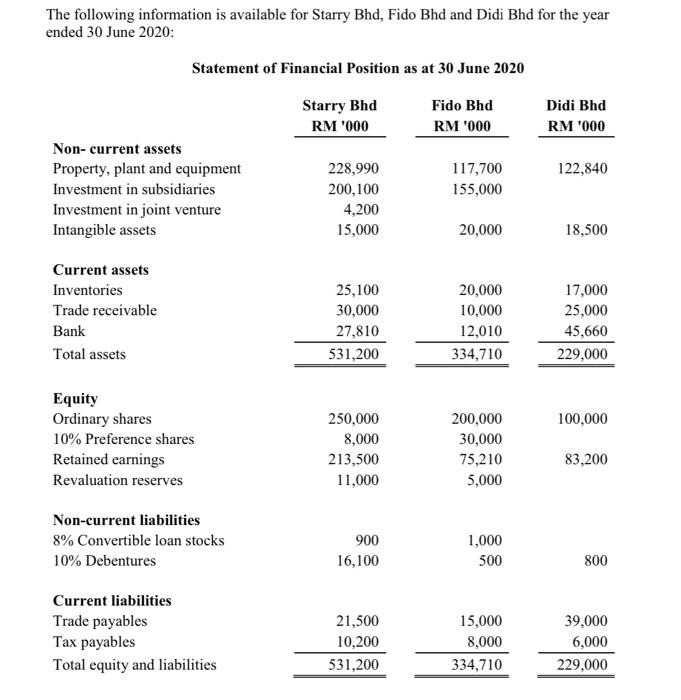

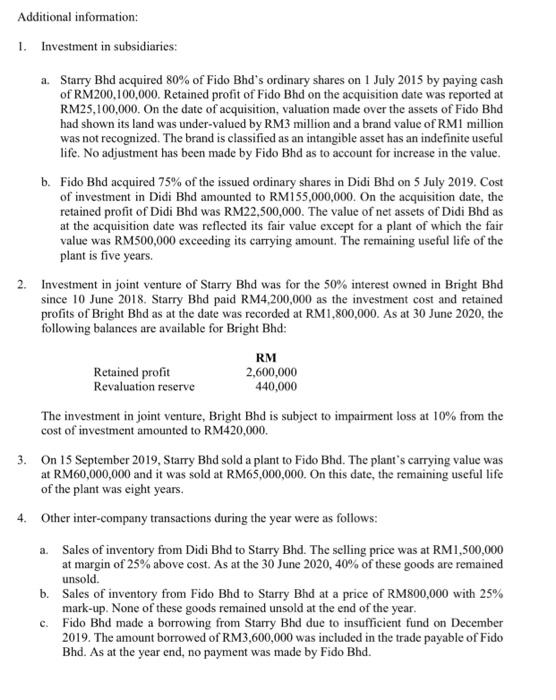

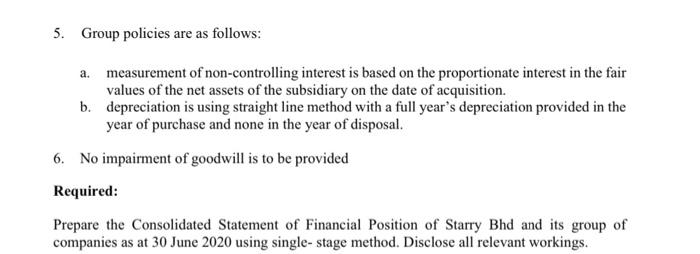

The following information is available for Starry Bhd, Fido Bhd and Didi Bhd for the year ended 30 June 2020: Statement of Financial Position as at 30 June 2020 Starry Bhd RM 1000 Fido Bhd RM '000 Didi Bhd RM 1000 122,840 Non-current assets Property, plant and equipment Investment in subsidiaries Investment in joint venture Intangible assets 117,700 155,000 228,990 200,100 4,200 15,000 20,000 18,500 Current assets Inventories Trade receivable Bank Total assets 25,100 30,000 27,810 531,200 20,000 10,000 12,010 334,710 17,000 25,000 45,660 229,000 100,000 Equity Ordinary shares 10% Preference shares Retained earnings Revaluation reserves 250,000 8,000 213,500 11,000 200,000 30,000 75,210 5,000 83,200 Non-current liabilities 8% Convertible loan stocks 10% Debentures 900 16,100 1,000 500 800 Current liabilities Trade payables Tax payables Total equity and liabilities 21,500 10,200 531,200 15,000 8,000 334,710 39,000 6,000 229,000 Additional information: 1. Investment in subsidiaries: a. Starry Bhd acquired 80% of Fido Bhd's ordinary shares on 1 July 2015 by paying cash of RM200,100,000. Retained profit of Fido Bhd on the acquisition date was reported at RM25,100,000. On the date of acquisition, valuation made over the assets of Fido Bhd had shown its land was under-valued by RM3 million and a brand value of RM1 million was not recognized. The brand is classified as an intangible asset has an indefinite useful life. No adjustment has been made by Fido Bhd as to account for increase in the value. b. Fido Bhd acquired 75% of the issued ordinary shares in Didi Bhd on 5 July 2019. Cost of investment in Didi Bhd amounted to RM155,000,000. On the acquisition date, the retained profit of Didi Bhd was RM22,500,000. The value of net assets of Didi Bhd as at the acquisition date was reflected its fair value except for a plant of which the fair value was RM500,000 exceeding its carrying amount. The remaining useful life of the plant is five years. 2. Investment in joint venture of Starry Bhd was for the 50% interest owned in Bright Bhd since 10 June 2018. Starry Bhd paid RM4,200,000 as the investment cost and retained profits of Bright Bhd as at the date was recorded at RM1,800,000. As at 30 June 2020, the following balances are available for Bright Bhd: RM Retained profit 2,600,000 Revaluation reserve 440,000 The investment in joint venture, Bright Bhd is subject to impairment loss at 10% from the cost of investment amounted to RM420,000. 3. On 15 September 2019, Starry Bhd sold a plant to Fido Bhd. The plant's carrying value was at RM60,000,000 and it was sold at RM65,000,000. On this date, the remaining useful life of the plant was eight years. 4. Other inter-company transactions during the year were as follows: a Sales of inventory from Didi Bhd to Starry Bhd. The selling price was at RM 1,500,000 at margin of 25% above cost. As at the 30 June 2020, 40% of these goods are remained unsold. b. Sales of inventory from Fido Bhd to Starry Bhd at a price of RM800,000 with 25% mark-up. None of these goods remained unsold at the end of the year. c. Fido Bhd made a borrowing from Starry Bhd due to insufficient fund on December 2019. The amount borrowed of RM3,600,000 was included in the trade payable of Fido Bhd. As at the year end, no payment was made by Fido Bhd. 5. Group policies are as follows: a. measurement of non-controlling interest is based on the proportionate interest in the fair values of the net assets of the subsidiary on the date of acquisition. b. depreciation is using straight line method with a full year's depreciation provided in the year of purchase and none in the year of disposal. 6. No impairment of goodwill is to be provided Required: Prepare the Consolidated Statement of Financial Position of Starry Bhd and its group of companies as at 30 June 2020 using single-stage method. Disclose all relevant workings. The following information is available for Starry Bhd, Fido Bhd and Didi Bhd for the year ended 30 June 2020: Statement of Financial Position as at 30 June 2020 Starry Bhd RM 1000 Fido Bhd RM '000 Didi Bhd RM 1000 122,840 Non-current assets Property, plant and equipment Investment in subsidiaries Investment in joint venture Intangible assets 117,700 155,000 228,990 200,100 4,200 15,000 20,000 18,500 Current assets Inventories Trade receivable Bank Total assets 25,100 30,000 27,810 531,200 20,000 10,000 12,010 334,710 17,000 25,000 45,660 229,000 100,000 Equity Ordinary shares 10% Preference shares Retained earnings Revaluation reserves 250,000 8,000 213,500 11,000 200,000 30,000 75,210 5,000 83,200 Non-current liabilities 8% Convertible loan stocks 10% Debentures 900 16,100 1,000 500 800 Current liabilities Trade payables Tax payables Total equity and liabilities 21,500 10,200 531,200 15,000 8,000 334,710 39,000 6,000 229,000 Additional information: 1. Investment in subsidiaries: a. Starry Bhd acquired 80% of Fido Bhd's ordinary shares on 1 July 2015 by paying cash of RM200,100,000. Retained profit of Fido Bhd on the acquisition date was reported at RM25,100,000. On the date of acquisition, valuation made over the assets of Fido Bhd had shown its land was under-valued by RM3 million and a brand value of RM1 million was not recognized. The brand is classified as an intangible asset has an indefinite useful life. No adjustment has been made by Fido Bhd as to account for increase in the value. b. Fido Bhd acquired 75% of the issued ordinary shares in Didi Bhd on 5 July 2019. Cost of investment in Didi Bhd amounted to RM155,000,000. On the acquisition date, the retained profit of Didi Bhd was RM22,500,000. The value of net assets of Didi Bhd as at the acquisition date was reflected its fair value except for a plant of which the fair value was RM500,000 exceeding its carrying amount. The remaining useful life of the plant is five years. 2. Investment in joint venture of Starry Bhd was for the 50% interest owned in Bright Bhd since 10 June 2018. Starry Bhd paid RM4,200,000 as the investment cost and retained profits of Bright Bhd as at the date was recorded at RM1,800,000. As at 30 June 2020, the following balances are available for Bright Bhd: RM Retained profit 2,600,000 Revaluation reserve 440,000 The investment in joint venture, Bright Bhd is subject to impairment loss at 10% from the cost of investment amounted to RM420,000. 3. On 15 September 2019, Starry Bhd sold a plant to Fido Bhd. The plant's carrying value was at RM60,000,000 and it was sold at RM65,000,000. On this date, the remaining useful life of the plant was eight years. 4. Other inter-company transactions during the year were as follows: a Sales of inventory from Didi Bhd to Starry Bhd. The selling price was at RM 1,500,000 at margin of 25% above cost. As at the 30 June 2020, 40% of these goods are remained unsold. b. Sales of inventory from Fido Bhd to Starry Bhd at a price of RM800,000 with 25% mark-up. None of these goods remained unsold at the end of the year. c. Fido Bhd made a borrowing from Starry Bhd due to insufficient fund on December 2019. The amount borrowed of RM3,600,000 was included in the trade payable of Fido Bhd. As at the year end, no payment was made by Fido Bhd. 5. Group policies are as follows: a. measurement of non-controlling interest is based on the proportionate interest in the fair values of the net assets of the subsidiary on the date of acquisition. b. depreciation is using straight line method with a full year's depreciation provided in the year of purchase and none in the year of disposal. 6. No impairment of goodwill is to be provided Required: Prepare the Consolidated Statement of Financial Position of Starry Bhd and its group of companies as at 30 June 2020 using single-stage method. Disclose all relevant workings