Question

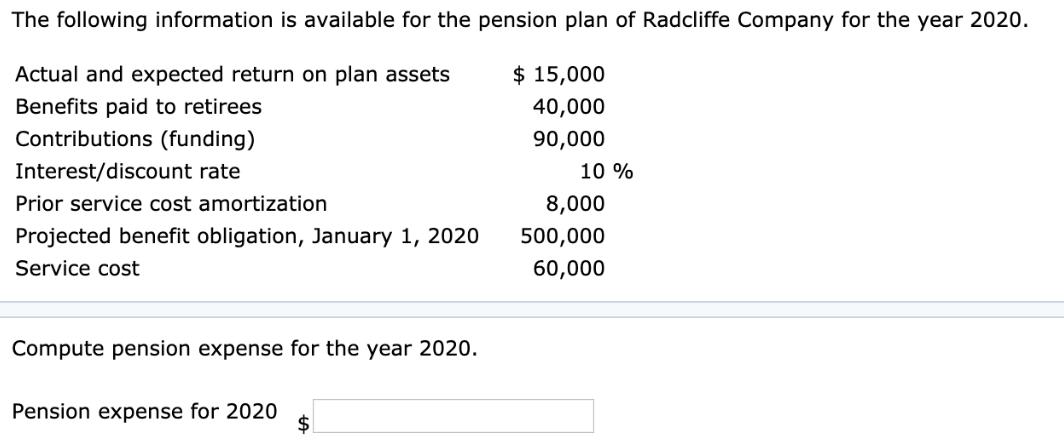

The following information is available for the pension plan of Radcliffe Company for the year 2020. Actual and expected return on plan assets $

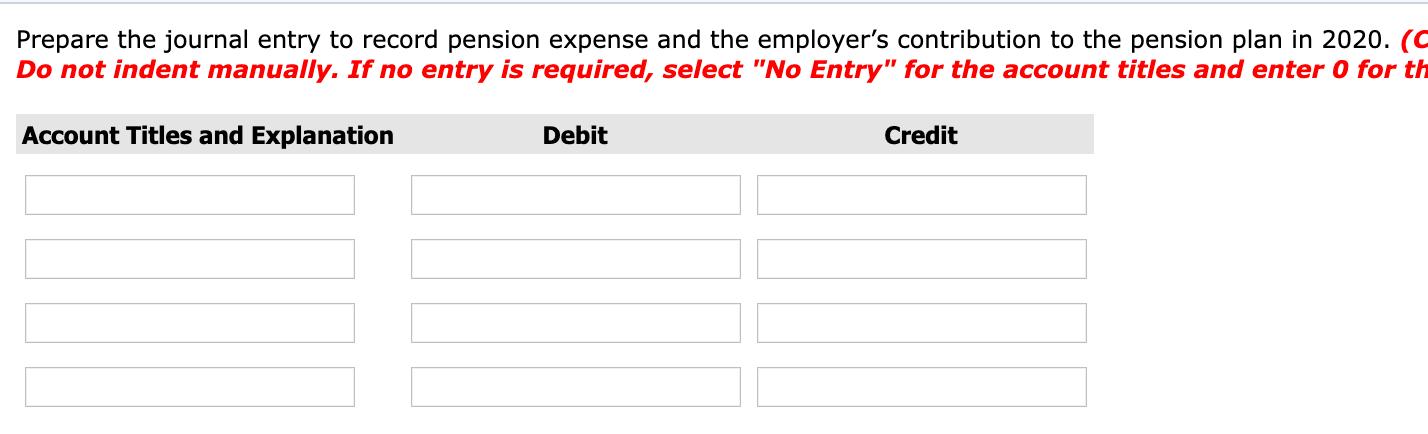

The following information is available for the pension plan of Radcliffe Company for the year 2020. Actual and expected return on plan assets $ 15,000 Benefits paid to retirees 40,000 Contributions (funding) 90,000 Interest/discount rate Prior service cost amortization Projected benefit obligation, January 1, 2020 Service cost Compute pension expense for the year 2020. Pension expense for 2020 $ 10 % 8,000 500,000 60,000 Prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2020. (C Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for th Account Titles and Explanation Debit Credit

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Computation of pension expense Service Cost 60000 Interest Cost 500000 10 50000 Actual expected r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

12th Canadian Edition

1119497043, 978-1119497042

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App