Question

The following information is available for two firms. Box Corporation and Cox Corporation. Calculate the market value of equity, market value of debt, and market

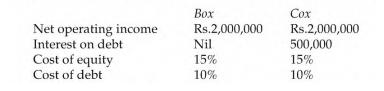

The following information is available for two firms. Box Corporation and Cox Corporation.

Calculate the market value of equity, market value of debt, and market value of the firm for Box Corporation and Cox Corporation.

(a) What is the average cost of capital for each of the firms?

(b) What happens to the average cost of capital of Box Corporation if it employs Rs.30 million of debt to finance a project that yields an operating income of Rs.4 million?

(c) What happens to the average cost of capital of Cox Corporation if it sells Rs.5 million of additional equity (at par) to retire Rs.5 million of outstanding debt?

In answering the above questions assume that the net income approach applies and there are no taxes.

Net operating income Interest on debt Cost of equity Cost of debt Box Rs.2,000,000 Nil 15% 10% Cox Rs.2,000,000 500,000 15% 10%

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The average cost of capital for Box Corporation is 1075 The average cost of capital for Cox Corpor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started