Answered step by step

Verified Expert Solution

Question

1 Approved Answer

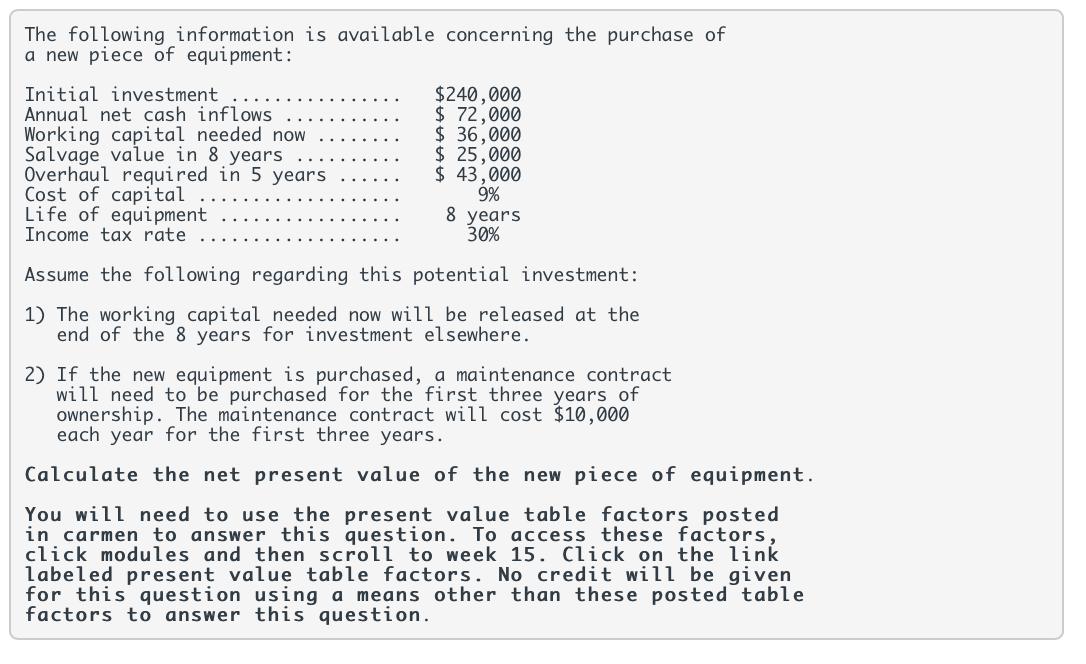

The following information is available concerning the purchase of a new piece of equipment: Initial investment Annual net cash inflows Working capital needed now

The following information is available concerning the purchase of a new piece of equipment: Initial investment Annual net cash inflows Working capital needed now Salvage value in 8 years Overhaul required in 5 years Cost of capital Life of equipment Income tax rate $240,000 $ 72,000 $ 36,000 $ 25,000 $ 43,000 9% 8 years 30% Assume the following regarding this potential investment: 1) The working capital needed now will be released at the end of the 8 years for investment elsewhere. 2) If the new equipment is purchased, a maintenance contract will need to be purchased for the first three years of ownership. The maintenance contract will cost $10,000 each year for the first three years. Calculate the net present value of the new piece of equipment. You will need to use the present value table factors posted in carmen to answer this question. To access these factors, click modules and then scroll to week 15. Click on the link labeled present value table factors. No credit will be given for this question using a means other than these posted table factors to answer this question.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Net Present Value of the new piece of Equipment SNo Particulars Year 1 Year 2 Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started