Question

The following information is available for three companies: Rope Co. $320,000 6% Line Co. $569,000 4% Chain Co. Face value of bonds payable Interest

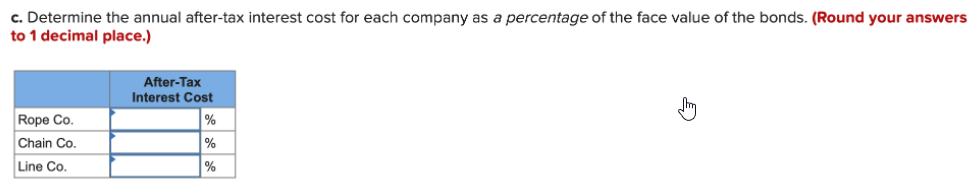

The following information is available for three companies: Rope Co. $320,000 6% Line Co. $569,000 4% Chain Co. Face value of bonds payable Interest rate Income tax rate $788,000 5% 30% 15% 20% Required a. Determine the annual before-tax interest cost for each company in dollars. Before-Tax Interest Cost Rope Co. Chain Co. Line Co. b. Determine the annual after-tax interest cost for each company in dollars. (Round your answers to the nearest dollar amount.) After-Tax Interest Cost Rope Co. Chain Co. Line Co. c. Determine the annual after-tax interest cost for each company as a percentage of the face value of the bonds. (Round your answers to 1 decimal place.) After-Tax Interest Cost Rope Co. % Chain Co. % Line Co. %

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Before tax interest cost Rope co 19200 Chain co 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial Accounting

Authors: Jay Rich, Jeff Jones

4th edition

978-1337690881, 9781337669450, 1337690880, 1337690899, 1337669458, 978-1337690898

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App