Answered step by step

Verified Expert Solution

Question

1 Approved Answer

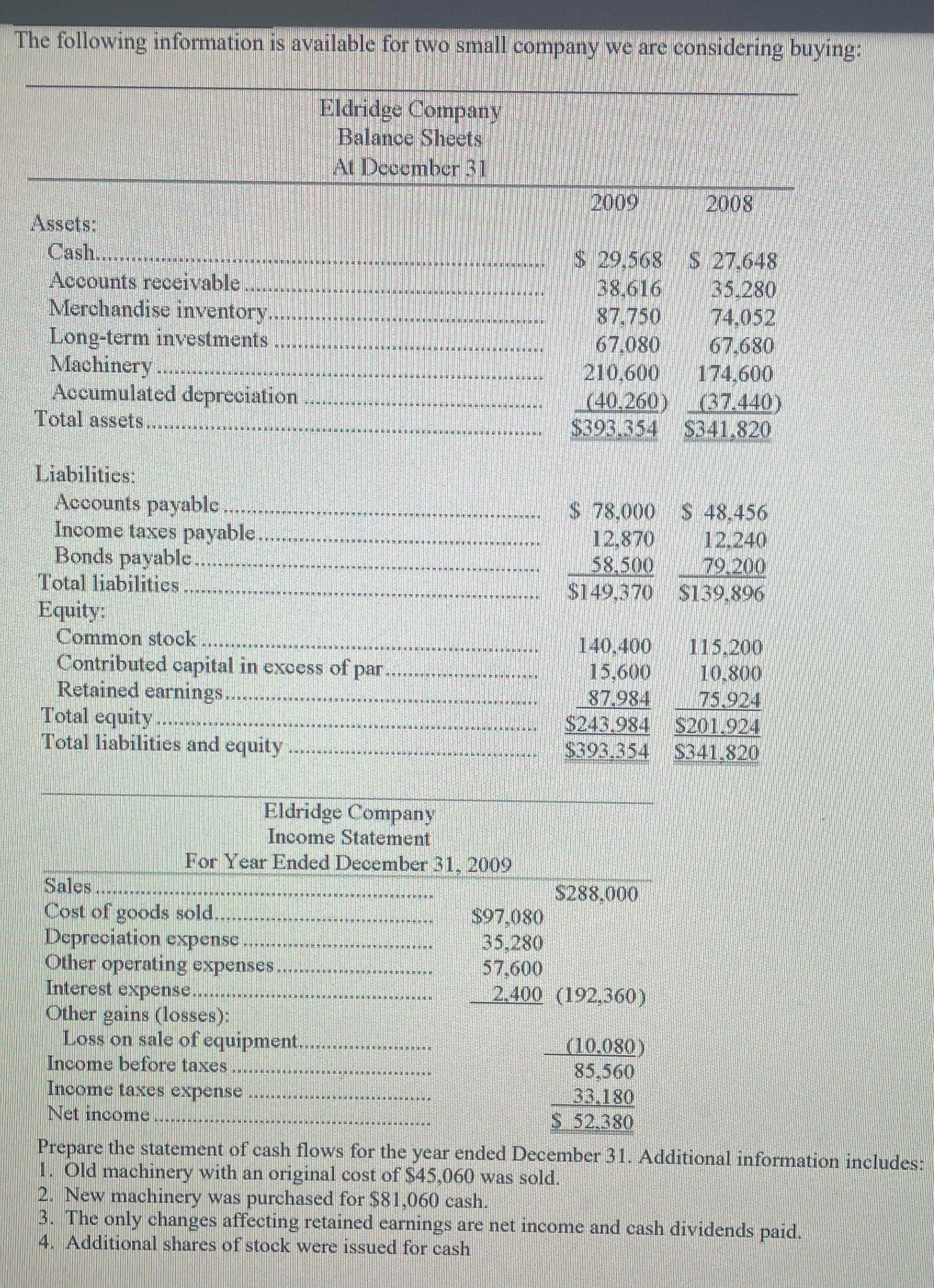

The following information is available for two small company we are considering buying: Eldridge Company Balance Sheets At December 31 Assets: Cash.......... Accounts receivable

The following information is available for two small company we are considering buying: Eldridge Company Balance Sheets At December 31 Assets: Cash.......... Accounts receivable Merchandise inventory.. Long-term investments Machinery.. Accumulated depreciation Total assets...******* Liabilities: 2009 2008 $ 29.568 S 27.648 38.616 35.280 87.750 74,052 67.080 67.680 210.600 174.600 (40.260) (37.440) $393.354 $341.820 Accounts payable.. $ 78.000 $ 48.456 Income taxes payable.. 12.870 12.240 Bonds payable.. 58.500 79.200 Total liabilities. $149.370 $139.896 Equity: Common stock. 140.400 115.200 Contributed capital in excess of par. 15.600 10.800 Retained earnings. 87.984 75.924 Total equity $243.984 $201.924 Total liabilities and equity $393.354 $341.820 Sales...........gmanet Eldridge Company Income Statement For Year Ended December 31, 2009 Cost of goods sold... Depreciation expense Other operating expenses.. Interest expense......... Other gains (losses): Loss on sale of equipment. Income before taxes $288.000 $97.080 35.280 57.600 2.400 (192,360) (10.080) 85.560 Income taxes expense Net income 33.180 $ 52.380 Prepare the statement of cash flows for the year ended December 31. Additional information includes: 1. Old machinery with an original cost of $45,060 was sold. 2. New machinery was purchased for $81,060 cash. 3. The only changes affecting retained earnings are net income and cash dividends paid. 4. Additional shares of stock were issued for cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started