Question

The following information has been gathered to assist you in doing this analysis: beta = 2.0, market risk premium = 5.50%, current stock price $24.75,

The following information has been gathered to assist you in doing this analysis: beta = 2.0, market risk premium = 5.50%, current stock price $24.75, YTM on Debt = 10.60%, 15 years to maturity on debt, current risk free rate = 1.25%.

Questions:

1. Calculate the WACC for the firm. In this calculation show the steps needed to calculate the cost of equity, cost of debt, market value of equity, and the market value of debt?

2. Calculate the WACC for the firm. In this calculation show the steps needed to calculate the cost of equity, cost of debt, market value of equity, and the market value of debt?

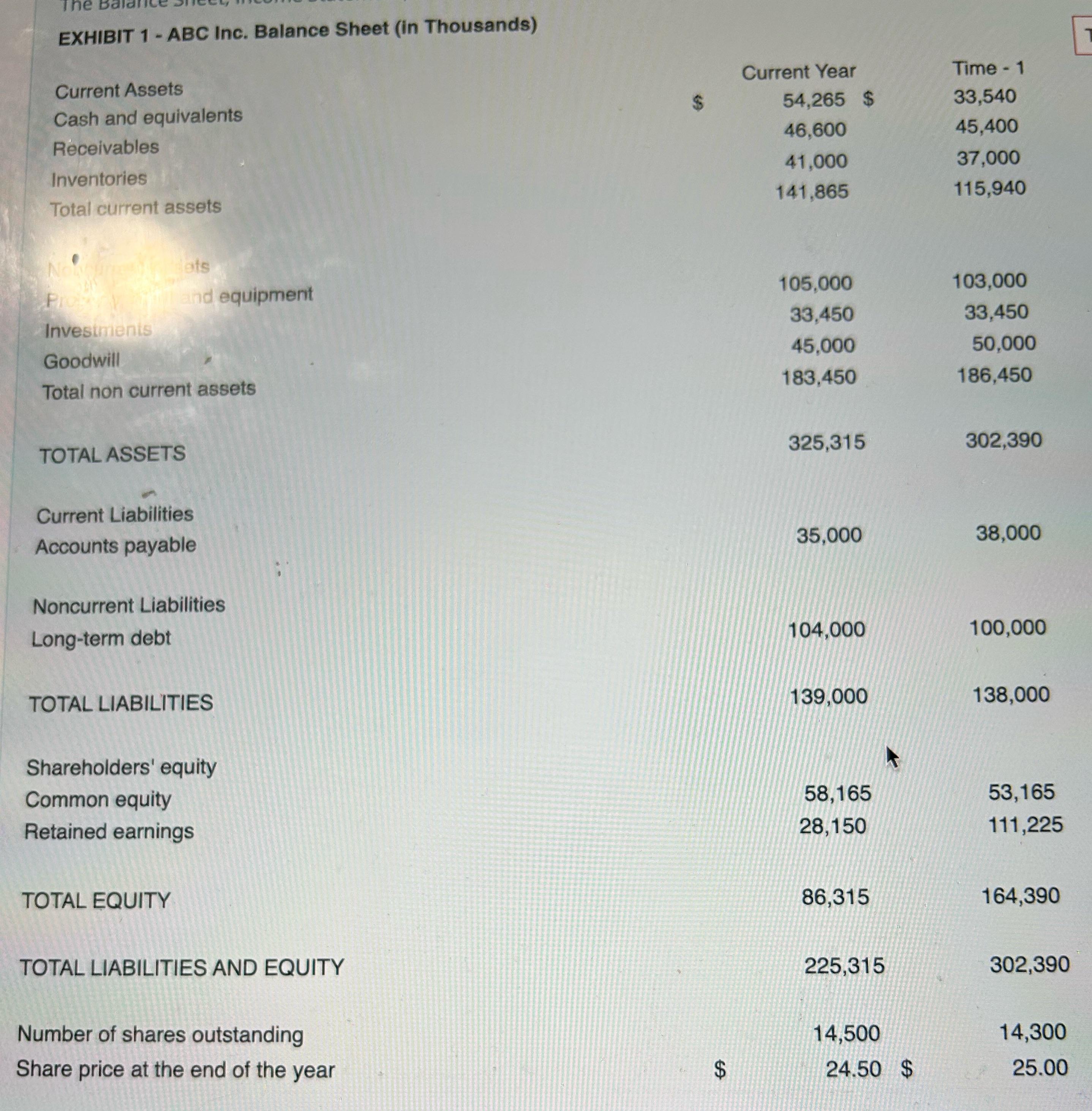

The EXHIBIT 1 - ABC Inc. Balance Sheet (in Thousands) Current Assets Cash and equivalents Receivables Inventories Total current assets Noncures Proy Investments Goodwill Total non current assets ots and equipment TOTAL ASSETS Current Liabilities Accounts payable Noncurrent Liabilities Long-term debt TOTAL LIABILITIES Shareholders' equity Common equity Retained earnings TOTAL EQUITY TOTAL LIABILITIES AND EQUITY Number of shares outstanding Share price at the end of the year $ Current Year 54,265 $ 46,600 41,000 141,865 105,000 33,450 45,000 183,450 325,315 35,000 104,000 139,000 58,165 28,150 86,315 225,315 14,500 24.50 $ Time - 1 33,540 45,400 37,000 115,940 103,000 33,450 50,000 186,450 302,390 38,000 100,000 138,000 53,165 111,225 164,390 302,390 14,300 25.00

Step by Step Solution

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

1 Cost of Equity Beta 20 Market Risk Premium MRP 550 Risk Free Rate Rf 125 Cost of Equity Ke Rf ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started