The following information has been taken from the consolidation worksheet of Graham Company and its 80% owned subsidiary, Stage Company. (1.) Graham reports a

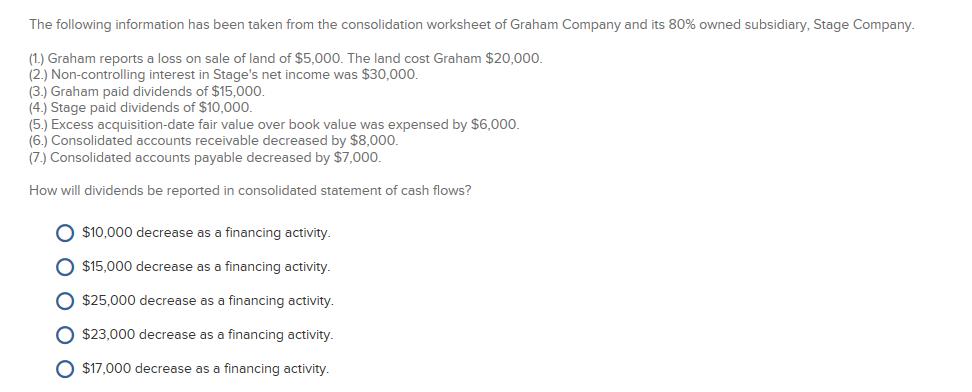

The following information has been taken from the consolidation worksheet of Graham Company and its 80% owned subsidiary, Stage Company. (1.) Graham reports a loss on sale of land of $5,000. The land cost Graham $20,000. (2.) Non-controlling interest in Stage's net income was $30,000. (3.) Graham paid dividends of $15,000. (4.) Stage paid dividends of $10,000. (5.) Excess acquisition-date fair value over book value was expensed by $6,000. (6.) Consolidated accounts receivable decreased by $8,000. (7.) Consolidated accounts payable decreased by $7,000. How will dividends be reported in consolidated statement of cash flows? O $10,000 decrease as a financing activity. O $15,000 decrease as a financing activity. O $25,000 decrease as a financing activity. O $23,000 decrease as a financing activity. O $17,000 decrease as a financing activity.

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option e 17000 decrease as a fi...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started