Answered step by step

Verified Expert Solution

Question

1 Approved Answer

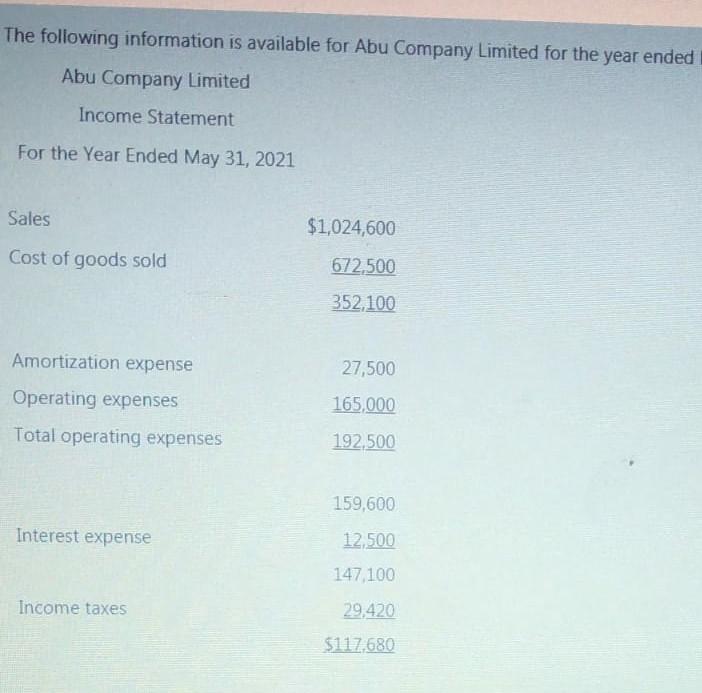

The following information is available for Abu Company Limited for the year ended Abu Company Limited Income Statement For the Year Ended May 31, 2021

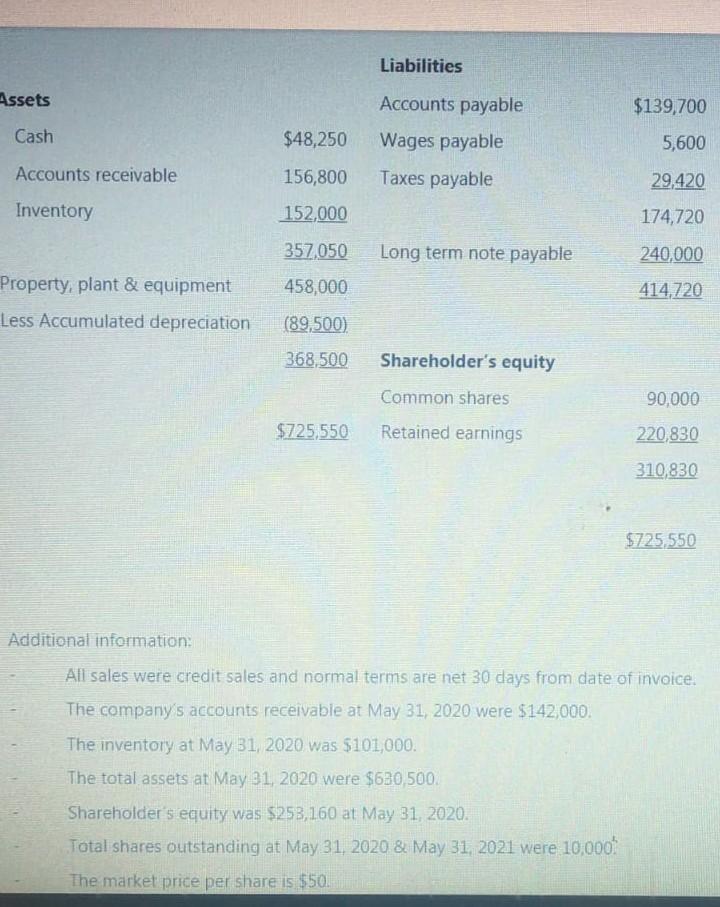

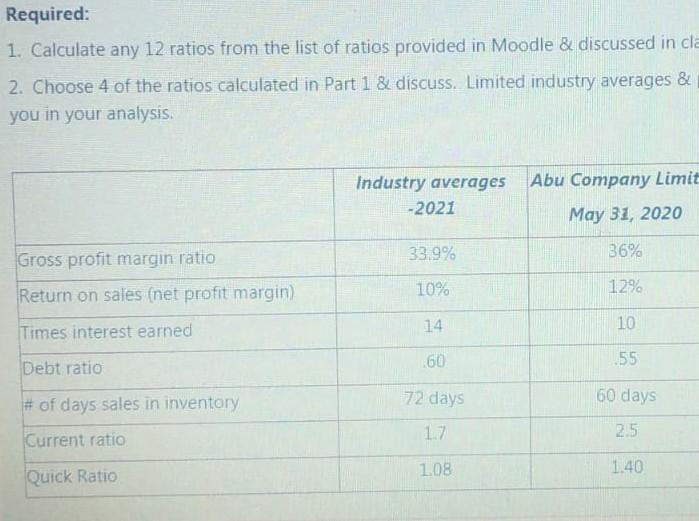

The following information is available for Abu Company Limited for the year ended Abu Company Limited Income Statement For the Year Ended May 31, 2021 Sales $1,024,600 Cost of goods sold 672,500 352,100 27,500 Amortization expense Operating expenses Total operating expenses 165,000 192,500 159,600 12,500 Interest expense 147 100 Income taxes 29,420 $117,680 Liabilities Assets Accounts payable $139,700 Cash $48,250 Wages payable 5,600 Accounts receivable 156,800 Taxes payable 29,420 Inventory 152,000 174,720 357,050 Long term note payable 240,000 458,000 414,720 Property, plant & equipment Less Accumulated depreciation (89,500) 368,500 Shareholder's equity Common shares 90,000 $725,550 Retained earnings 220,830 310,830 $725,550 Additional information: All sales were credit sales and normal terms are net 30 days from date of invoice. The company's accounts receivable at May 31, 2020 were $142,000. The inventory at May 31, 2020 was 5101,000. The total assets at May 31, 2020 were $630,500 Shareholder's equity was $253,160 at May 31, 2020. Total shares outstanding at May 31, 2020 & May 31, 2021 were 10,000 The market price per share is $50, Liabilities Assets Accounts payable Wages payable Cash $48,250 Accounts receivable 156,800 Taxes payable Inventory 152,000 357,050 Long term note payable 458,000 Property, plant & equipment Less Accumulated depreciation (89,500) 368,500 Shareholder's equity Common shares $725,550 Retained earnings Required: 1. Calculate any 12 ratios from the list of ratios provided in Moodle & discussed in cla 2. Choose 4 of the ratios calculated in Part 1 & discuss. Limited industry averages & you in your analysis Abu Company Limit Industry averages -2021 May 31, 2020 33.9% 36% Gross profit margin ratio Return on sales (net profit margin) 10% 12% Times interest earned 14 10 .60 Debt ratio 55 # of days sales in inventory 60 days 72 days 1.7 2.5 Current ratio 1.08 1.40 Quick Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started