Question

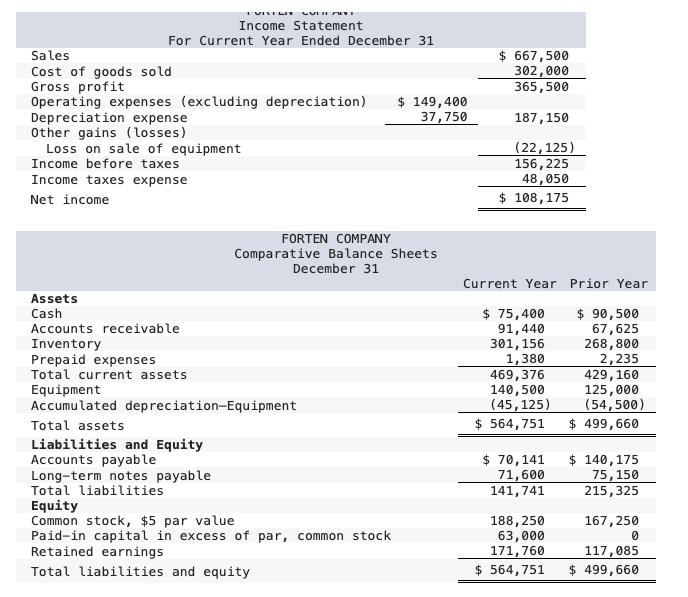

The following information is about Forten company: Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $22,125

The following information is about Forten company:

Additional Information on Current Year Transactions

a. The loss on the cash sale of equipment was $22,125 (details in b ).

b. Sold equipment costing $97,875, with accumulated depreciation of $47,125, for $28,625 cash.

c. Purchased equipment costing $113,375 by paying $64,000 cash and signing a long-term notes payable for t

balance.

d. Paid $52,925 cash to reduce the long-term notes payable.

e. Issued 4,200 shares of common stock for $20 cash per share.

f. Declared and paid cash dividends of $53,500.

- Required:

- Prepare a complete statement of cash flows using the direct method.

- Amounts to be deducted should be indicated with a minus sign.

VITTLE VERE Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) $ 149,400 37,750 Depreciation expense Other gains (losses) Loss on sale of equipment Income before taxes Income taxes expense: Net income Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated Total assets Liabilities and Equity Accounts payable Long-term notes payable Total liabilities FORTEN COMPANY Comparative Balance Sheets December 31 depreciation-Equipment Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity $ 667,500 302,000 365,500 187,150 (22, 125) 156, 225 48,050 $ 108,175 Current Year Prior Year $ 75,400 $ 90,500 91,440 301, 156 67,625 268,800 1,380 2,235 429, 160 469,376 140,500 (45,125) $ 564,751 $70,141 71,600 141,741 188,250 63,000 171,760 $ 564,751 125,000 (54,500) $ 499,660 $ 140,175 75,150 215,325 167,250 0 117,085 $ 499,660

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a complete statement of cash flows using the direct method we need to analyze the given i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started