Answered step by step

Verified Expert Solution

Question

1 Approved Answer

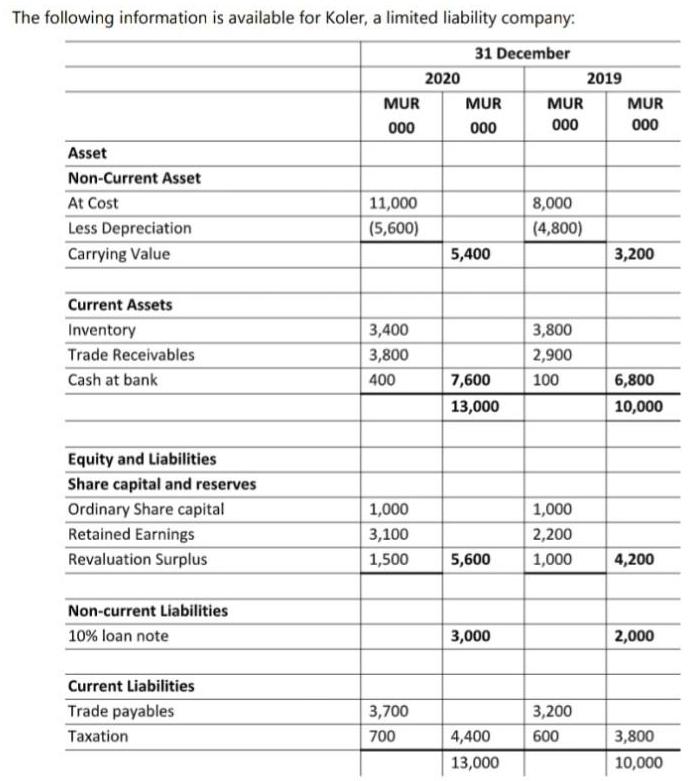

The following information is available for Koler, a limited liability company: 31 December 2020 2019 MUR MUR MUR MUR 000 00 000 000 Asset

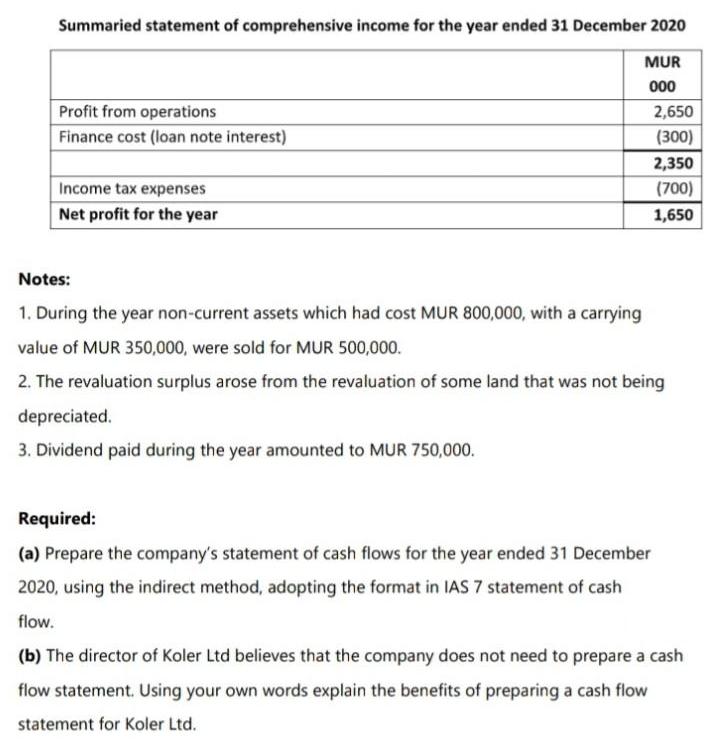

The following information is available for Koler, a limited liability company: 31 December 2020 2019 MUR MUR MUR MUR 000 00 000 000 Asset Non-Current Asset At Cost 11,000 8,000 Less Depreciation (5,600) (4,800) Carrying Value 5,400 3,200 Current Assets Inventory 3,400 3,800 Trade Receivables 3,800 2,900 Cash at bank 400 7,600 100 6,800 13,000 10,000 Equity and Liabilities Share capital and reserves Ordinary Share capital 1,000 1,000 Retained Earnings 3,100 2,200 Revaluation Surplus 1,500 5,600 1,000 4,200 Non-current Liabilities 10% loan note 3,000 2,000 Current Liabilities Trade payables 3,700 3,200 Taxation 700 4,400 600 3,800 13,000 10,000 Summaried statement of comprehensive income for the year ended 31 December 2020 MUR 000 Profit from operations 2,650 Finance cost (loan note interest) (300) 2,350 Income tax expenses (700) Net profit for the year 1,650 Notes: 1. During the year non-current assets which had cost MUR 800,000, with a carrying value of MUR 350,000, were sold for MUR 500,000. 2. The revaluation surplus arose from the revaluation of some land that was not being depreciated. 3. Dividend paid during the year amounted to MUR 750,000. Required: (a) Prepare the company's statement of cash flows for the year ended 31 December 2020, using the indirect method, adopting the format in IAS 7 statement of cash flow. (b) The director of Koler Ltd believes that the company does not need to prepare a cash flow statement. Using your own words explain the benefits of preparing a cash flow statement for Koler Ltd.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Cash flow Statement Cash flow from Operating Income Net income 1650000 Increase in trade receivabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started