Answered step by step

Verified Expert Solution

Question

1 Approved Answer

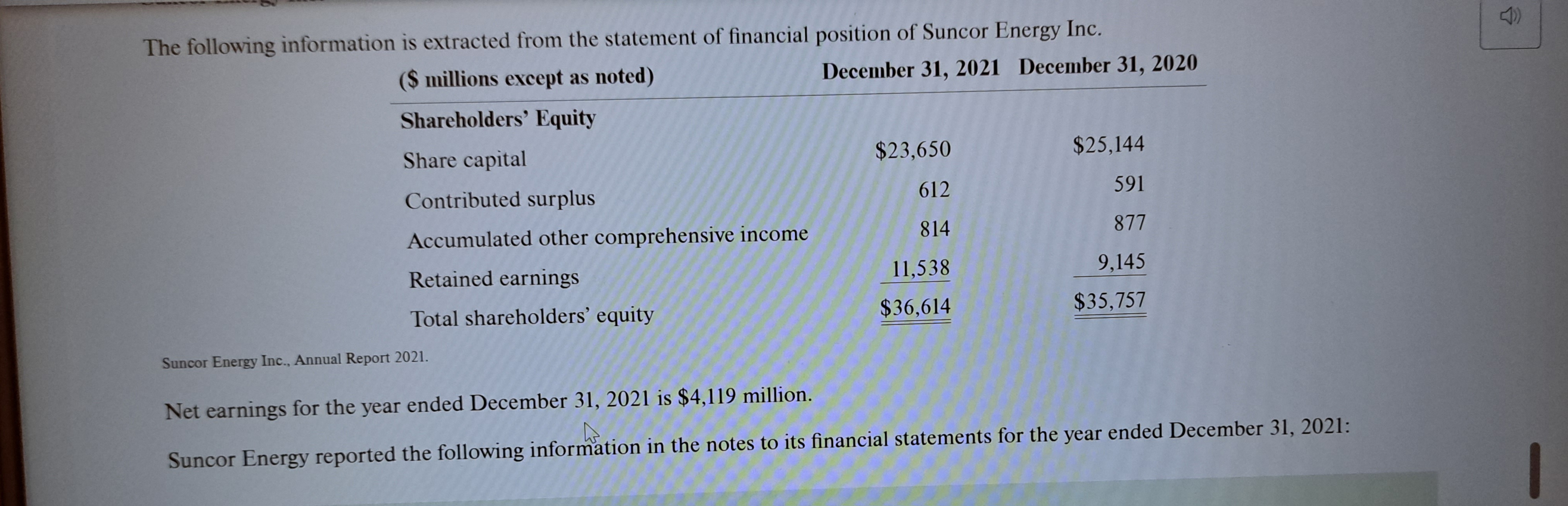

The following information is extracted from the statement of financial position of Suncor Energy Inc. Suncor Energy Inc., Annual Report 2 0 2 1 .

The following information is extracted from the statement of financial position of Suncor Energy Inc.

Suncor Energy Inc., Annual Report

Net earnings for the year ended December

is $

million

Suncor Energy reported the following information in the notes to its financial statements for the year ended December

:

Summary of Significant Accounting Policies

t

Share Capital Common shares are classified as equity, incremental costs directly attributable to the insurance of common shares are recognized as a deduction from equity, net of any tax effects. When the company repurchases its own common shares, share capital is reduced by the average carrying value of the shares repurchased.The excess of the purchase price over the average carrying value is recognized as a deuction from retained Earnings.Shares are cancelled upon repurchase.

Share capital Normal Course Issuer Bid For the twelve months ended December

the company repurchased

milion common shares under the

NCIB at an average price of $

per share, for a total repurchase cost of $

bilion The repurchase transactions resulted in a reduction of the company's common share capital by $

bilion Required:

Prepare a summary journal entry to record the share repurchase transactions durning fiscal year

What was the average carrying value of the repurchased shares?

Why do you think Suncor decided to repurchase its common shares?Explain.

Did Suncor declare any dividends during fiscal year

If so

compute the amount of dividends declared by the company.The following information is extracted from the statement of financial position of Suncor Energy Inc.

Suncor Energy Inc., Annual Report

Net earnings for the year ended December is $ million.

Suncor Energy reported the following information in the notes to its financial statements for the year ended December :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started