Answered step by step

Verified Expert Solution

Question

1 Approved Answer

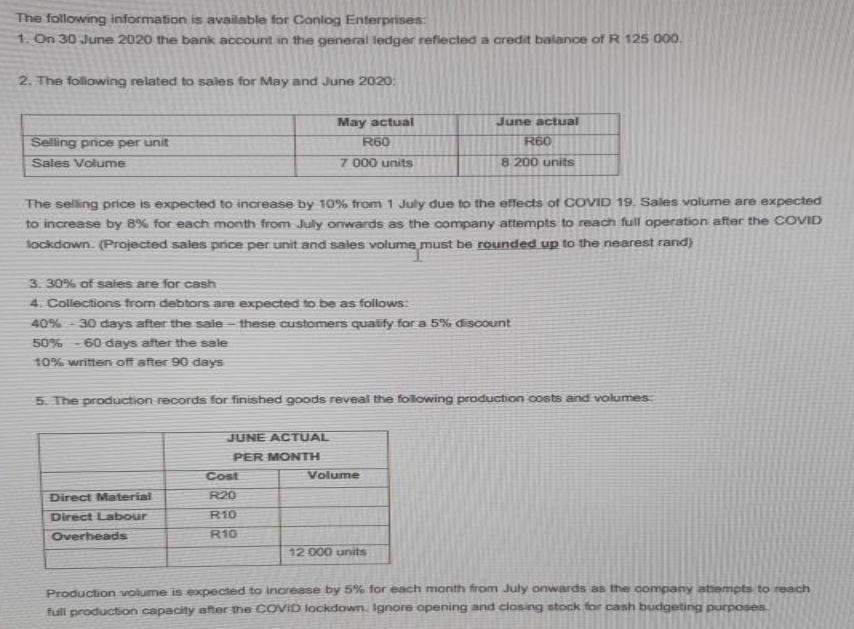

The following information is available for Coniog Enterprises: 1. On 30 June 2020 the bank account in the general ledger refiected a credit balance

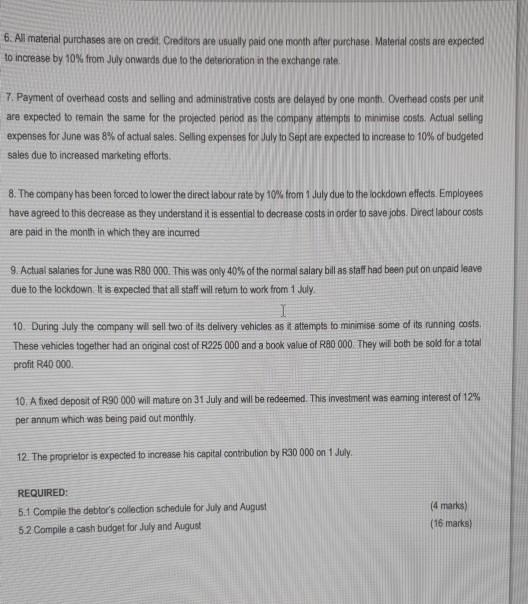

The following information is available for Coniog Enterprises: 1. On 30 June 2020 the bank account in the general ledger refiected a credit balance of R 125 000. 2. The following related to sales for May and June 2020: May actual June actual Selling prioe per unit R60 R60 Sales Volume 7 000 units 8 200 units The selling price is expected to increase by 10% from 1 July due to the effects of COVID 19. Sales volume are expected to increase by 8% for each month from July onwards as the company attempts to reach full operation after the COVID lackdown. (Projected sales price per unit and sales volume must be rounded up to the nearest rand) 3. 30% of sales are for cash 4. Collections from debtors are expected to be as follows 40%- 30 days after the saie- these customers qualify for a 5% discount 50% -60 days after the sale 10% written off after 90 days 5. The production records for finished goods reveal the folowing production costs and volumes JUNE ACTUAL PER MONTH Cost Volume Direct Material R20 Direct Labour R10 Overheads R10 12 000 units Production volume is expected to increase by 5% for each morith from July onwards as the company athempts to reach full production capacity after the COVID lockdown. Ignore opening and closing stock for cash budgeting purposes 6. All material purchases are on credit. Creditors are usually paid one month after purchase Material costs are expected to increase by 10% from July onwards due to the deterioration in the exchange rate. 7. Payment of overhead costs and selling and administrative costs are delayed by one month. Overhead costs per unit are expected to remain the same for the projected period as the company attempts to minimise costs. Actual selling expenses for June was 8% of actual sales. Selling expenses for July to Sept are expected to increase to 10% of budgeted sales due to increased marketing efforts. 8. The company has been forced to lower the direct labour rate by 10% trom 1 July due to the lockdown effects. Employees have agreed to this decrease as they understand it is essential to decrease costs in order to save jobs. Direct labour costs are paid in the month in which they are incurred 9. Actual salanes for June was R80 000. This was only 40% of the normal salary bill as staff had been put on unpaid leave due to the lockdown. It is expected that all staf wil reum to work from 1 July. 10. During July the company will sell two of its delivery vehicles as it attempts to minimise some of its running costs. These vehicles together had an oniginal cost of R225 000 and a book value of Ra0 000 They will both be sold for a total profit R40 000. 10. A fixed deposit of R90 000 will mature on 31 July and will be redeemed. This investment was eaming interest of 12% per annum which was being paid out monthly. 12. The proprietor is expected to increase his capital contribution by R30 000 on 1 July. REQUIRED: (4 marks) 5.1 Compile the debtor's collection schedule for July and August (16 marks) 52 Compile a cash budget for July and August

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started