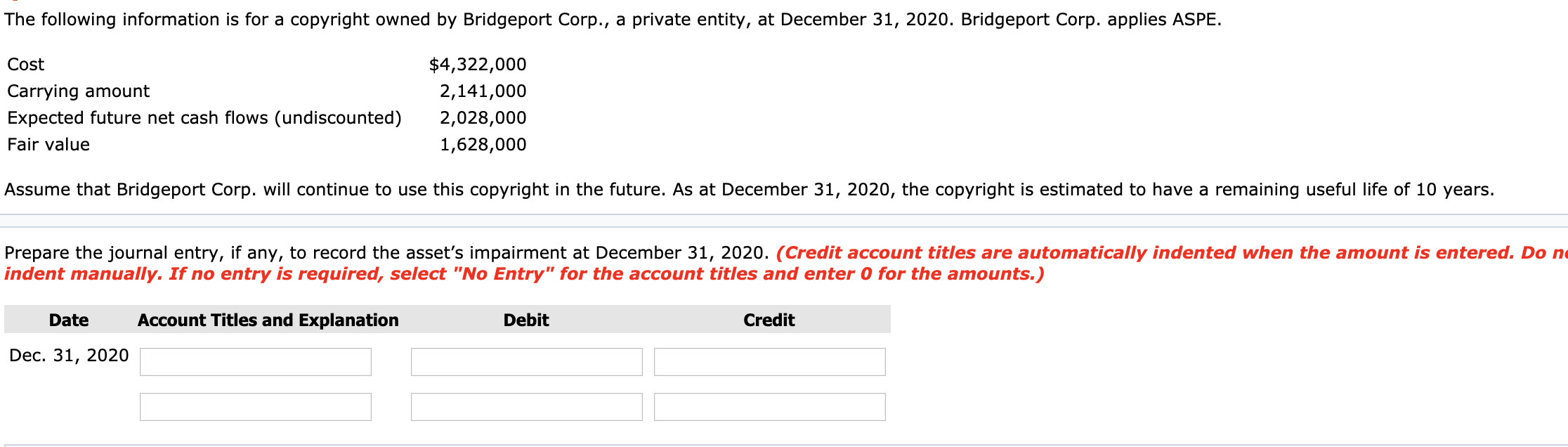

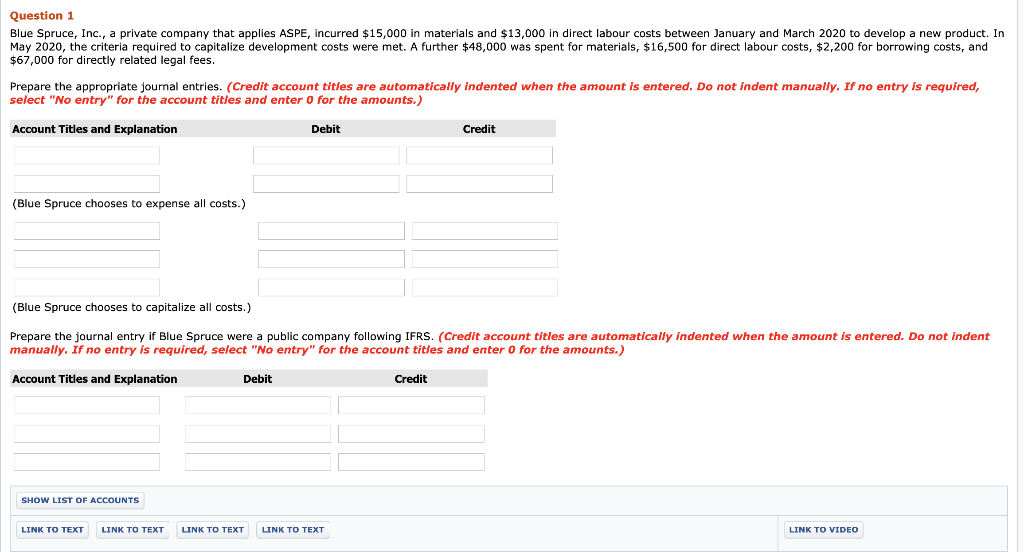

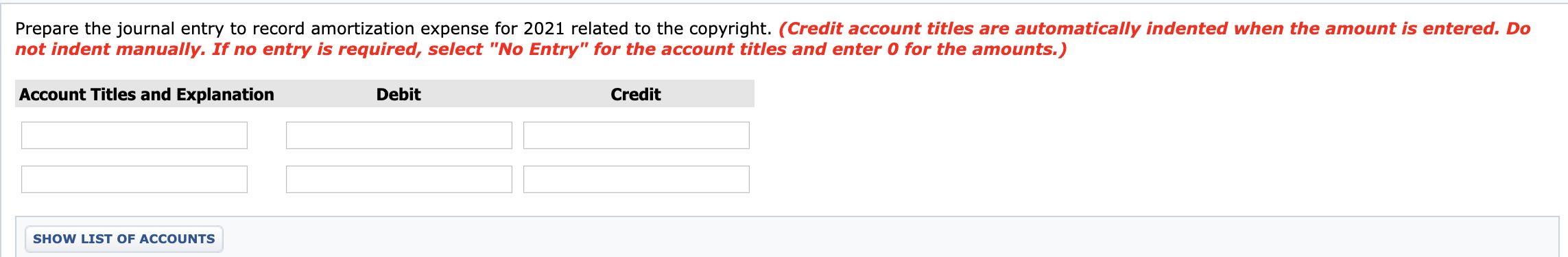

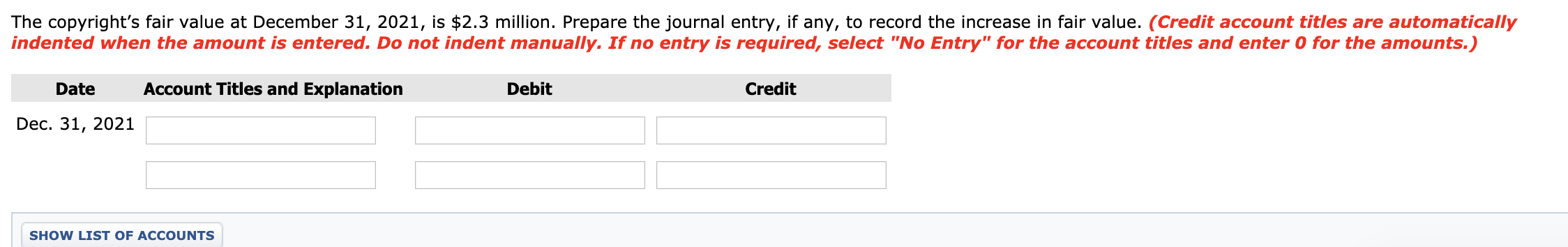

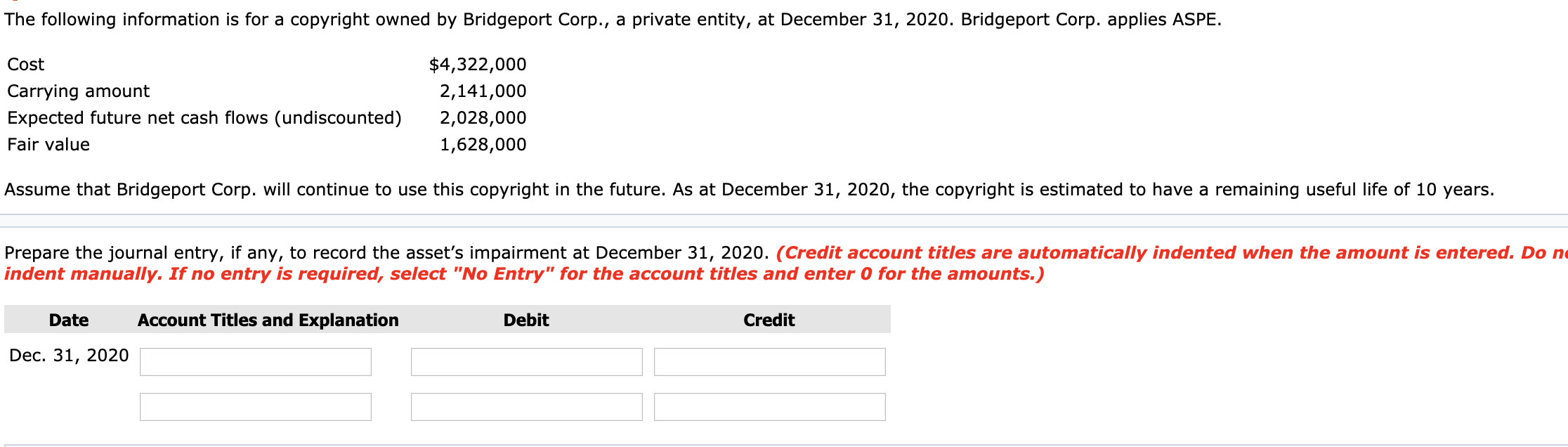

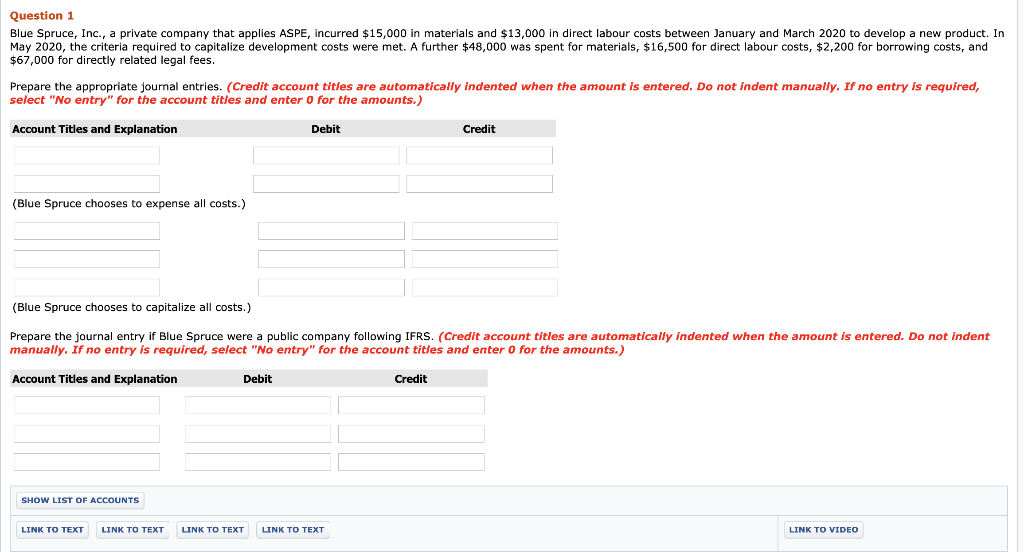

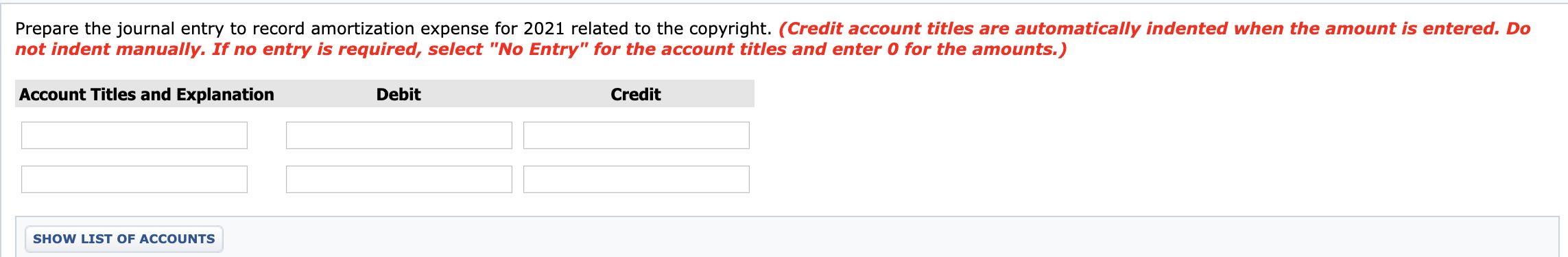

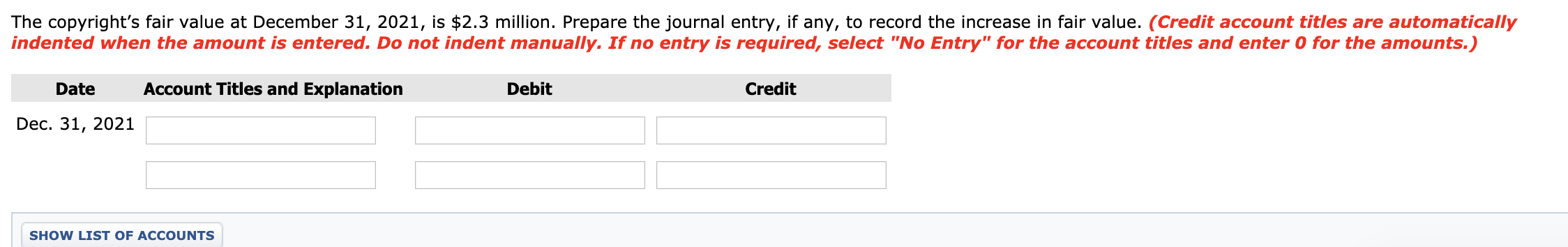

The following information is for a copyright owned by Bridgeport Corp., a private entity, at December 31, 2020. Bridgeport Corp. applies ASPE. Cost Carrying amount Expected future net cash flows (undiscounted) Fair value $4,322,000 2,141,000 2,028,000 1,628,000 Assume that Bridgeport Corp. will continue to use this copyright in the future. As at December 31, 2020, the copyright is estimated to have a remaining useful life of 10 years. Prepare the journal entry, if any, to record the asset's impairment at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do na indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Date Dec. 31, 2020 Question 1 Blue Spruce, Inc., a private company that applies ASPE, incurred $15,000 in materials and $13,000 in direct labour costs between January and March 2020 to develop a new product. In May 2020, the criteria required to capitalize development costs were met. A further $48,000 was spent for materials, $16,500 for direct labour costs, $2,200 for borrowing costs, and $67,000 for directly related legal fees. Prepare the appropriate journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit (Blue Spruce chooses to expense all costs.) (Blue Spruce chooses to capitalize all costs.) Prepare the journal entry if Blue Spruce were a public company following IFRS. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No entry" for the account tities and enter o for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO VIDEO Prepare the journal entry to record amortization expense for 2021 related to the copyright. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS The copyright's fair value at December 31, 2021, is $2.3 million. Prepare the journal entry, if any, to record the increase in fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation Dec. 31, 2021 SHOW LIST OF ACCOUNTS