Question

The following information is available for the preparation of the government-wide financial statements for the City of Southern Springs as of April 30, 2017: Cash

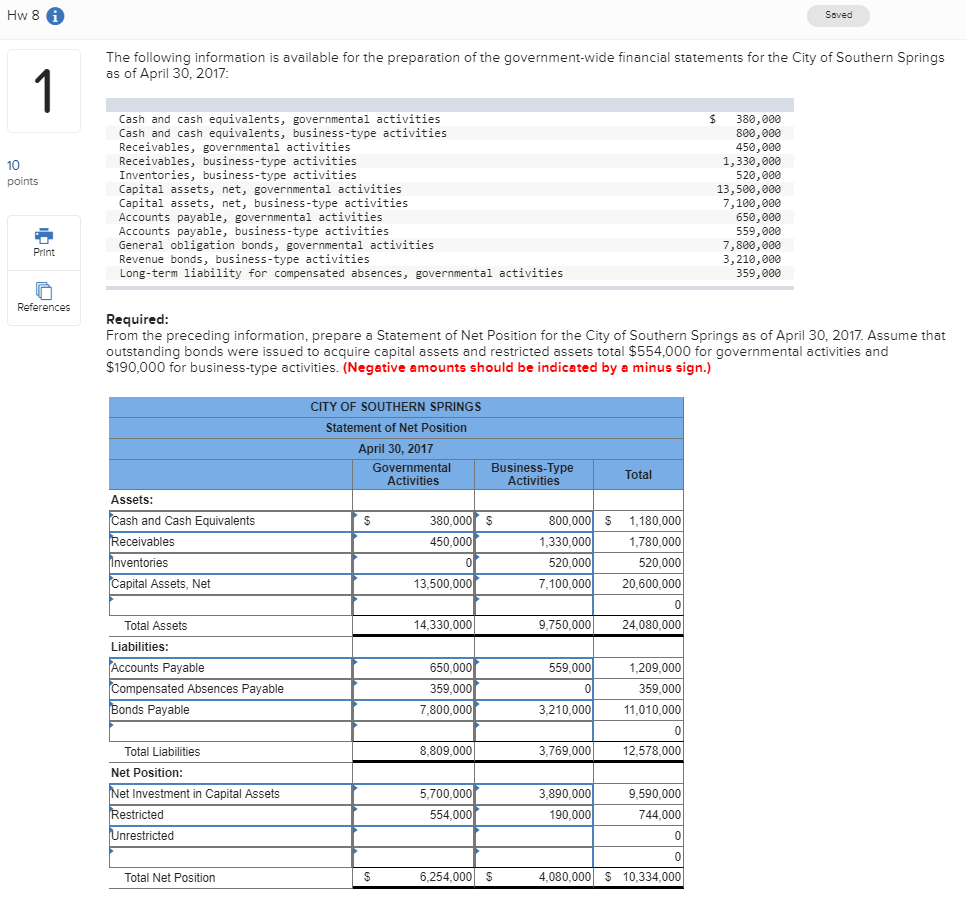

The following information is available for the preparation of the government-wide financial statements for the City of Southern Springs as of April 30, 2017: Cash and cash equivalents, governmental activities $ 380,000 Cash and cash equivalents, business-type activities 800,000 Receivables, governmental activities 450,000 Receivables, business-type activities 1,330,000 Inventories, business-type activities 520,000 Capital assets, net, governmental activities 13,500,000 Capital assets, net, business-type activities 7,100,000 Accounts payable, governmental activities 650,000 Accounts payable, business-type activities 559,000 General obligation bonds, governmental activities 7,800,000 Revenue bonds, business-type activities 3,210,000 Long-term liability for compensated absences, governmental activities 359,000 Required: From the preceding information, prepare a Statement of Net Position for the City of Southern Springs as of April 30, 2017. Assume that outstanding bonds were issued to acquire capital assets and restricted assets total $554,000 for governmental activities and $190,000 for business-type activities. (Negative amounts should be indicated by a minus sign.)

The following information is available for the preparation of the government-wide financial statements for the City of Southern Springs as of April 30, 2017: Cash and cash equivalents, governmental activities $ 380,000 Cash and cash equivalents, business-type activities 800,000 Receivables, governmental activities 450,000 Receivables, business-type activities 1,330,000 Inventories, business-type activities 520,000 Capital assets, net, governmental activities 13,500,000 Capital assets, net, business-type activities 7,100,000 Accounts payable, governmental activities 650,000 Accounts payable, business-type activities 559,000 General obligation bonds, governmental activities 7,800,000 Revenue bonds, business-type activities 3,210,000 Long-term liability for compensated absences, governmental activities 359,000 Required: From the preceding information, prepare a Statement of Net Position for the City of Southern Springs as of April 30, 2017. Assume that outstanding bonds were issued to acquire capital assets and restricted assets total $554,000 for governmental activities and $190,000 for business-type activities. (Negative amounts should be indicated by a minus sign.)

Please explain how to calculate the Unrestricted "Plug" amount

Hw 8 Saved The following information is available for the preparation of the government-wide financial statements for the City of Southern Springs as of April 30, 2017 Cash and cash equivalents, governmental activities Cash and cash equivalents, business-type activities Receivables, governmental activities Receivables, business-type activities Inventories, business-type activities Capital assets, net, governmental activities Capital assets, net, business-type activities Accounts payable, governmental activities Accounts payable, business-type activities General obligation bonds, governmental activities Revenue bonds, business-type activities Long-term liability for compensated absences, governmental activities $ 380,000 800,000 450,000 1,330,000 520,000 13,500,000 7,100,000 650,000 559,000 7,800,000 3,210,000 359,000 10 points Print References Required: From the preceding information, prepare a Statement of Net Position for the City of Southern Springs as of April 30, 2017. Assume that outstanding bonds were issued to acquire capital assets and restricted assets total $554,000 for governmental activities and $190,000 for business-type activities. (Negative amounts should be indicated by a minus sign.) CITY OF SOUTHERN SPRINGS Statement of Net Position April 30, 2017 Governmental Activities Business-Type Activities Total Assets: 380,000 800,000 1,180,000 1,780,000 520,000 20,600,000 ash and Cash Equivalents 450,000 1,330,000 520,000 7,100,000 eceivables nventories apital Assets, Net 13,500,000 Total Assets 14,330,000 9,750,000 24,080,000 Liabilities nts Payable 650,000 359,000 7,800,000 559,000 ompensated Absences Payable onds Payable 1,209,000 359,000 11,010,000 3,210,000 Total Liabilities 8,809,000 3,769,000 12,578,000 Net Position et Investment in Capital Assets 5,700,000 3,890,000 9,590,000 554,000 190,000 744,000 nrestricted Total Net Position 6,254,000S 4,080,000S 10,334,000 Hw 8 Saved The following information is available for the preparation of the government-wide financial statements for the City of Southern Springs as of April 30, 2017 Cash and cash equivalents, governmental activities Cash and cash equivalents, business-type activities Receivables, governmental activities Receivables, business-type activities Inventories, business-type activities Capital assets, net, governmental activities Capital assets, net, business-type activities Accounts payable, governmental activities Accounts payable, business-type activities General obligation bonds, governmental activities Revenue bonds, business-type activities Long-term liability for compensated absences, governmental activities $ 380,000 800,000 450,000 1,330,000 520,000 13,500,000 7,100,000 650,000 559,000 7,800,000 3,210,000 359,000 10 points Print References Required: From the preceding information, prepare a Statement of Net Position for the City of Southern Springs as of April 30, 2017. Assume that outstanding bonds were issued to acquire capital assets and restricted assets total $554,000 for governmental activities and $190,000 for business-type activities. (Negative amounts should be indicated by a minus sign.) CITY OF SOUTHERN SPRINGS Statement of Net Position April 30, 2017 Governmental Activities Business-Type Activities Total Assets: 380,000 800,000 1,180,000 1,780,000 520,000 20,600,000 ash and Cash Equivalents 450,000 1,330,000 520,000 7,100,000 eceivables nventories apital Assets, Net 13,500,000 Total Assets 14,330,000 9,750,000 24,080,000 Liabilities nts Payable 650,000 359,000 7,800,000 559,000 ompensated Absences Payable onds Payable 1,209,000 359,000 11,010,000 3,210,000 Total Liabilities 8,809,000 3,769,000 12,578,000 Net Position et Investment in Capital Assets 5,700,000 3,890,000 9,590,000 554,000 190,000 744,000 nrestricted Total Net Position 6,254,000S 4,080,000S 10,334,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started