Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is available. In Years 1 to 5, sales will be 390 tons of coal per week, at a selling price of

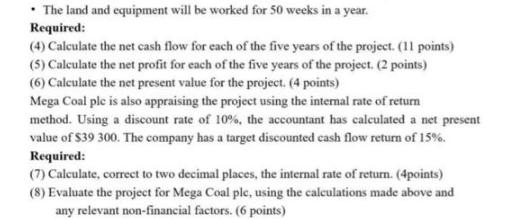

The following information is available. In Years 1 to 5, sales will be 390 tons of coal per week, at a selling price of $60 per ton. In Years I to 5, the expected running costs (including depreciation) are expected to be $19 000 per week. On the last day of Year 5, the land and equipment will be sold for $500 000. The land and equipment will be worked for 50 weeks in a year. Required: (4) Calculate the net cash flow for each of the five years of the project. (11 points) (5) Calculate the net profit for each of the five years of the project. (2 points) (6) Calculate the net present value for the project. (4 points) Mega Coal ple is also appraising the project using the internal rate of return method. Using a discount rate of 10%, the accountant has calculated a net present value of $39 300. The company has a target discounted cash flow return of 15%. Required: (Cal The land and equipment will be worked for 50 weeks in a year. Required: (4) Calculate the net cash flow for each of the five years of the project. (11 points) (5) Calculate the net profit for each of the five years of the project. (2 points) (6) Calculate the net present value for the project. (4 points) Mega Coal ple is also appraising the project using the internal rate of return method. Using a discount rate of 10%, the accountant has calculated a net present value of $39 300. The company has a target discounted cash flow return of 15%. Required: (7) Calculate, correct to two decimal places, the internal rate of return. (4points) (8) Evaluate the project for Mega Coal ple, using the calculations made above and any relevant non-financial factors. (6 points)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

4 Net Cash Flow 3906052 1216800 Net Cash Flow 1216800 per year 5 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started