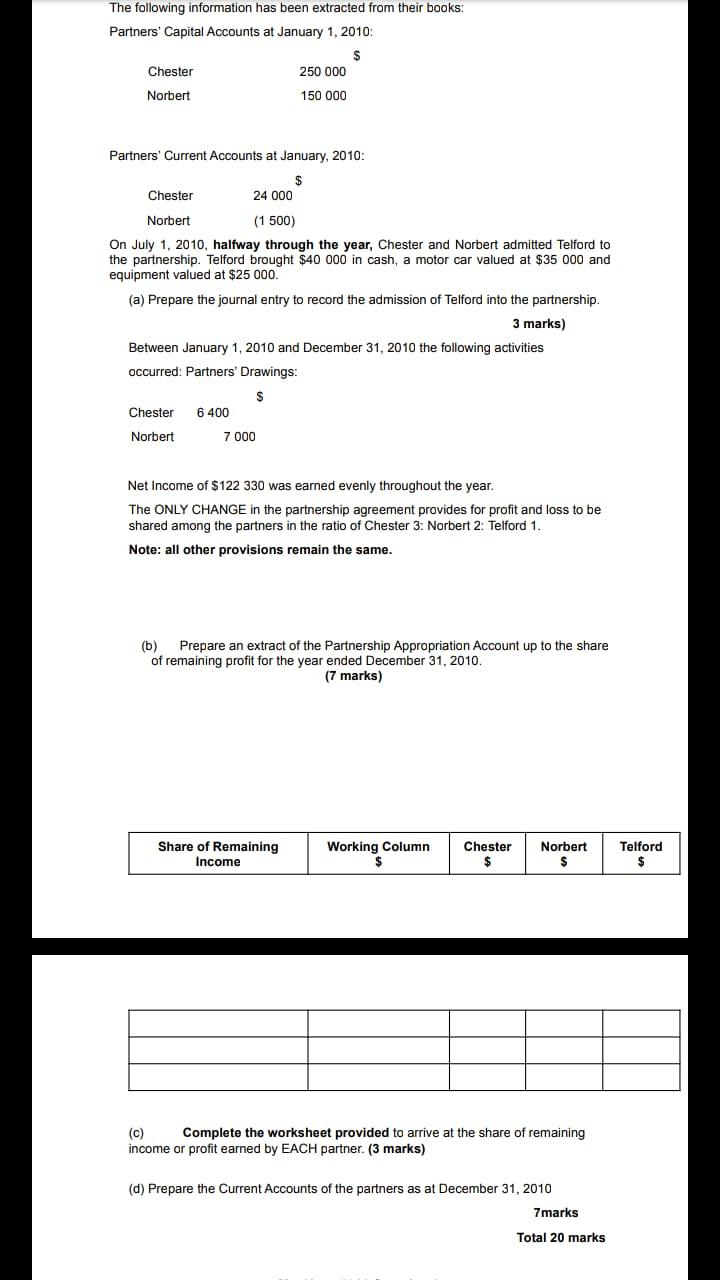

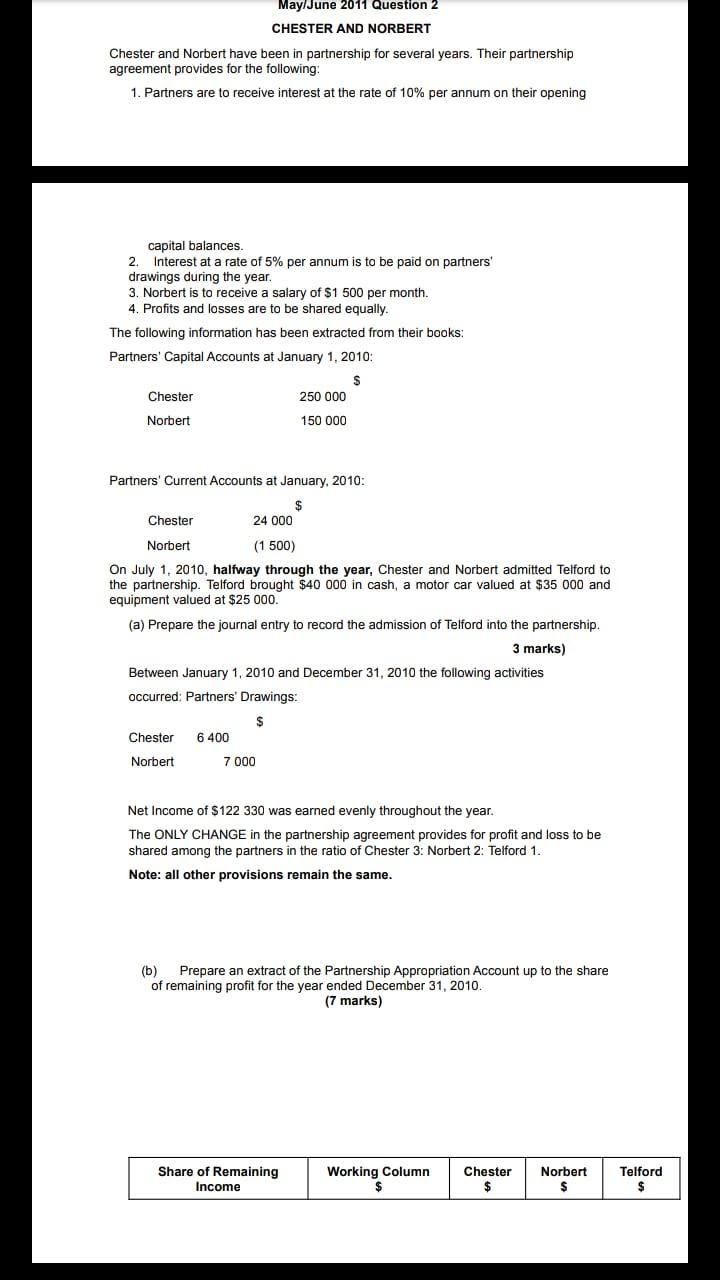

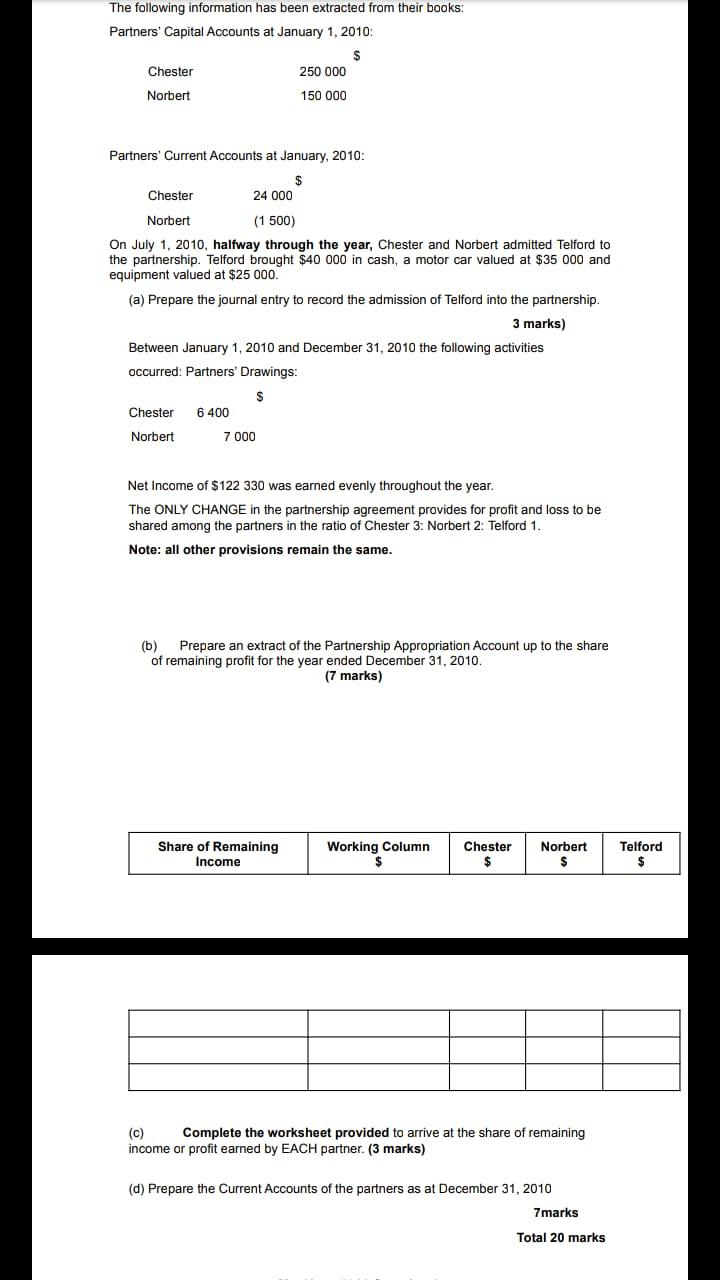

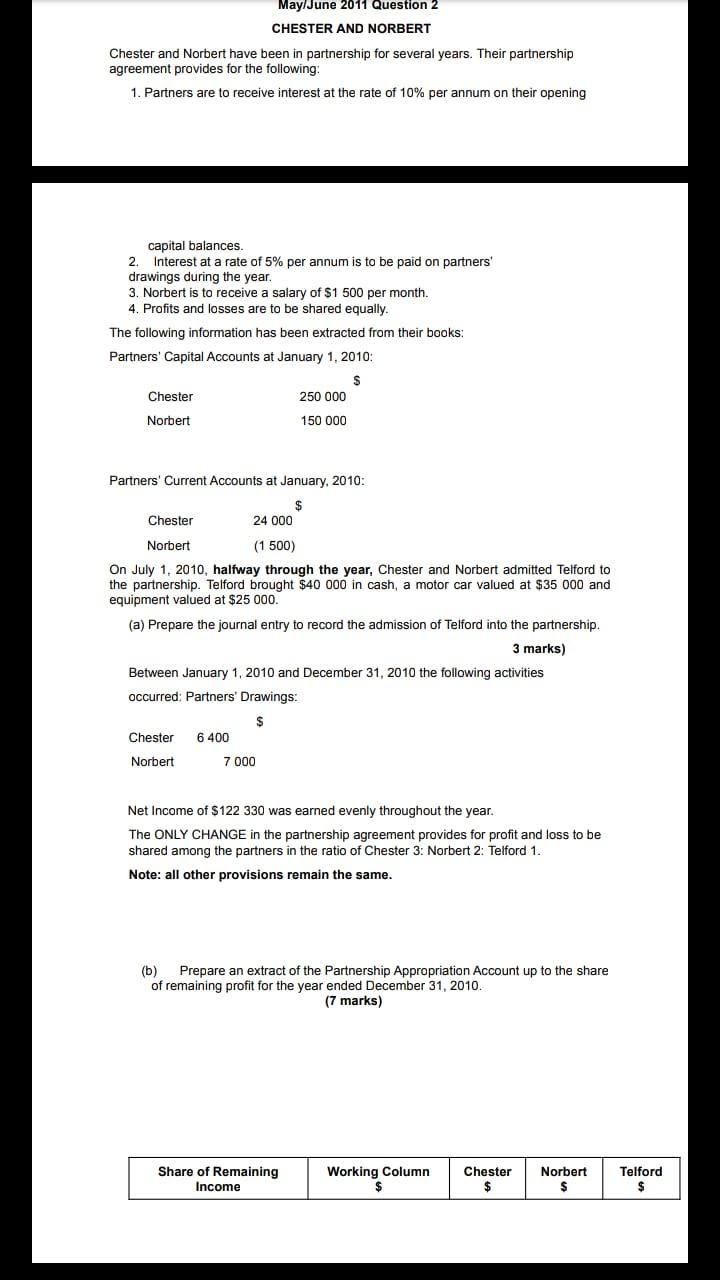

The following information has been extracted from their books: Partners' Capital Accounts at January 1, 2010: $ Chester 250 000 Norbert 150 000 Partners' Current Accounts at January, 2010: $ Chester 24 000 Norbert (1 500) ) On July 1, 2010, halfway through the year, Chester and Norbert admitted Telford to the partnership. Telford brought $40 000 in cash, a motor car valued at $35 000 and equipment valued at $25 000 (a) Prepare the journal entry to record the admission of Telford into the partnership. 3 marks) Between January 1, 2010 and December 31, 2010 the following activities occurred: Partners' Drawings: $ Chester 6 400 Norbert 7 7 000 Net Income of $122 330 was earned evenly throughout the year. The ONLY CHANGE in the partnership agreement provides for profit and loss to be shared among the partners in the ratio of Chester 3: Norbert 2: Telford 1. Note: all other provisions remain the same. (b) Prepare an extract of the Partnership Appropriation Account up to the share of remaining profit for the year ended December 31, 2010. (7 marks) Share of Remaining Income Working Column $ Chester $ Norbert $ Telford $ $ (c) Complete the worksheet provided to arrive at the share of remaining income or profit earned by EACH partner. (3 marks) (d) Prepare the Current Accounts of the partners as at December 31, 2010 7marks Total 20 marks May/June 2011 Question 2 CHESTER AND NORBERT Chester and Norbert have been in partnership for several years. Their partnership agreement provides for the following: 1. Partners are to receive interest at the rate of 10% per annum on their opening capital balances. . 2. Interest at a rate of 5% per annum is to be paid on partners drawings during the year. 3. Norbert is to receive a salary of $1 500 per month 4. Profits and losses are to be shared equally. The following information has been extracted from their books: Partners' Capital Accounts at January 1, 2010: s Chester 250 000 Norbert 150 000 Partners' Current Accounts at January, 2010: $ Chester 24 000 Norbert (1 500) On July 1, 2010, halfway through the year, Chester and Norbert admitted Telford to the partnership. Telford brought $40 000 in cash, a motor car valued at $35 000 and equipment valued at $25 000. (a) Prepare the journal entry to record the admission of Telford into the partnership. 3 marks) Between January 1, 2010 and December 31, 2010 the following activities occurred: Partners' Drawings: $ Chester 6 400 Norbert 7 000 Net Income of $122 330 was earned evenly throughout the year. The ONLY CHANGE in the partnership agreement provides for profit and loss to be shared among the partners in the ratio of Chester 3: Norbert 2: Telford 1. Note: all other provisions remain the same. (b) Prepare an extract of the Partnership Appropriation Account up to the share of remaining profit for the year ended December 31, 2010 (7 marks) Chester Share of Remaining Income Working Column $ $ $ Norbert $ s Telford $