Answered step by step

Verified Expert Solution

Question

1 Approved Answer

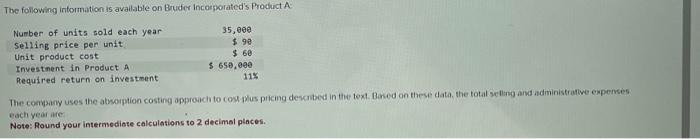

The following information is available on Bruder Incorporated's Product A Number of units sold each year Selling price per unit Unit product cost Investment

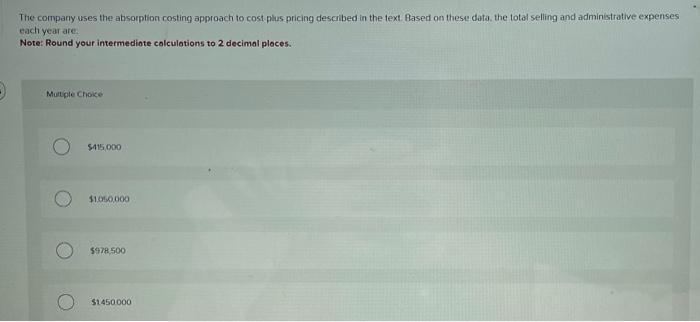

The following information is available on Bruder Incorporated's Product A Number of units sold each year Selling price per unit Unit product cost Investment in Product A Required return on investment 35,000 $.90 $ 60 $ 650,000 11% The company uses the absorption costing approach to cost plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are Note: Round your intermediate calculations to 2 decimal places. The company uses the absorption costing approach to cost plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are Note: Round your intermediate calculations to 2 decimal places. Multiple Choice $415,000 $1.050,000 $978,500 $1450000 The following information is available on Bruder Incorporated's Product A Number of units sold each year Selling price per unit Unit product cost Investment in Product A Required return on investment 35,000 $.90 $ 60 $ 650,000 11% The company uses the absorption costing approach to cost plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are Note: Round your intermediate calculations to 2 decimal places. The company uses the absorption costing approach to cost plus pricing described in the text. Based on these data, the total selling and administrative expenses each year are Note: Round your intermediate calculations to 2 decimal places. Multiple Choice $415,000 $1.050,000 $978,500 $1450000

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Units sold per year 35000 Selling price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started