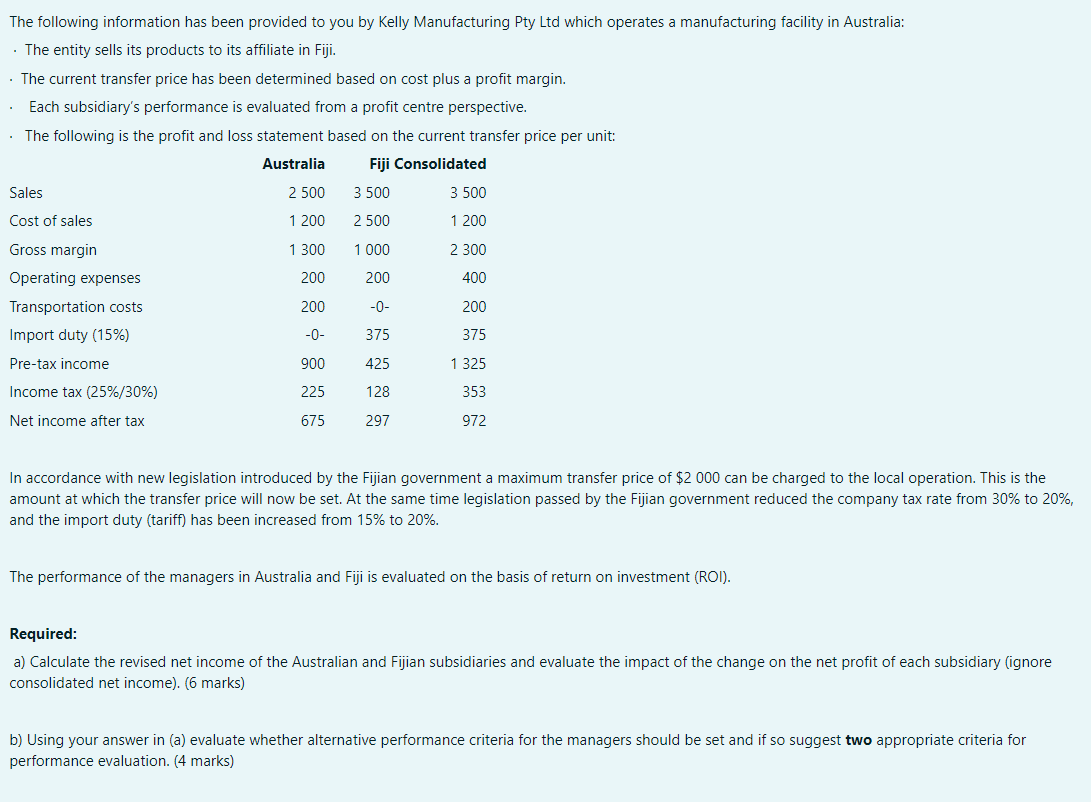

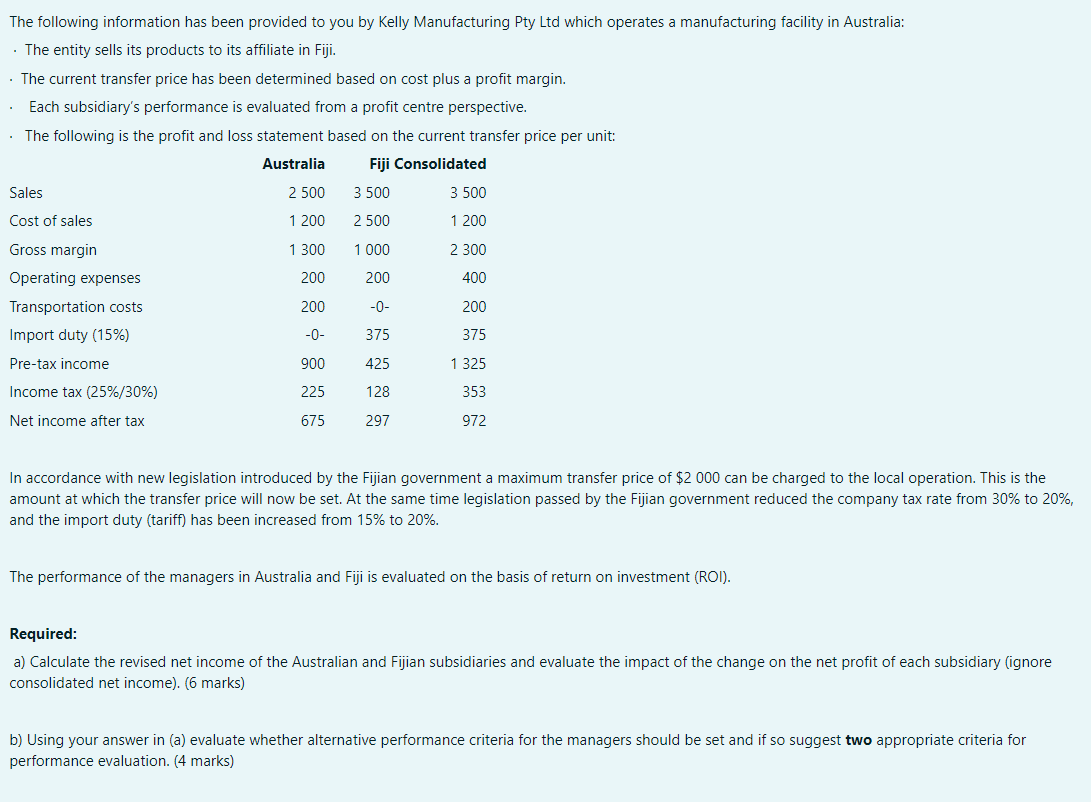

The following information has been provided to you by Kelly Manufacturing Pty Ltd which operates a manufacturing facility in Australia: The entity sells its products to its affiliate in Fiji. The current transfer price has been determined based on cost plus a profit margin. Each subsidiary's performance is evaluated from a profit centre perspective. The following is the profit and loss statement based on the current transfer price per unit: Australia Fiji Consolidated Sales 2 500 3 500 3 500 Cost of sales 1 200 2 500 1 200 Gross margin 1 300 1 000 2 300 Operating expenses 200 200 400 Transportation costs 200 -0- 200 Import duty (15%) -0- 375 375 Pre-tax income 900 425 1 325 Income tax (25%/30%) 225 128 353 Net income after tax 675 297 972 In accordance with new legislation introduced by the Fijian government a maximum transfer price of $2 000 can be charged to the local operation. This is the amount at which the transfer price will now be set. At the same time legislation passed by the Fijian government reduced the company tax rate from 30% to 20%, and the import duty (tariff) has been increased from 15% to 20%. The performance of the managers in Australia and Fiji is evaluated on the basis of return on investment (ROI). Required: a) Calculate the revised net income of the Australian and Fijian subsidiaries and evaluate the impact of the change on the net profit of each subsidiary (ignore consolidated net income). (6 marks) b) Using your answer in (a) evaluate whether alternative performance criteria for the managers should be set and if so suggest two appropriate criteria for performance evaluation. (4 marks) The following information has been provided to you by Kelly Manufacturing Pty Ltd which operates a manufacturing facility in Australia: The entity sells its products to its affiliate in Fiji. The current transfer price has been determined based on cost plus a profit margin. Each subsidiary's performance is evaluated from a profit centre perspective. The following is the profit and loss statement based on the current transfer price per unit: Australia Fiji Consolidated Sales 2 500 3 500 3 500 Cost of sales 1 200 2 500 1 200 Gross margin 1 300 1 000 2 300 Operating expenses 200 200 400 Transportation costs 200 -0- 200 Import duty (15%) -0- 375 375 Pre-tax income 900 425 1 325 Income tax (25%/30%) 225 128 353 Net income after tax 675 297 972 In accordance with new legislation introduced by the Fijian government a maximum transfer price of $2 000 can be charged to the local operation. This is the amount at which the transfer price will now be set. At the same time legislation passed by the Fijian government reduced the company tax rate from 30% to 20%, and the import duty (tariff) has been increased from 15% to 20%. The performance of the managers in Australia and Fiji is evaluated on the basis of return on investment (ROI). Required: a) Calculate the revised net income of the Australian and Fijian subsidiaries and evaluate the impact of the change on the net profit of each subsidiary (ignore consolidated net income). (6 marks) b) Using your answer in (a) evaluate whether alternative performance criteria for the managers should be set and if so suggest two appropriate criteria for performance evaluation. (4 marks)