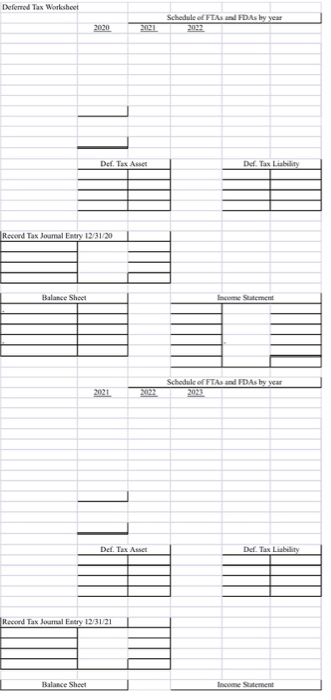

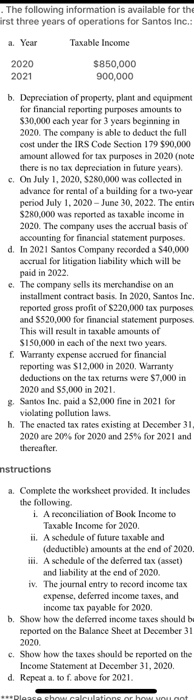

The following information is available for the irst three years of operations for Santos Inc.: a. Year Taxable income 2020 $850,000 2021 900,000 b. Depreciation of property, plant and equipment for financial reporting purposes amounts to $30,000 each year for 3 years beginning in 2020. The company is able to deduct the full cost under the IRS Code Section 179 $90,000 amount allowed for tax purposes in 2020 (note there is no tax depreciation in future years). c. On July 1, 2020, $280,000 was collected in advance for rental of a building for a two-year period July 1, 2020 - June 30, 2022. The entire $280,000 was reported as taxable income in 2020. The company uses the accrual basis of accounting for financial statement purposes. d. In 2021 Santos Company recorded a $40,000 accrual for litigation liability which will be paid in 2022 e. The company sells its merchandise on an installment contract basis. In 2020, Santos Inc reported gross profit of $220,000 tax purposes and 5520,000 for financial statement purposes This will result in taxable amounts of $150,000 in each of the next two years. f. Warranty expense accrued for financial reporting was $12,000 in 2020, Warranty deductions on the tax returns were $7,000 in 2020 and $5,000 in 2021. 8. Santos Inc. paid a $2,000 fine in 2021 for violating pollution laws. h. The enacted tax rates existing at December 31 2020 are 20% for 2020 and 25% for 2021 and thereafter. nstructions a. Complete the worksheet provided. It includes the following i. A reconciliation of Book Income to Taxable income for 2020 ii. A schedule of future taxable and (deductible) amounts at the end of 2020 ii. A schedule of the deferred tax (asset) and liability at the end of 2020. iv. The journal entry to record income tax expense, deferred income taxes, and income tax payable for 2020. b. Show how the deferred income taxes should be reported on the Balance Sheet at December 31 2020 c. Show how the taxes should be reported on the Income Statement at December 31, 2020. d. Repeat ato f. above for 2021. please show calculations or how Ont Deferred Tax Worksheet Schedule of FTAFAs by year 2022 2020 Def Tax Asset Def. Tax Liability Record Tax Journal Entry 12/31/20 Balance Sheet Income Statement Schedule of FTAs and FDAs by year 2033 2021 Del. Tax Asset Def. Tax Liability Record Tax Journal Entry 12/31/21 Balance Sheet Income Statement