Answered step by step

Verified Expert Solution

Question

1 Approved Answer

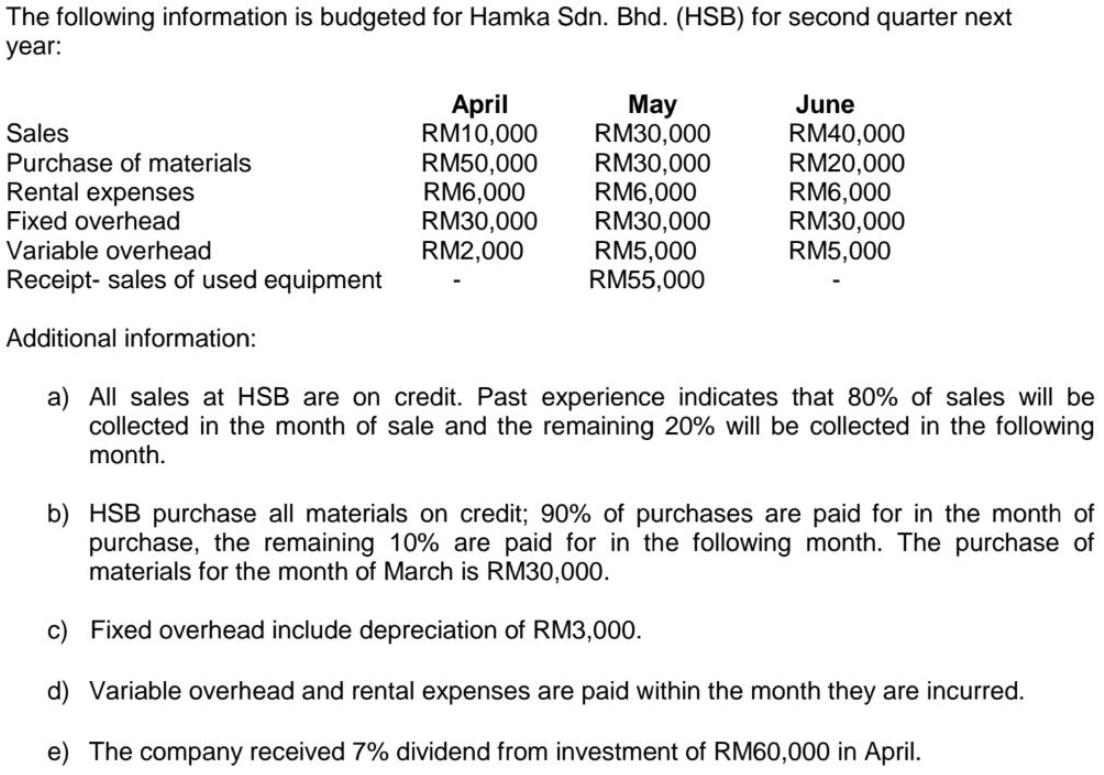

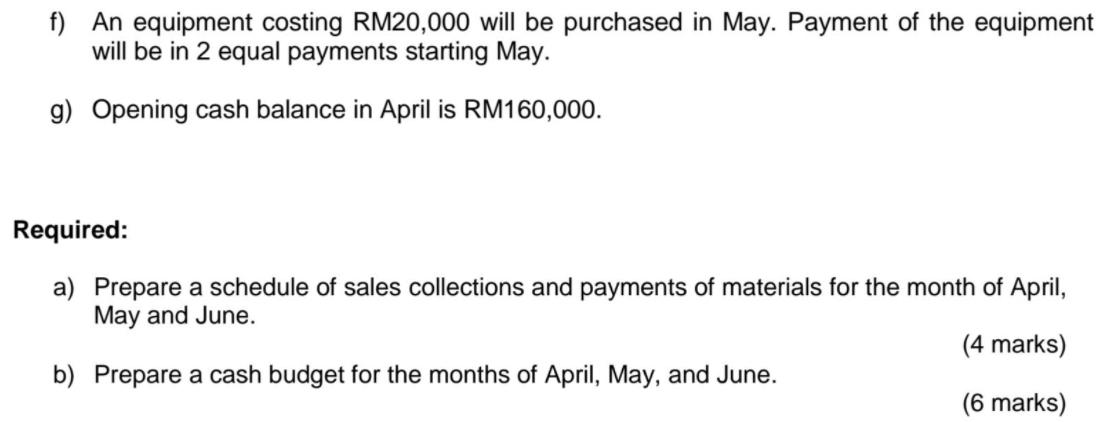

The following information is budgeted for Hamka Sdn. Bhd. (HSB) for second quarter next year: April RM10,000 RM50,000 RM6,000 RM30,000 RM2,000 May RM30,000 RM30,000

The following information is budgeted for Hamka Sdn. Bhd. (HSB) for second quarter next year: April RM10,000 RM50,000 RM6,000 RM30,000 RM2,000 May RM30,000 RM30,000 RM6,000 RM30,000 RM5,000 RM55,000 June RM40,000 RM20,000 RM6,000 RM30,000 RM5,000 Sales Purchase of materials Rental expenses Fixed overhead Variable overhead Receipt- sales of used equipment Additional information: a) All sales at HSB are on credit. Past experience indicates that 80% of sales will be collected in the month of sale and the remaining 20% will be collected in the following month. b) HSB purchase all materials on credit; 90% of purchases are paid for in the month of purchase, the remaining 10% are paid for in the following month. The purchase of materials for the month of March is RM30,000. c) Fixed overhead include depreciation of RM3,000. d) Variable overhead and rental expenses are paid within the month they are incurred. e) The company received 7% dividend from investment of RM60,000 in April. f) An equipment costing RM20,000 will be purchased in May. Payment of the equipment will be in 2 equal payments starting May. g) Opening cash balance in April is RM160,000. Required: a) Prepare a schedule of sales collections and payments of materials for the month of April, May and June. (4 marks) b) Prepare a cash budget for the months of April, May, and June. (6 marks) The following information is budgeted for Hamka Sdn. Bhd. (HSB) for second quarter next year: April RM10,000 RM50,000 RM6,000 RM30,000 RM2,000 May RM30,000 RM30,000 RM6,000 RM30,000 RM5,000 RM55,000 June RM40,000 RM20,000 RM6,000 RM30,000 RM5,000 Sales Purchase of materials Rental expenses Fixed overhead Variable overhead Receipt- sales of used equipment Additional information: a) All sales at HSB are on credit. Past experience indicates that 80% of sales will be collected in the month of sale and the remaining 20% will be collected in the following month. b) HSB purchase all materials on credit; 90% of purchases are paid for in the month of purchase, the remaining 10% are paid for in the following month. The purchase of materials for the month of March is RM30,000. c) Fixed overhead include depreciation of RM3,000. d) Variable overhead and rental expenses are paid within the month they are incurred. e) The company received 7% dividend from investment of RM60,000 in April. f) An equipment costing RM20,000 will be purchased in May. Payment of the equipment will be in 2 equal payments starting May. g) Opening cash balance in April is RM160,000. Required: a) Prepare a schedule of sales collections and payments of materials for the month of April, May and June. (4 marks) b) Prepare a cash budget for the months of April, May, and June. (6 marks) The following information is budgeted for Hamka Sdn. Bhd. (HSB) for second quarter next year: April RM10,000 RM50,000 RM6,000 RM30,000 RM2,000 May RM30,000 RM30,000 RM6,000 RM30,000 RM5,000 RM55,000 June RM40,000 RM20,000 RM6,000 RM30,000 RM5,000 Sales Purchase of materials Rental expenses Fixed overhead Variable overhead Receipt- sales of used equipment Additional information: a) All sales at HSB are on credit. Past experience indicates that 80% of sales will be collected in the month of sale and the remaining 20% will be collected in the following month. b) HSB purchase all materials on credit; 90% of purchases are paid for in the month of purchase, the remaining 10% are paid for in the following month. The purchase of materials for the month of March is RM30,000. c) Fixed overhead include depreciation of RM3,000. d) Variable overhead and rental expenses are paid within the month they are incurred. e) The company received 7% dividend from investment of RM60,000 in April. f) An equipment costing RM20,000 will be purchased in May. Payment of the equipment will be in 2 equal payments starting May. g) Opening cash balance in April is RM160,000. Required: a) Prepare a schedule of sales collections and payments of materials for the month of April, May and June. (4 marks) b) Prepare a cash budget for the months of April, May, and June. (6 marks)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1Sales collections Particulars April May June Total Sales 10000 30000 40000 80000 80 in month of sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started