Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information has been provided to you by Stars Limited which operates a manufacturing facility in the United States: 1. The entity sells

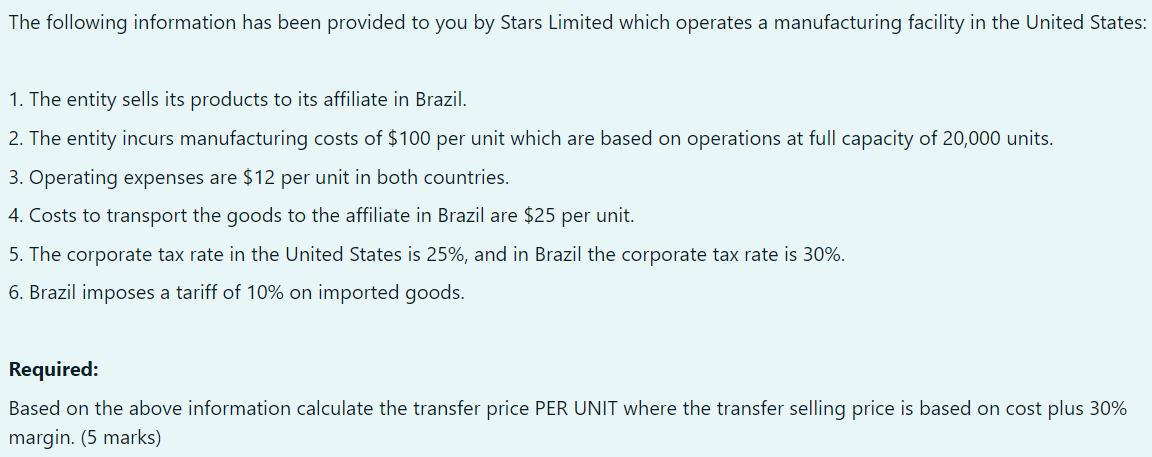

The following information has been provided to you by Stars Limited which operates a manufacturing facility in the United States: 1. The entity sells its products to its affiliate in Brazil. 2. The entity incurs manufacturing costs of $100 per unit which are based on operations at full capacity of 20,000 units. 3. Operating expenses are $12 per unit in both countries. 4. Costs to transport the goods to the affiliate in Brazil are $25 per unit. 5. The corporate tax rate in the United States is 25%, and in Brazil the corporate tax rate is 30%. 6. Brazil imposes a tariff of 10% on imported goods. Required: Based on the above information calculate the transfer price PER UNIT where the transfer selling price is based on cost plus 30% margin. (5 marks)

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Transfer selling price is based on Cost plus 30 margin Here the cost will include a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started