The journal entry would have been Interest expense payable Dividends payable Income tax payable led Kingdom MacBook Air